From Chairman Powell’s opening comments:

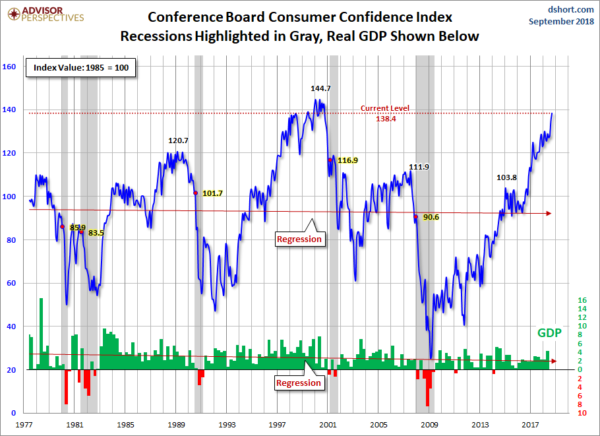

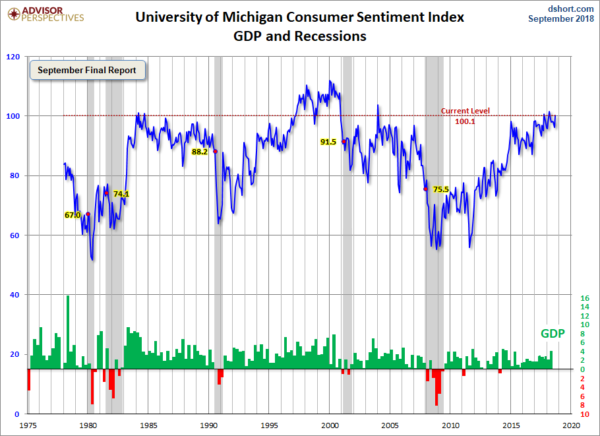

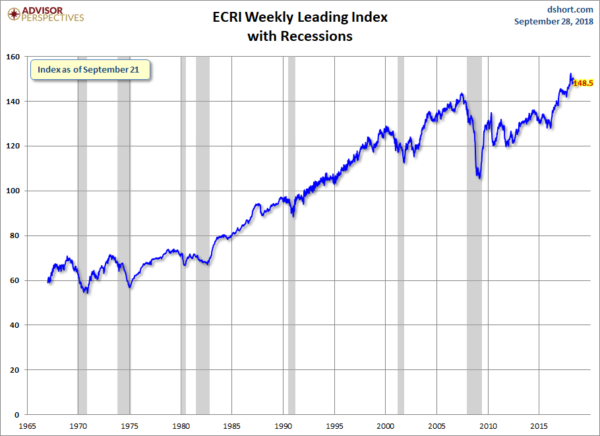

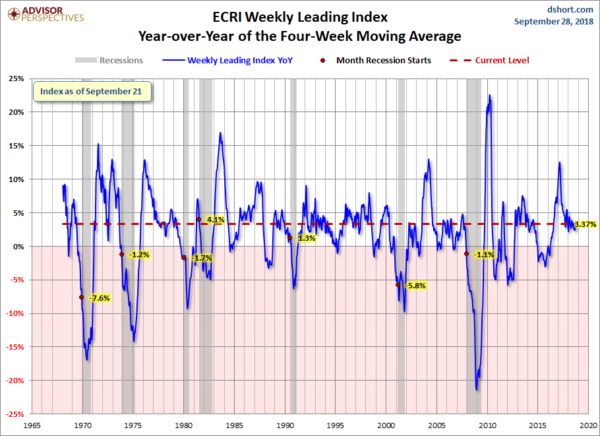

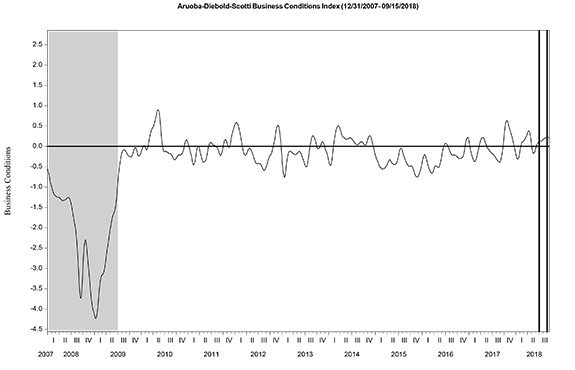

Our economy is strong. Growth is running at a healthy clip. Unemployment is low, the number of people working is rising steadily, and wages are up. Inflation is low and stable. All of these are very good signs. Of course, that’s not say that everything is perfect. The benefits of this strong economy have not reached all Americans. Many of our country’s economic challenges are beyond the scope of the Fed, but my colleagues and I are doing all we can to keep the economy strong, healthy, and moving forward. That is the best way we can promote an environment in which every American has the opportunity to succeed.

