On July 8, 2020 the latest CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

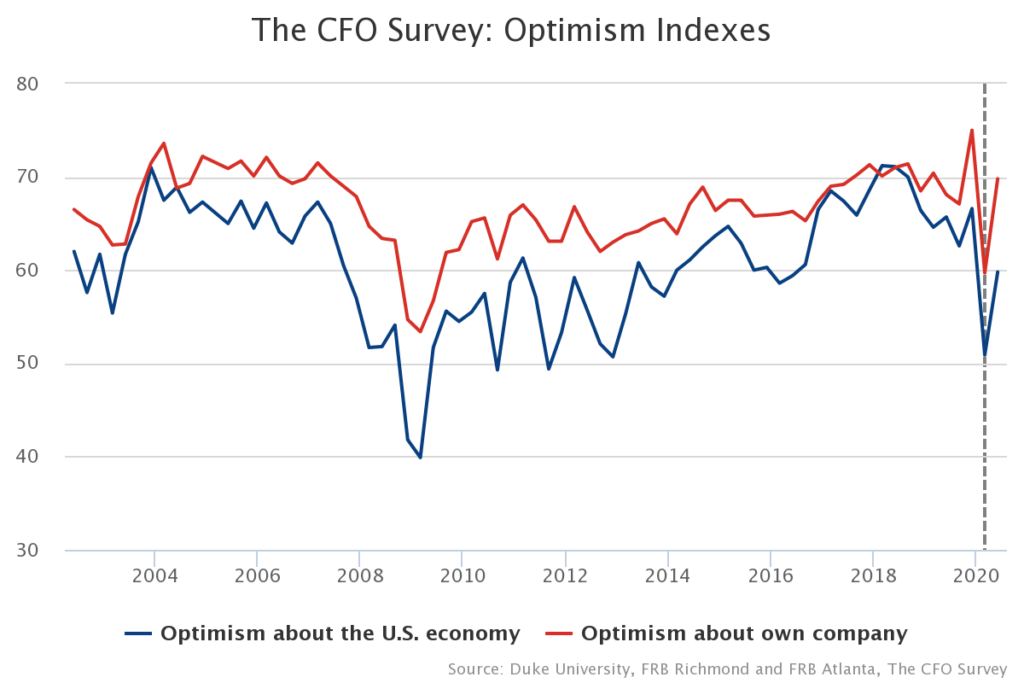

The CFO Survey was conducted from June 15-26 among financial decision-makers in firms of varying sizes and across industries. When participants were asked to rate their optimism for the financial prospects of their firms on a scale of 0 to 100, the average optimism rating was 70, an improvement from the first quarter (60) and close to the average for the past several years. When asked to rate their optimism about the overall U.S. economy from 0 to 100, the average rating was 60 — also an improvement from 51 in the first quarter, which was conducted from the beginning of March through the beginning of April in 2020.In spite of the improvement in the optimism indexes, the trajectory of the recovery was not clear, according to survey responses. “Firms continued to express concerns around the shape and strength of the recovery — for their firms, their industries, and their customers,” said Brent Meyer, policy advisor and economist at the Federal Reserve Bank of Atlanta. “The comments from CFOs and financial decision-makers from firms across industries indicate that the COVID-19 pandemic has dramatically affected their views of the U.S. economy and the financial prospects of their firms.”On average, firms expected revenue to decline 2 percent in 2020, but grow 7 percent in 2021. Operating income, employment, and total compensation were also expected to bounce back in 2021 after shrinking in 2020. This pessimism about 2020 was corroborated by firms’ low expectations for gross domestic product (GDP) growth; almost 40 percent of firms expected GDP growth to be negative for the calendar year 2020.When asked about their most pressing concerns, by far respondents’ most common concern was around their own firms’ sales/revenues and customer demand. Further, about one-third of firms responding to the survey cut employment since early March, with the average firm reducing their workforce by 5.5 percent. Most of the respondents attributed the cuts to reduced demand during the COVID-19 pandemic.

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 60, as seen below:

[Note: The dashed vertical line denotes a moderate change in the question wording and presentation. Please see The CFO Survey Methodology for further information.]

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3151.56 as this post is written

No comments:

Post a Comment