On October 7, 2020 the latest CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Corporate financial decision-makers generally expect employment and revenues to remain below pre-COVID levels until at least 2021, although they remain optimistic about the future financial prospects for the U.S. economy and their own firms. This is according to results of The CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta.

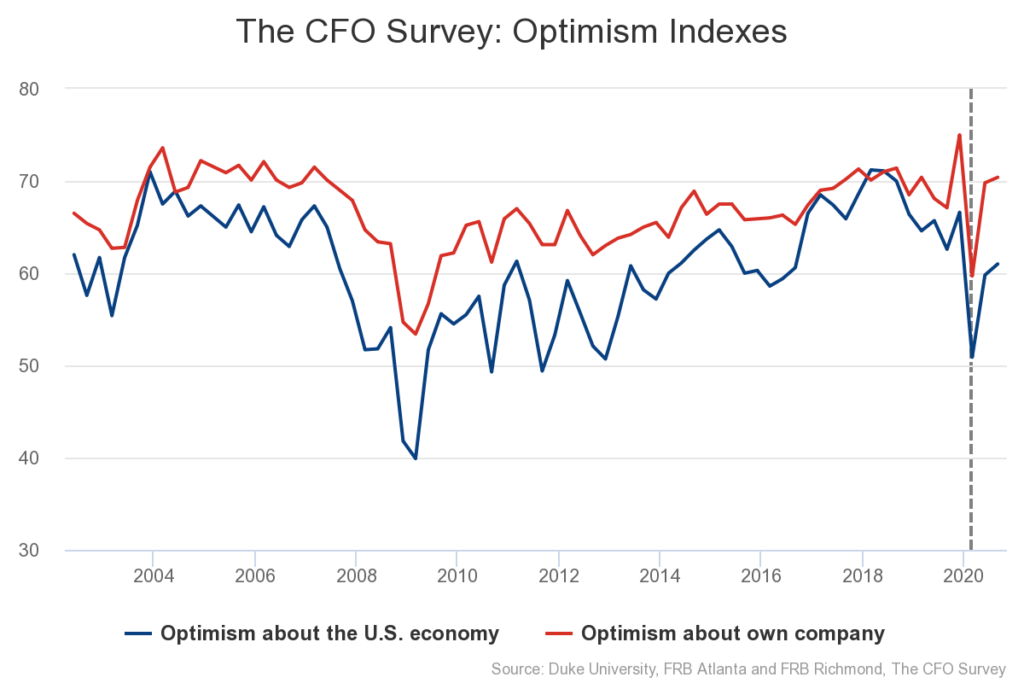

The CFO Survey was conducted from September 14–25, 2020, among financial decision-makers in U.S. firms of varying sizes and across industries. When participants were asked to rate their optimism for the financial prospects of their firms, the average optimism was just above 70 on a scale of 0 to 100 —approximately in-line with the second-quarter reading. When asked to rate their optimism about the overall U.S. economy, the average rating was 61, also in-line with the average of 60 from the second-quarter survey, which was conducted from June 15–26. Both of the new optimism ratings were well above those reported in the first quarter, which marked the onset of the pandemic-induced economic downturn.

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 61, as seen below:

[Note: The dashed vertical line denotes a moderate change in the question wording and presentation. Please see The CFO Survey Methodology for further information.]

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3407.53 as this post is written

No comments:

Post a Comment