also:

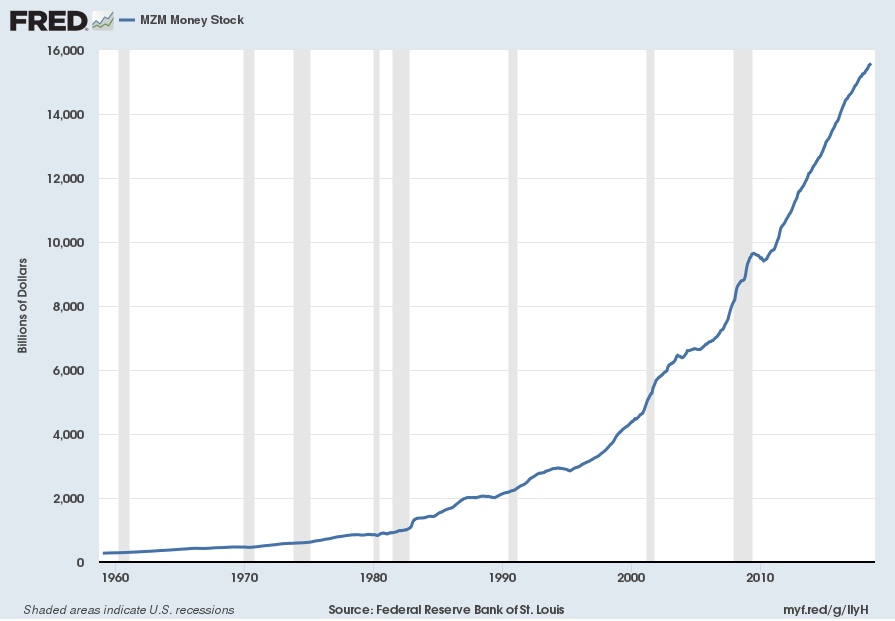

Both household spending and business investment are expanding briskly, and the overall growth outlook remains favorable. Several factors support this assessment: Fiscal policy is boosting the economy, ongoing job gains are raising incomes and confidence, and overall financial conditions remain accommodative. These conditions are consistent with our Summary of Economic Projections for this meeting. The median of Committee participants’ projections for the growth of real GDP is 3.1 percent this year and 2.5 percent next year.

Job gains averaged 185,000 per month over the last three months, well above the pace needed in the longer run to provide jobs for new entrants to the labor force. The unemployment rate stood at 3.9 percent in August, and has been near that level since April. Smoothing through month-to-month variations, the labor force participation rate remains about where it was in late 2013–a positive sign, given that the aging of our population is putting downward pressure on participation. We expect the job market to remain strong. And the median of Committee participants’ projections for the unemployment rate later this year is 3.7 percent, and a bit lower than that in 2019.

also:

Today the Committee raised the target range for the federal funds rate by 1/4 percentage point, bringing it to 2 to 2-1/4 percent. This action reflects the strength we see in the economy, and is one more step in the process that we began almost three years ago of gradually returning interest rates to more normal levels. Looking ahead, today’s projections show gradual interest rate increases continuing roughly as foreseen in June. The median of the participants’ views on appropriate policy through 2020 are unchanged since the June meeting.

Jerome Powell’s responses as indicated to the various questions:

SAM FLEMING. Thanks very much. Sam Fleming from the Financial Times. The Fed has recently been saying that financial stability risks are moderate. What kind of developments could prompt a change in that assessment to elevated risks? And is there an argument for moving the counter cyclical capital buffer, even when risks are moderate, rather than waiting until the risks are seen as elevated, which arguably could be too late? Thanks.

