Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

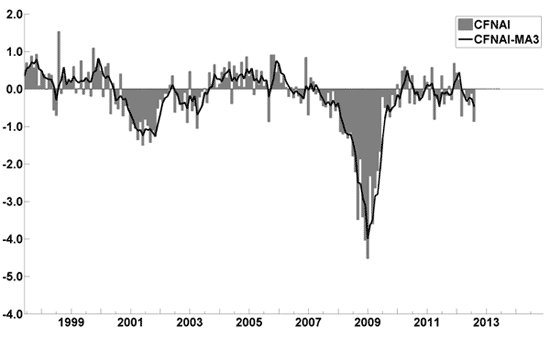

The September Chicago Fed National Activity Index (CFNAI)(pdf) updated as of September 24, 2012:

-

As of 9/21/12 (incorporating data through 9/14/12) the WLI was at 125.4 and the WLI, Gr. was at 2.7%.

A chart of the WLI, Gr. since 2000, from Doug Short’s blog of September 21 titled “ECRI Weekly Leading Index Growth at Highest Level Since July 2011” :

-

Here is the latest chart, depicting 9-15-10 to 9-15-12:

-

As per the September 20 release, the LEI was at 95.7 and the CEI was at 104.7 in August.

An excerpt from the September 20 release:

Says Ken Goldstein, economist at The Conference Board: “The economy continues to be buffeted by strong headwinds domestically and internationally. As a result, the pace of growth is unlikely to change much in the coming months. Weak domestic demand continues to be a major drag on the economy.”

Here is a chart of the LEI from Doug Short’s blog post of September 20 titled “Conference Board Leading Economic Index: Fluctuating Around a Flat Trend” :

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1455.10 as this post is written

No comments:

Post a Comment