On June 4, 2020, the Zillow Q2 2020 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

Coronavirus and subsequent stay-at-home orders resulted in lower-than-expected transaction volume during what was primed to be a busy spring home shopping season. While it was thought the spring buying season could shift to the fall, the pandemic effects are poised to continue into summer and only 10% of the survey panelists believe those transactions will materialize later in 2020. More than twice as many experts (22%) expect a “double up” during next spring’s shopping season, and the vast majority predict that recovery will be spread out over the next several years.This prediction is in line with how the experts expect the U.S. economy to recover overall. Forty-one percent think economic recovery will follow a ‘U’ shape, and 33% say it will be a bumpy, multi-year return back to trend growth. Both patterns are characterized first by a sharp decline and then match how experts see transaction volume recovering, with the consensus generally being a more gradual journey back to normal.Prices nationally are now projected to fall 0.3 percent this year according to the panel-wide average forecast — down from an expected increase of 3.3 percent just three months ago.“This is the first time since 2012 that the panel-wide price outlook has turned negative, and the quarter-to-quarter swing in expectations is the largest we’ve seen in more than a decade,” said Terry Loebs, founder of Pulsenomics. “Longer term, the outlook for home values nationwide is mixed — price projections for 2022 and beyond actually inched higher from levels recorded prior to the Covid-19 outbreak. However, nearly seven in ten experts now indicate that their five-year forecast has downside risk. Last quarter, fewer than four in ten panelists foresaw downside — of course, that was before the Covid-19 crisis, its economic devastation and unprecedented government response.”

–

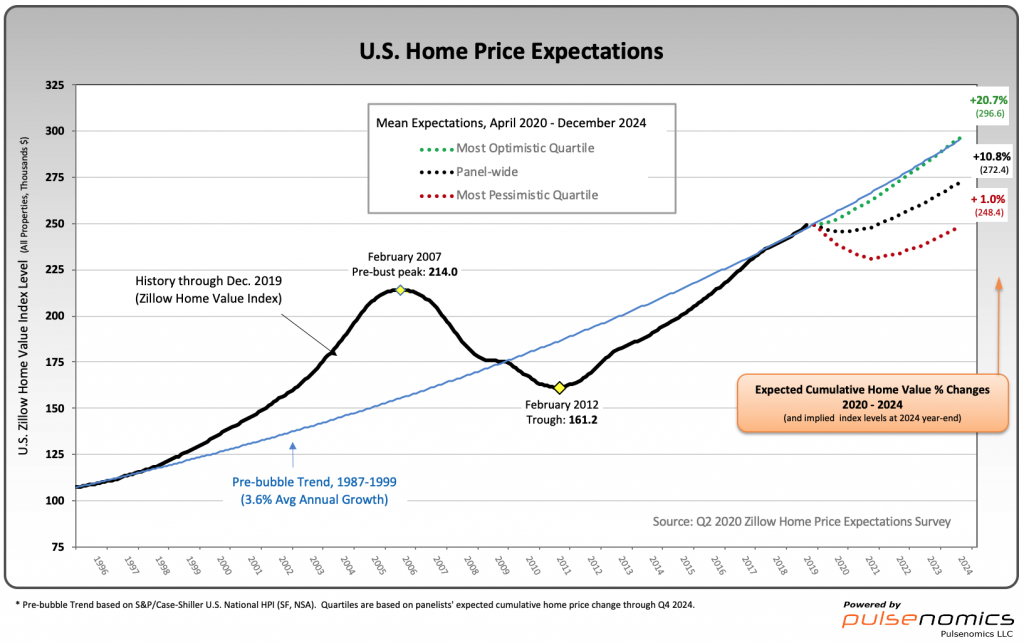

Various Q2 2020 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb after a brief decline.

The detail of the Q2 2020 Home Price Expectations Survey is interesting. Of the 100+ survey respondents, only eight (of the displayed responses) forecasts a cumulative price decrease through 2024, and one of those forecasts is for a double-digit percentage decline. The largest decline is seen as a 18.9% cumulative price decrease through 2024.

The Median Cumulative Home Price Appreciation for years 2020-2024 is seen as .6%, 1.46%, 4.37%, 7.99%, and 11.42% respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in the above-referenced forecast) will prove far too optimistic in hindsight. From a longer-term historical perspective, such a decline is very mild in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3106.31 as this post is written

No comments:

Post a Comment