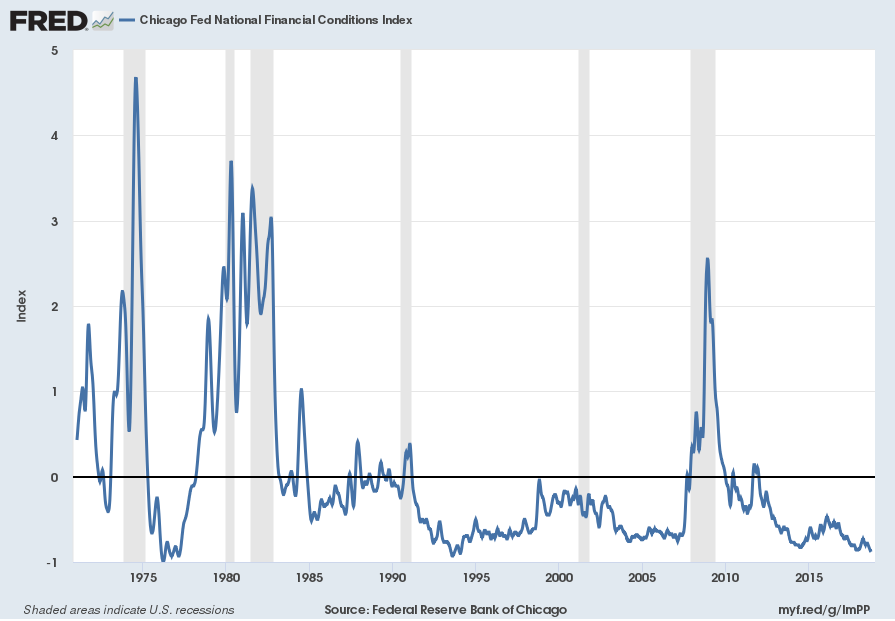

CHAIRMAN POWELL. So, I think one of the most important lessons from the financial crisis is really the importance of the stability of the financial system. And so, we — since the financial crisis, as you’re aware, we’ve had a major focus on building up our monitoring of financial conditions and financial stability issues. We’ve also put in place many, many initiatives to strengthen the financial system through higher capital, and better regulation, more transparency, central clearing, margins on unclear derivatives, all kinds of things like that, which are meant to strengthen the financial system. We’ve done many of those things, and we feel that the financial system is in a much better place.

