On September 10, 2015 the September Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey, I found the following to be the most notable excerpts:

Ninety-three percent of U.S. companies say they have job openings in key positions and nearly half of these firms say it is difficult to fill these slots. CFOs list the difficulty in attracting and retaining qualified employees as one of their top three overall business concerns.U.S. firms expect to hike wages 3.3 percent over the next year, with wage growth strongest in services, consulting and construction.

also:

Though economic uncertainty is the top business concern across much of the globe, CFOs are worried that companies are not adequately managing risk. Almost half (44 percent) of financial executives believe firms in their own industries have become complacent about managing downside risk."It is especially troubling that a greater proportion, 55 percent, of CFOs in the banking industry believe their industry has become complacent about managing risk," Harvey said.

also:

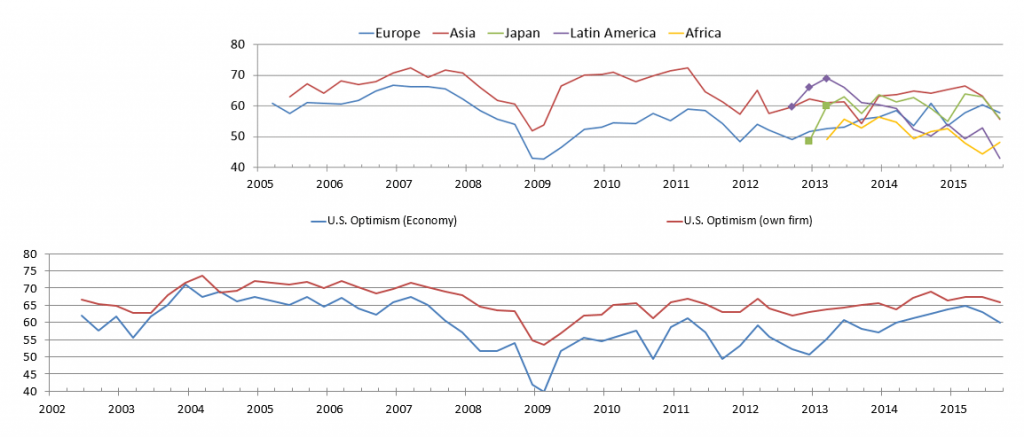

CFO optimism about the U.S. economy has weakened but remains the strongest in the world. On a scale from zero to 100, financial executives rate the outlook at 60, down from 65 in the spring and 63 last quarter. As a result, business plans will soften somewhat. Capital spending is expected to increase only 2.4 percent at U.S. companies and earnings will rise only 3 percent. Merger and acquisition activity will continue, with the deals funded primarily by cash and debt.

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 60, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1950.79 as this post is written

No comments:

Post a Comment