This post provides an update to various past posts discussing

deflation and “deflationary pressures,” including the most recent post, that of January 27, 2015 titled "

U.S. Deflation - January 27, 2015 Update." I have extensively written of “deflationary pressures” and deflation as I continue to believe that prolonged U.S. deflationary conditions are on the horizon, and that such deflationary conditions will cause, as well as accompany, inordinate economic hardship. [note: to clarify, for purposes of this discussion, when I mention “deflation” I am referring to the CPI going below zero. Also, I have been using the term “deflationary pressures” as a term to describe deflationary manifestations within an environment that is still overall inflationary but heading towards deflation.]

The subject of deflation contains many complex aspects, and as such no short discussion can even begin to be a comprehensive discussion of such. However, in this post I would like to highlight some recent notable developments.

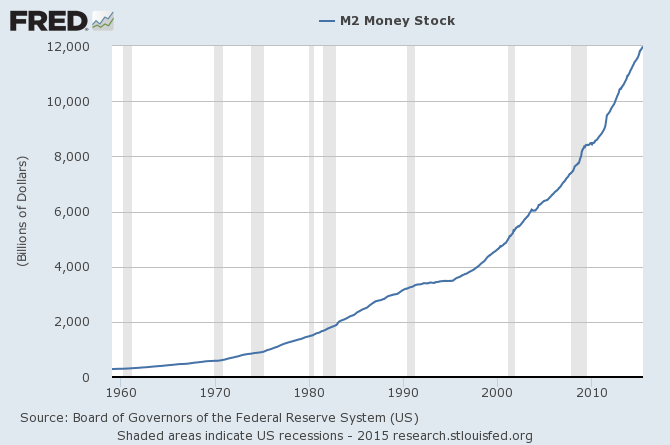

Another notable aspect concerning inflation and deflation is whether the Federal Reserve, through its various actions, can actually "control" inflation, which would include avoiding outright deflation. It seems that it is widely believed that the Federal Reserve can do so. Perhaps the most prominent comments on the subject in recent years are found in Ben Bernanke's speech of November 21, 2002, titled "

Deflation: Making Sure 'It' Doesn't Happen Here." While I don't agree with various assertions and conclusions made in the speech, I do agree with the general premise that "sustained deflation can be highly destructive to a modern economy," especially given the dynamics and characteristics of our current economy and financial system.

Another noteworthy aspect of our current economic situation is that of a continuing shortfall between the Federal Reserve's stated inflation target (2% on the PCE) and the actual inflation reading. This 2% inflation target has been “missed” (inflation has been less than 2%) for over 37 months. As the Wall Street Journal article of June 1, 2015 ("

Inflation Misses Fed's 2% Target for 36th Straight Month") mentions, "April 2012 was the last time the inflation rate was on target. That’s the longest such stretch of sub-2% inflation since the 1960s."

While many (including the views expressed in the Federal Reserve Bank of San Francisco's July 20 Economic Letter titled "

Assessing the Recent Behavior of Inflation") seem to believe that this continuing shortfall is of little overall significance, I do believe that this shortfall is very significant, as, among other things, it shows that at this point inflation is far less "controllable" than commonly believed.