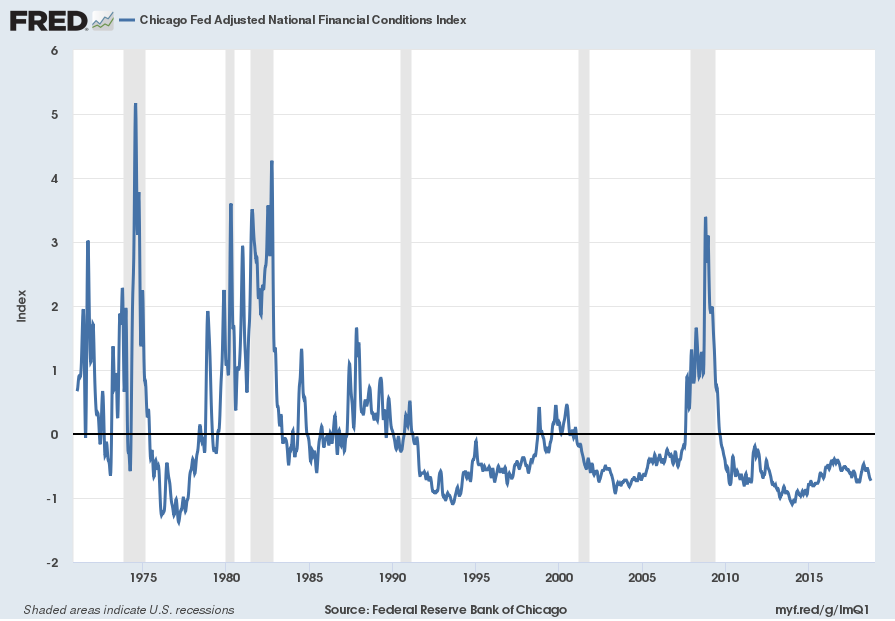

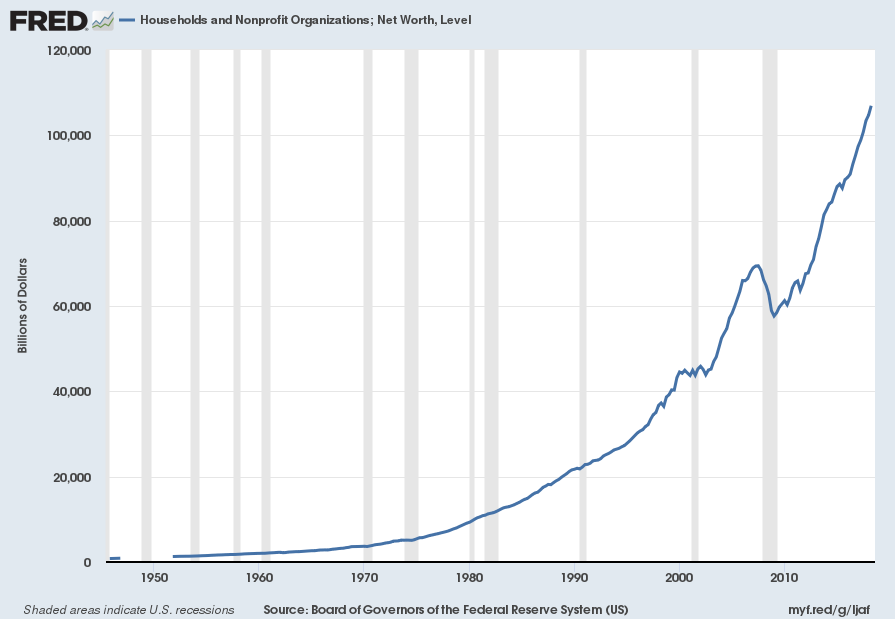

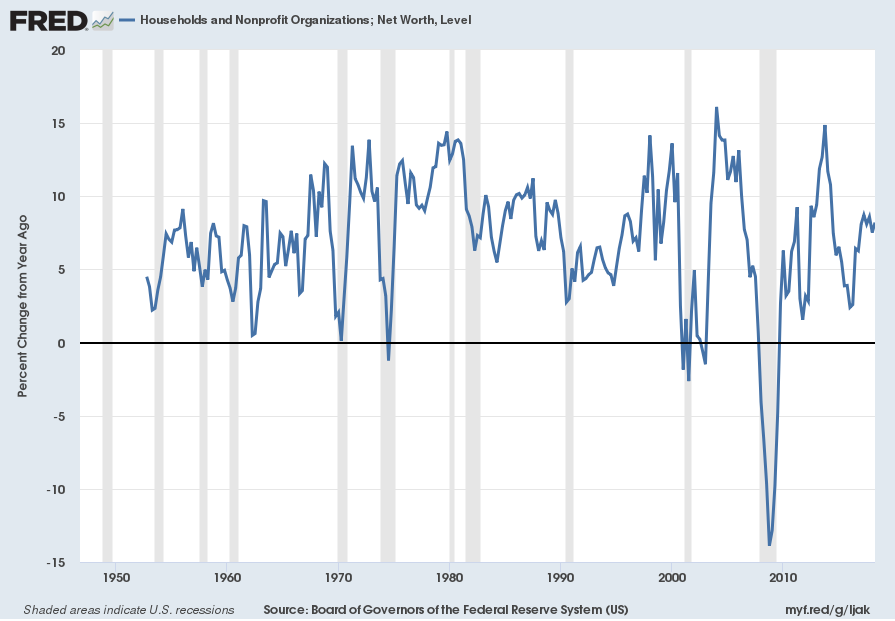

As we look at — as we look at conditions most recently, and this was at our last meeting and it was in our minutes for the last meeting, quarterly, we have a briefing at the FOMC, and also at the Board, of the staffs’ views on financial stability, and the staff judged the overall vulnerabilities to be moderate. If you dig into the different aspects of that question, households or balance sheets are in good shape. You know, employment is high, wages are rising, that sort of thing. The banking system, as I mentioned, is, you know, much higher capital, much higher liquidity, is much stronger. If you look at asset prices, it is true that some asset prices are in the upper range of their historical — upper reach of their historical ranges. And then if you look at non-financial corporates, you get — there is the story of leverage there. So, it’s not that there aren’t any vulnerabilities, but we see them as moderate.

