I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they (on average) depict such a tenuous situation now – 44 months after the official (as per the 9-20-10 NBER announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts (except one, as noted) are from the Federal Reserve, and represent the most recently updated data.

The following 8 charts are from the St. Louis Federal Reserve:

(click on charts to enlarge images)

Housing starts (last updated 2-20-13):

-

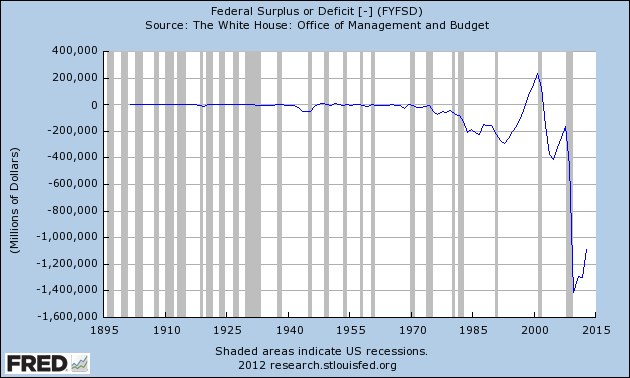

The Federal Deficit (last updated 10-15-12):

-

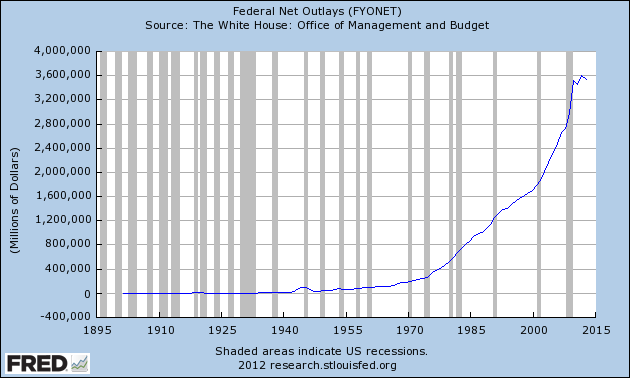

Federal Net Outlays (last updated 10-15-12):

-

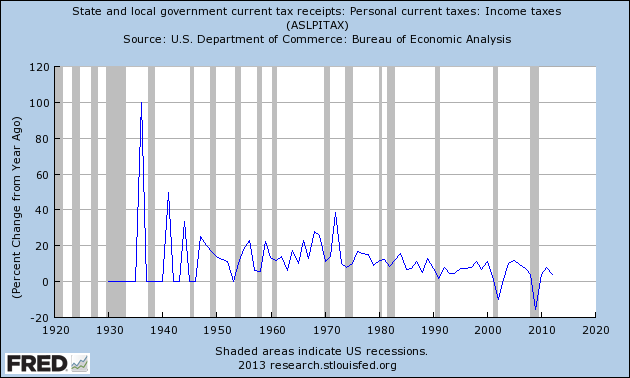

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated 2-28-13):

-

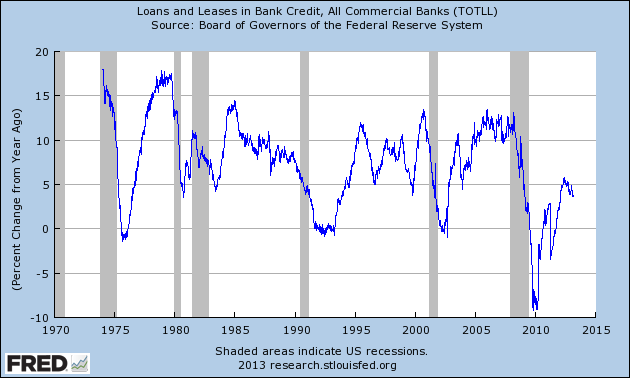

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated 3-9-13):

-

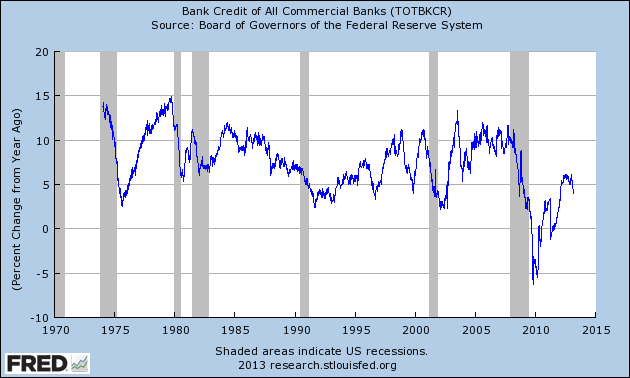

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated 3-8-13):

-

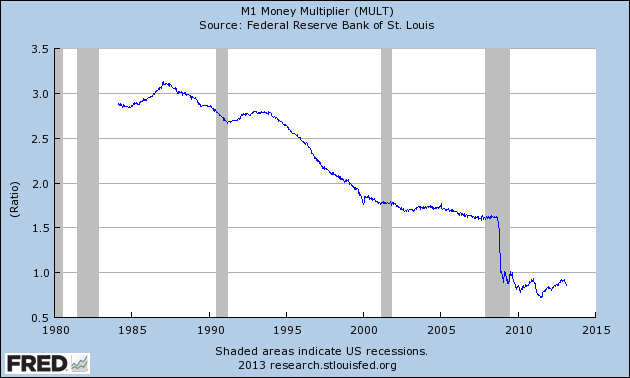

M1 Money Multiplier (last updated 2-28-13):