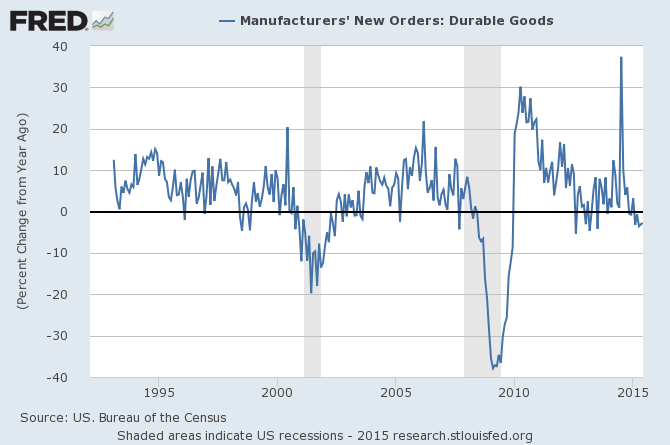

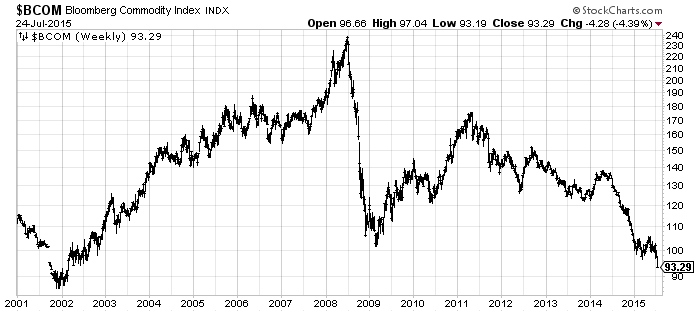

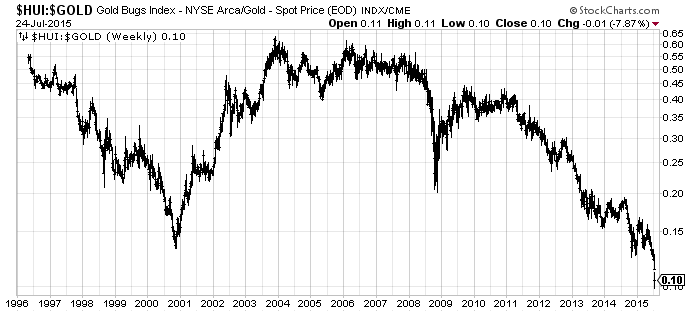

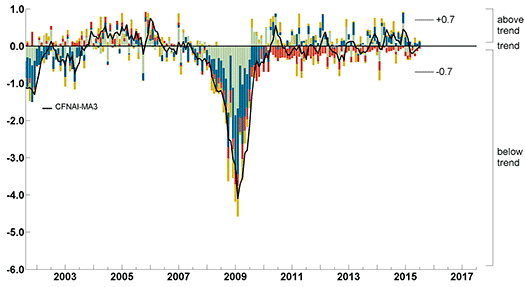

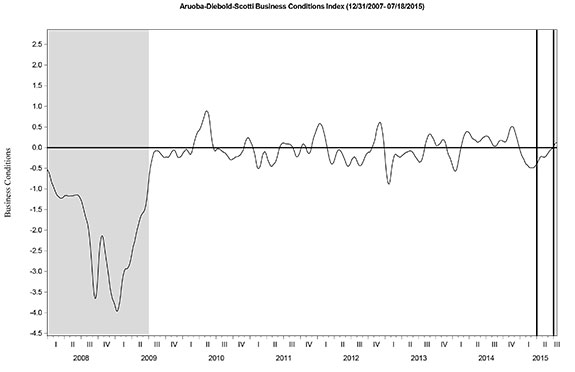

Recent market developments and other aspects show that "deflationary pressures" are in many ways intensifying. While there are numerous measures that, in my opinion, indicate such, here are three prominent ones:

(charts courtesy of StockCharts.com; chart creation and annotation by the author)

The Bloomberg Commodity Index, now at 13-year lows (and notably less than levels seen during the Financial Crisis):

(depicted on a weekly LOG basis)

The HUI:Gold Ratio, which is the ratio of the HUI (an index of gold stocks) to that of the physical metal itself. One theory, perhaps the predominant one, is that the gold stocks should anticipate, or at least verify, the price movements of the physical gold itself. An implication of such is that a declining HUI:Gold ratio is an augur of lower gold prices. Both the absolute levels of this HUI:Gold ratio, as well its continuing decline, would seem to suggest a forthcoming decline in the gold price to a level that almost certainly will signal deflation:

(depicted on a weekly LOG basis)

Light Crude Oil, now again below $50/bbl. Notably, the widely anticipated "uptick" in consumer spending that was supposed to accompany such a decline in the price of oil has yet to materialize. As Janet Yellen stated at her

June 17, 2015 press conference, "There are questions at this point about just how much impact we’ve seen of lower energy prices on consumer spending. The decline in oil prices translates into an improvement in household income on average of something like $700 per household, and I’m not convinced yet by the data that we have seen the kind of response to that that I would ultimately expect."

(depicted on a weekly LOG basis)

_____

The Special Note summarizes my overall thoughts about our economic situation

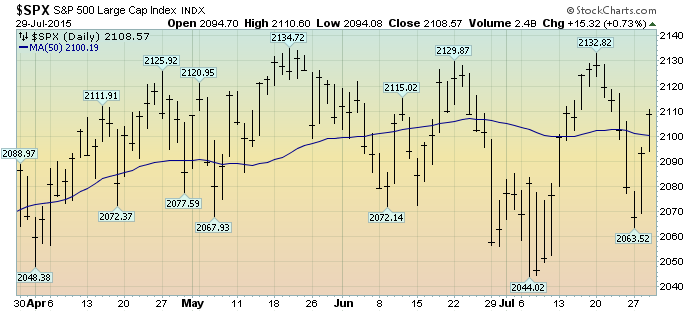

SPX at 2079.66 as this post is written