Now you ask about the counter cyclical capital buffer. The counter cyclical capital buffer is a tool that we added to our toolkit I think finally back in 2016. We said that we would deploy it when vulnerabilities were meaningfully above normal. We revisit that on a regular schedule and the last time we revisited it was I think last year — sometime last year and concluded that the test was not met. As I mentioned at the last briefing, the — you know, the assessment was that vulnerabilities were moderate, but it remains a kit — a tool for our toolkit that we can deploy, you know, when and as we feel appropriate.

also:

GREG ROBB. Thank you, Mr. Chairman. Greg Robb from MarketWatch. The 10-year anniversary of the bankruptcy of Lehman Brothers got a lot of attention over the last month. I was wondering if you thought there were any lessons from the crisis that you want to share and two points on that. You go to Congress a lot and talk to members of Congress. Now Secretary Paulson and Mr. Geithner and Chair Bernanke have said that Congress made a mistake when it took away the Fed’s emergency powers in Dodd-Frank. And then one other thing is that are you confident that all these non-banks didn’t – you know, non-banks never got put into the, you know, the FSOC, you know, system. So, are you confident that the — you can see the risks in the financial system? Thank you.

CHAIRMAN POWELL. So, three things there. The first thing is the single biggest thing I think that we learned was the — as I mentioned I think earlier, the importance of maintaining the stability of the financial system. So, I think if you look — if you look back at the way the models worked, and the way people thought about risk in the economy, that’s what was missing, and I think it’s not missing anymore. So, we — you know, we put a tremendous focus on that. We raised capital, liquidity. We have stress tests, which force banks to understand — the largest banks particularly — to understand and better manage their risk and have enough capital to survive a really substantial shock that’s at least as bad as the financial crisis. And if all that doesn’t work, we’ve got resolution plans, which we’ve, you know, through many cycles, have made really substantial progress, more than I had thought was likely. So, we’ve done a lot. Nobody’s — you know, nobody is I think overconfident that we solved every problem. And, you know, now we’re going back and kind of taking a hard look at everything, and, you know, trying to make — trying to — trying to keep at it.

So, I think those are the really important lessons and, you know, we — we’re determined not to, you know, not to forget them, and that’s I think a risk now is to — is to forget things that we — that we learned. That’s just human nature over time.

I saw the article you’re talking about, the question is, did Congress take things away, emergency powers from the Fed? So, there was sort of a trade for taking away our power under 13, section 13(3) to provide support to individual non-banks, which is really holding companies and other companies. In exchange for that, we got order liquidation authority and a resolution authority. Was it a mistake? I don’t think there’s any sense that Congress would seriously look at changing that. I have real doubts about whether it was wise to take away our crisis-fighting tools. I think you put them away, and you hope you never need them, and I certainly strongly oppose efforts to take away more of our tools.

You know, the third thing you mentioned is the designation power, so it’s a really important power. In my mind, it should be used — my thinking, it should be used sparingly, and that means, you know, in situations where you have — I mean, in principle, you could have another Lehman Brothers come up out of the ground that’s not a bank, and it could be very threatening — or it could be capable of creating systemic risk, and so I think it’s a critical power to have. But, again, I would use it — I would tend to use it fairly sparingly.

also:

VIRGINIE MONTET. Virginie Montet with Agence France Presse. You mentioned earlier a possible, not probably correction, and I want to come back to the high level of the stock market. Are there any participants to the FOMC to think that we are witnessing an episode of irrational exuberance or rational exuberance? And if there was a steep correction, would it provoke financial stability concerns?

CHAIRMAN POWELL. So, I don’t comment on the appropriateness of the level of stock prices. I can say that by some valuation measures they’re in the upper range of their historical value ranges. But, you know, I wouldn’t want to — I wouldn’t want to speculate about what the consequences of a market correction should be. You know, we would — we would look very carefully at the nature of it and I mean it — really, really what hurts is if consumers are borrowing heavily and doing so against, for example, an asset that can fall into value, so that’s a really serious matter when you have a housing bubble and highly levered consumers, and housing values fall. We know that that’s a really bad situation. A simple drop in equity prices is, all by itself, doesn’t really have those features. It could certainly feature — it could certainly affect consumption and have a negative effect on the economy though.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2923.15 as this post is written