U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

While many U.S. economic indicators – including GDP – are indicating economic growth, others depict (or imply) various degrees of weak growth or economic contraction. As seen in the October 2018 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 3.1% GDP growth in 2018 and 2.4% GDP growth in 2019. However, there are other broad-based economic indicators that seem to imply a weaker growth rate.

As well, it should be remembered that GDP figures can be (substantially) revised.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

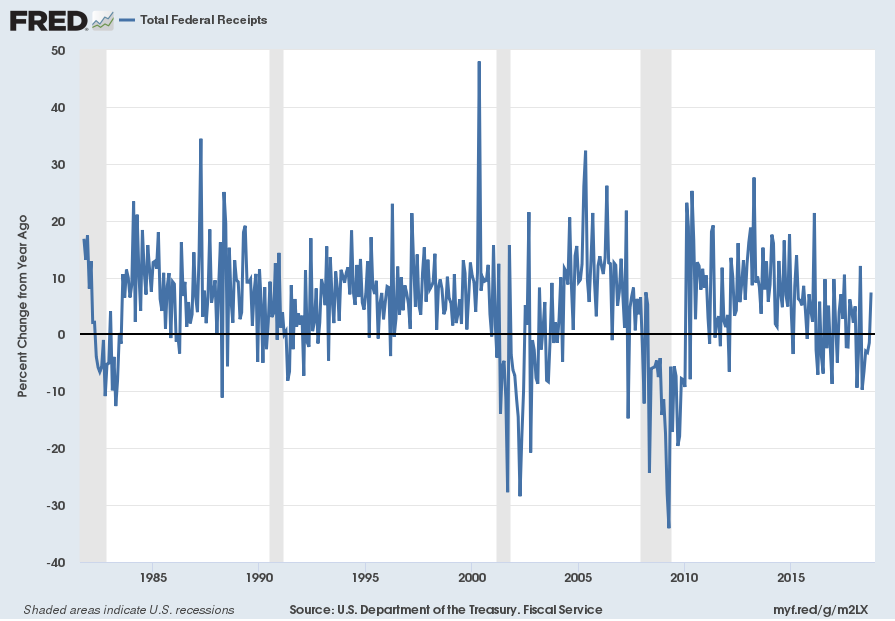

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through October had a last value of $252,692 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value 7.4%, last updated November 13, 2018:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed November 13, 2018:

__

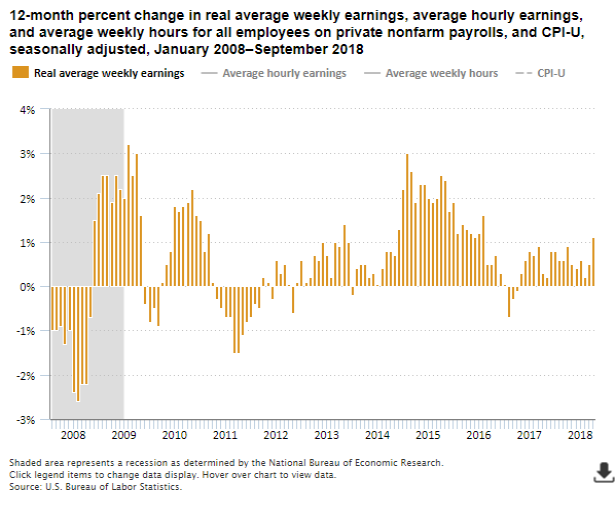

Real Hourly Earnings

The level and growth rates of wages and household earnings continues to be (highly) problematical. I have extensively discussed these worrisome trends in income and earnings.

As seen in many measures the problem is chronic (i.e long-term) in nature.

Shown below is a chart depicting the 12-month percent change in real average weekly earnings for all employees from January 2008 – September 2018. As seen in the chart below, growth in this measure over the time period depicted has been intermittent, volatile, and, especially since 2017, weak:

source: Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Real average weekly earnings increase 1.1 percent, September 2017 to September 2018 on the Internet at https://www.bls.gov/opub/ted/2018/real-average-weekly-earnings-increase-1-point-1-percent-september-2017-to-september-2018.htm(visited November 09, 2018).

