On May 16, 2014, the Zillow Q2 2014 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

Two excerpts from the Press Release:

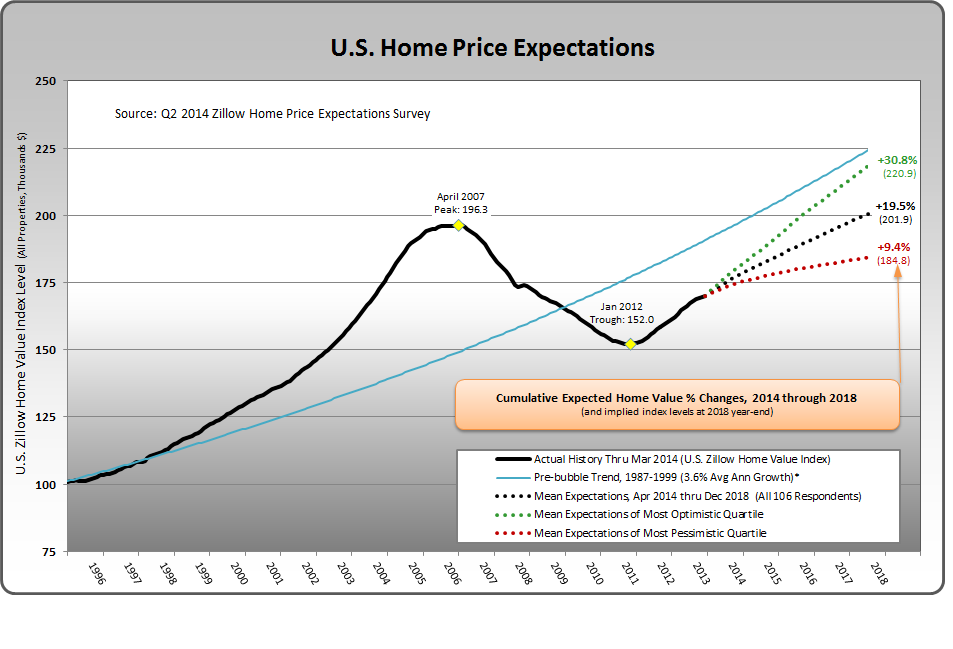

The survey of 106 economists, real estate experts and investment and market strategists asked panelists to predict the path of the U.S. Zillow Home Value Indexi through 2018 and solicited opinions on the main cause of declining home affordability. The survey was sponsored by leading real estate information marketplace Zillow, Inc. and is conducted quarterly by Pulsenomics LLC.

also:

On average, panelists said they expect nationwide home value appreciation of 4.4 percent through the end of this year, to a Zillow Home Value Index of$176,380. Panelists said they expect home value appreciation to slow to 3.8 percent by the end of 2015, on average, and to 3.4 percent through 2016. During the pre-bubble years from 1987 to 1999, home values grew at 3.6 percent per year.The most optimistic groupii of panelists predicted a 5.8 percent annual increase in home values this year, on average, while the most pessimisticiiipredicted an average increase of 3.2 percent. On average, panelists said they expected U.S. median home values to exceed their pre-recession peaks by Q1 2018. The most optimistic panelists predicted home values would rise roughly 12.6 percent above their 2007 peaks by the end of 2018, on average, while the most pessimistic said they expected home values to remain about 5.9 percent below 2007 peaks.

Various Q2 2014 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q2 2014 Home Price Expectations Survey (pdf) is interesting. Of the 106 survey respondents, only one (of the displayed responses) forecasts a cumulative price decrease through 2018; and even that one does not foresee a double-digit percentage cumulative price drop. That forecast is from Mark Hanson’s prediction, which foresees a 5.11% cumulative price decrease through 2018.

The Median Cumulative Home Price Appreciation for years 2014-2018 is seen as 4.50%, 8.54%, 12.37%, 15.85%, and 19.33%, respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in Mark Hanson’s above-referenced forecast) will prove too optimistic in hindsight. From a longer-term historical perspective, such a decline is very mild in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, (even) from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1877.86 as this post is written

No comments:

Post a Comment