-

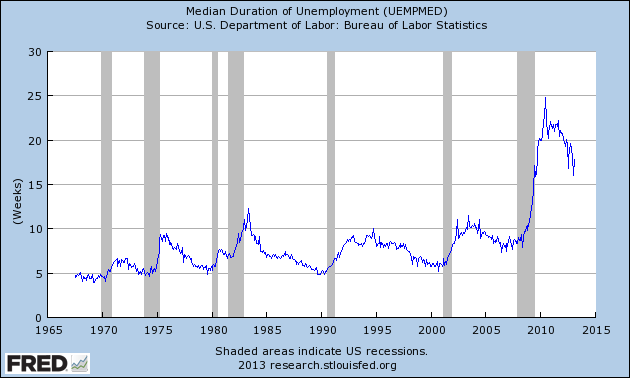

Median Duration of Unemployment (last updated 3-8-13):

-

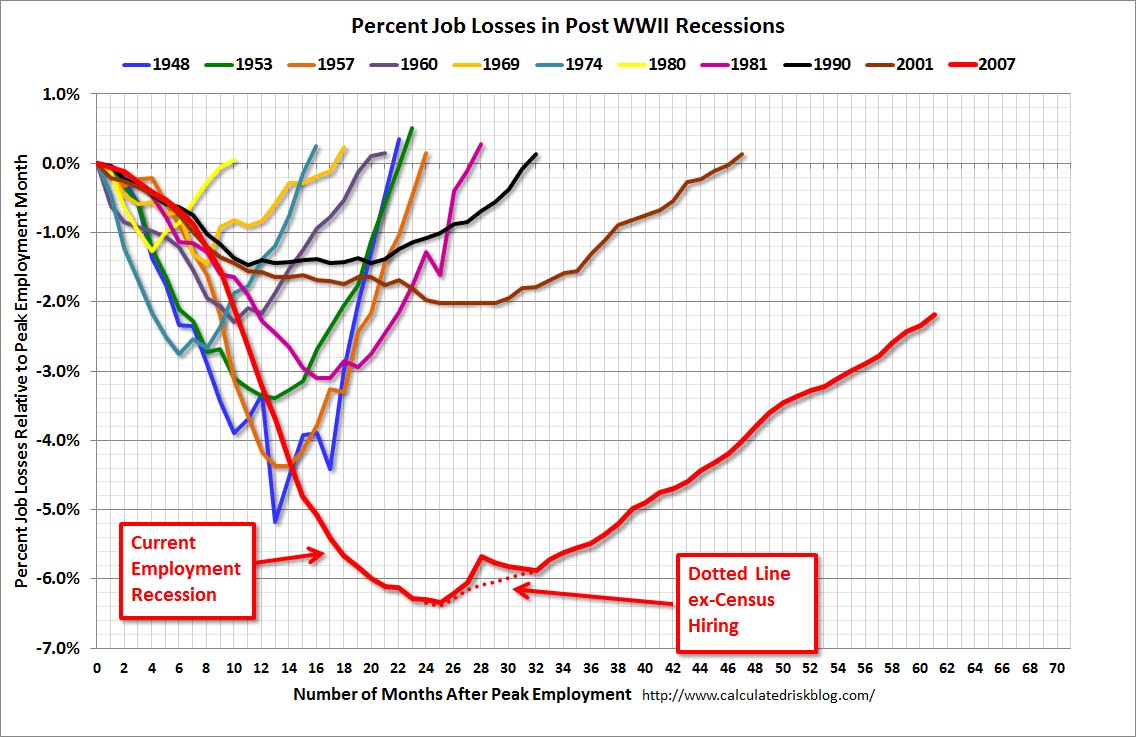

This next chart is from the CalculatedRisk.com blog post of March 8, 2013, titled "February Employment Report: 236,000 Jobs, 7.7% Unemployment Rate" and it shows (in red) the relative length and depth of this downturn and subsequent recovery from an employment perspective:

-

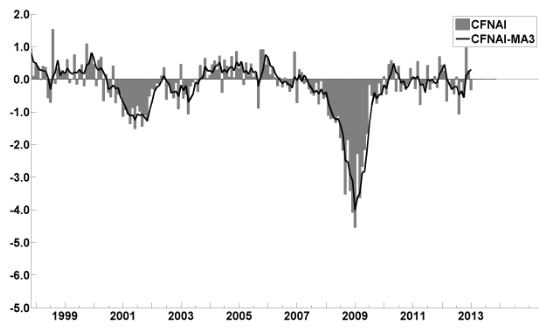

This last chart is of the Chicago Fed National Activity Index (CFNAI, and its 3-month moving average CFNAI-MA3) and it depicts broad-based economic activity (last updated 2-25-13):

-

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1550.03 as this post is written

How would these deficit and outlays charts change if you made them as % of GDP? Or as % of tax revenue? Things have structurally changed in the US since 1920.

ReplyDeleteThanks for putting this together. Very interesting.