__

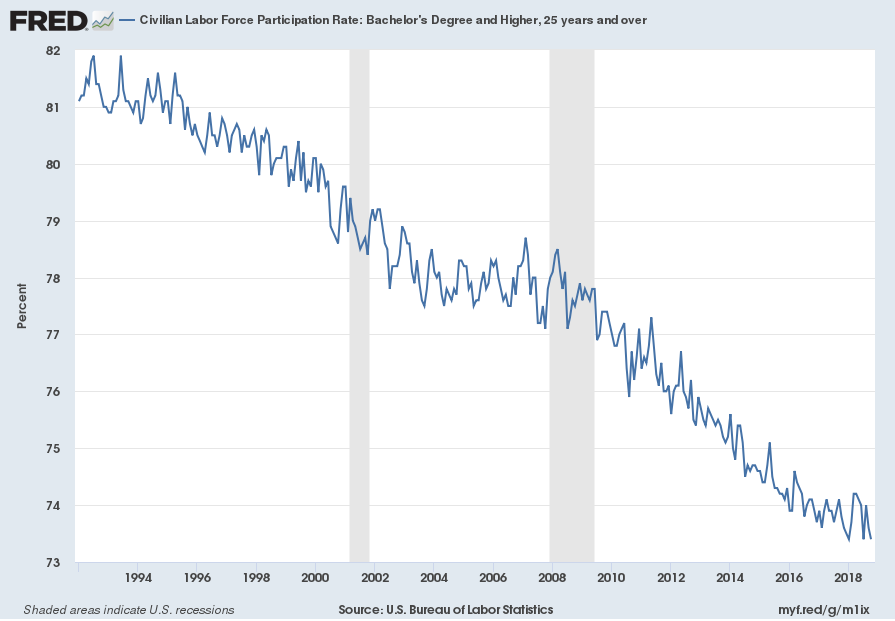

Unemployment

I have written extensively concerning unemployment, as the current and future unemployment issue is of tremendous importance.

The consensus belief is that employment is robust, citing total nonfarm payroll growth and the current unemployment rate of 3.7%. However, my analyses continue to indicate that the conclusion that employment is strong is incorrect. While the unemployment rate indicates that unemployment is (very) low, closer examination indicates that this metric is, for a number of reasons, highly misleading.

My analyses indicate that the underlying dynamics of the unemployment situation remain exceedingly worrisome, especially with regard to the future. These dynamics are numerous and complex, and greatly lack recognition and understanding, especially as how from an “all-things-considered” standpoint they will evolve in an economic and societal manner. I have recently written of the current and future U.S. employment situation on the “U.S. Employment Trends” page.

While there are many charts that can be shown, one that depicts a worrisome trend is the Civilian Labor Force Participation Rate for those with a Bachelor’s Degree and Higher, 25 years and over. Among disconcerting aspects of this measure is the long-term (most notably the post-2009) trend, especially given this demographic segment.

The current value as of the November 2, 2018 update (reflecting data through the October employment report) is 73.4%:

source: U.S. Bureau of Labor Statistics, Civilian Labor Force Participation Rate: Bachelor’s Degree and Higher, 25 years and over [LNS11327662], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed November 12, 2018:

__

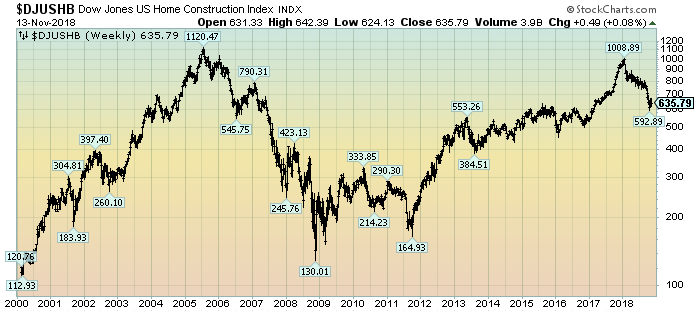

New Home Sales

For numerous economic reasons, the number and price of homes sales, especially new home sales, is a very important aspect of the U.S. economy.

As an indication for the overall health of the overall new home sales market, below is the Dow Jones Home Construction Index, depicted on a weekly basis, LOG scale, from the year 2000 through the closing price of 635.79 on November 13, 2018. As one can see, the latest peak was on January 24, 2018 at 1008.89:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate economic weakness or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2722.18 as this post is written

No comments:

Post a Comment