U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

While many U.S. economic indicators – including GDP – are indicating economic growth, others depict (or imply) various degrees of weak growth or economic contraction. As seen in the November 2019 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 2.1% GDP growth in 2019 and 1.7% GDP growth in 2020. However, there are other broad-based economic indicators that seem to imply a weaker growth rate.

As well, it should be remembered that GDP figures can be (substantially) revised.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

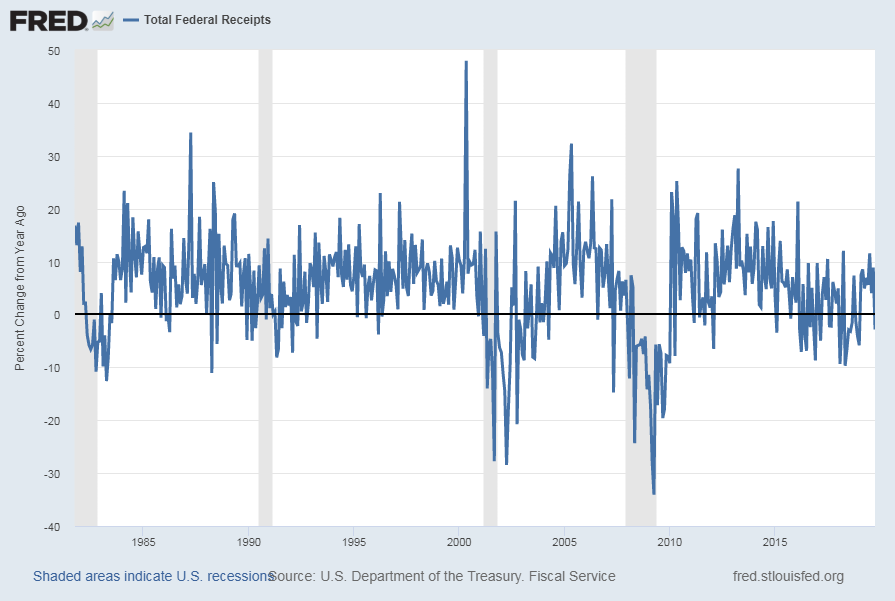

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through October had a last monthly value of $245,520 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value -2.8%, last updated November 13, 2019:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed November 13, 2019:

https://fred.stlouisfed.org/series/MTSR133FMS

https://fred.stlouisfed.org/series/MTSR133FMS

__

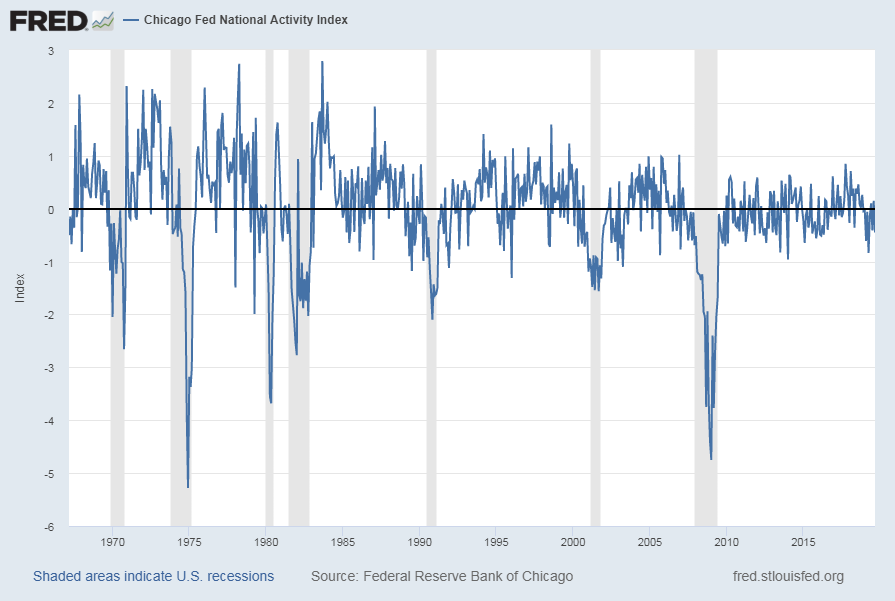

The Chicago Fed National Activity Index (CFNAI)

A broad-based economic indicator that has been implying weaker growth or mild contraction is the Chicago Fed National Activity Index (CFNAI).

The October 2019 Chicago Fed National Activity Index (CFNAI) updated as of October 28, 2019:

The CFNAI, with current reading of -.45:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 28, 2019:

https://fred.stlouisfed.org/series/CFNAI

https://fred.stlouisfed.org/series/CFNAI

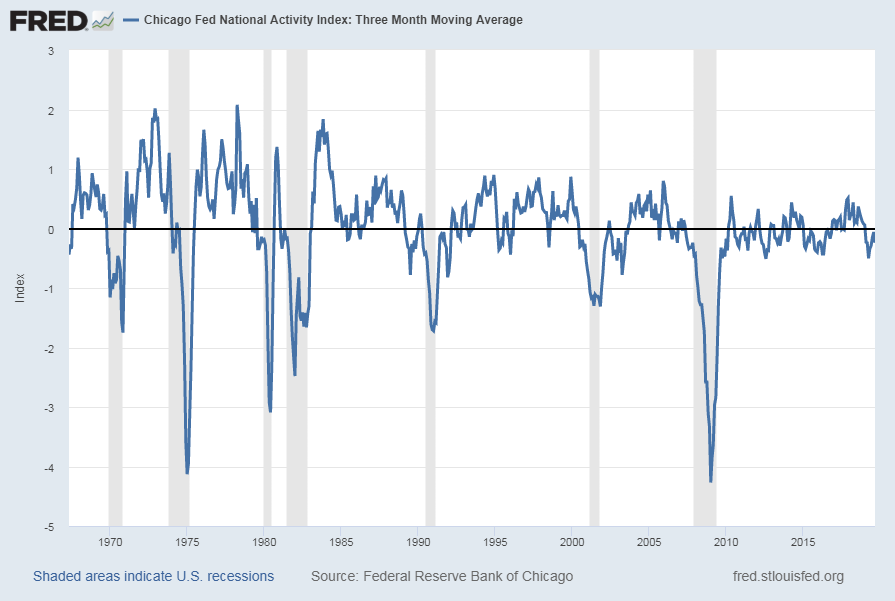

The CFNAI-MA3 (CFNAI three-month moving average) with current reading of -.24:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; October 28, 2019:

https://fred.stlouisfed.org/series/CFNAIMA3

https://fred.stlouisfed.org/series/CFNAIMA3

__

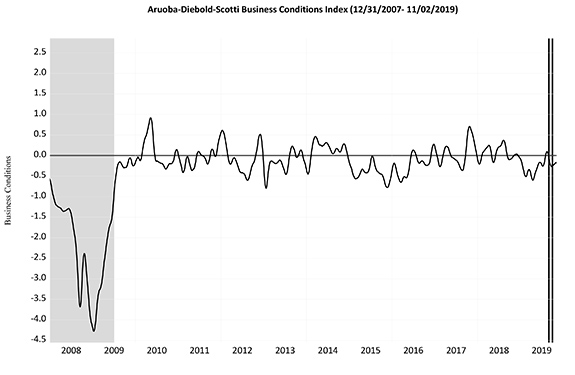

The Aruoba-Diebold-Scotti Business Conditions Index (ADS Index)

Another broad-based economic indicator that seems to imply a weaker recent growth rate is the Aruoba-Diebold-Scotti Business Conditions Index (ADS Index.)

Below is a chart of the index from December 31, 2007 through November 2, 2019, with a value of -.1673, as of the November 7 update:

source: Federal Reserve Bank of Philadelphia, Aruoba-Diebold-Scotti Business Conditions Index (ADS Index)

__

Unemployment

I have written extensively concerning unemployment, as the current and future unemployment issue is of tremendous importance.

The consensus belief is that employment remains robust, citing total nonfarm payroll growth and the current unemployment rate of 3.6%. However, my analyses continue to indicate that the conclusion that employment is strong is incorrect. While the unemployment rate indicates that unemployment is (very) low, closer examination indicates that this metric is, for a number of reasons, highly misleading.

My analyses indicate that the underlying dynamics of the unemployment situation remain exceedingly worrisome, especially with regard to the future. These dynamics are numerous and complex, and greatly lack recognition and understanding, especially as how from an “all-things-considered” standpoint they will evolve in an economic and societal manner. I have discussed the overall current and future U.S. employment situation on the “U.S. Employment Trends” page.

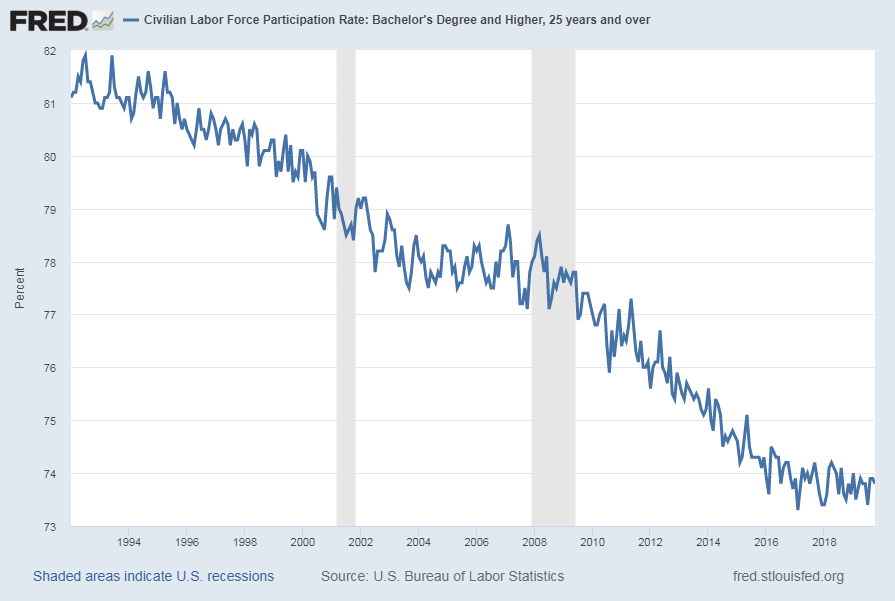

While there are many charts that can be shown, one that depicts a worrisome trend is the Civilian Labor Force Participation Rate for those with a Bachelor’s Degree and Higher, 25 years and over. Among disconcerting aspects of this measure is the long-term (most notably the post-2009) trend, especially given this demographic segment.

The current value as of the November 1, 2018 update (reflecting data through the October employment report) is 73.8%:

source: U.S. Bureau of Labor Statistics, Civilian Labor Force Participation Rate: Bachelor’s Degree and Higher, 25 years and over [LNS11327662], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed November 11, 2019: https://fred.stlouisfed.org/series/LNS11327662

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate economic weakness or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3094.04 as this post is written

No comments:

Post a Comment