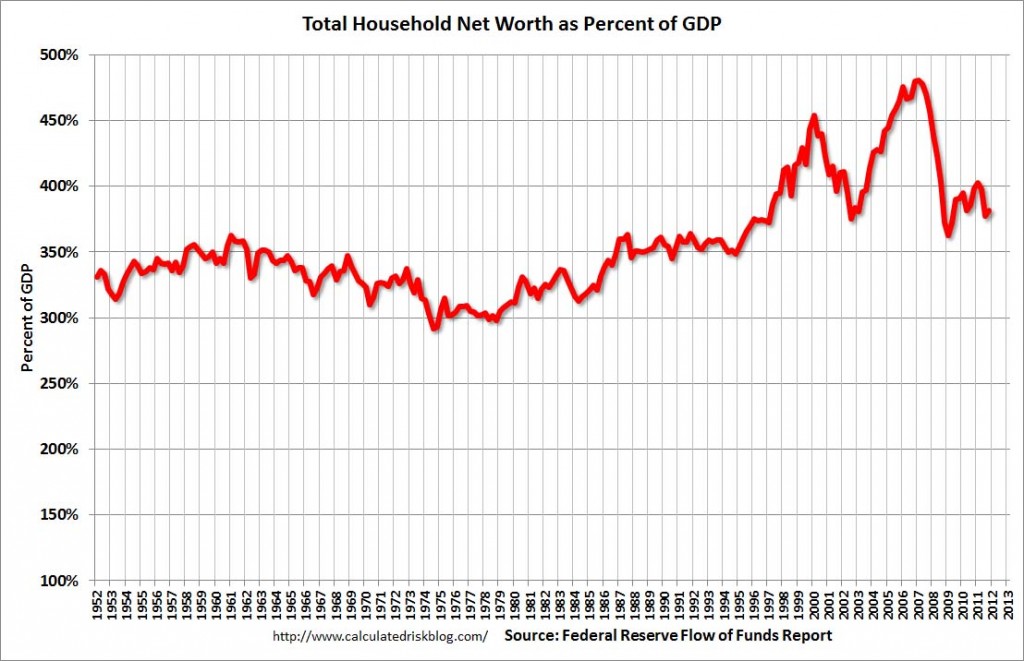

The following chart is from the CalculatedRisk blog post of March 8, 2012 titled “Fed's Flow of Funds: Household Real Estate Value declined $213 billion in Q4.” It depicts Total Household Net Worth as a Percent of GDP. The underlying data is from The Federal Reserve Flow of Funds 4Q 2011 report:

(click on chart to enlarge image)

As seen in the above-referenced CalculatedRisk blog post:

According to the Fed, household net worth peaked at $66.8 trillion in Q2 2007, and then net worth fell to $50.4 trillion in Q1 2009 (a loss of $16.4 trillion). Household net worth was at $58.5 trillion in Q4 2011 (up $8.0 trillion from the trough, but still down $8.4 trillion from the peak).

The Fed estimated that the value of household real estate fell $213 billion to $15.96 trillion in Q4 2011. The value of household real estate has fallen $6.75 trillion from the peak - and was still falling at the end of 2011.My comments:

As I have written in previous posts on this Household Net Worth (as a percent of GDP) topic:

As one can see, the first outsized peak was in 2000, and attained after the stock market bull market / stock market bubbles and economic strength. The second outsized peak was in 2007, right near the peak of the housing bubble as well as near the stock market peak.

As seen on the chart, the Total Household Net Worth is making an upturn, but is significantly below the prior 2007 peak.

I could extensively write about various interpretations that can be made from this chart. One way this chart can be interpreted is a gauge of “what’s in it for me?” as far as the aggregated wealth citizens are gleaning from economic activity, as measured compared to GDP.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1365.91 as this post is written

No comments:

Post a Comment