On April 14, 2021, the Zillow Q1 2021 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

Strong competition for available homes pushed up prices last year — the typical home appreciated by more than $20,000 in 2020. Even with an expectation for more inventory to help meet buyer demand, ZHPE panelists on average expect home prices to grow 6.2% in 2021 — a full two percentage points higher than when they were surveyed in Q4 2020 — and several panelists call for double-digit price growth this year.

“This is the most bullish near-term outlook for home prices we’ve seen from our experts since the early stages of the post-bust recovery, and the panel’s five-year average annual home price forecast has never been more optimistic,” said Terry Loebs, founder of Pulsenomics. “In the wake of last year’s heady home equity gains, these new projections indicate that the aggregate value of homes across the country will increase by another $2 trillion in 2021. This is great news for existing homeowners, but even with a robust economic rebound in the coming months affordability will likely remain a challenge for many aspirational renters looking to move into homeownership this year.”

–

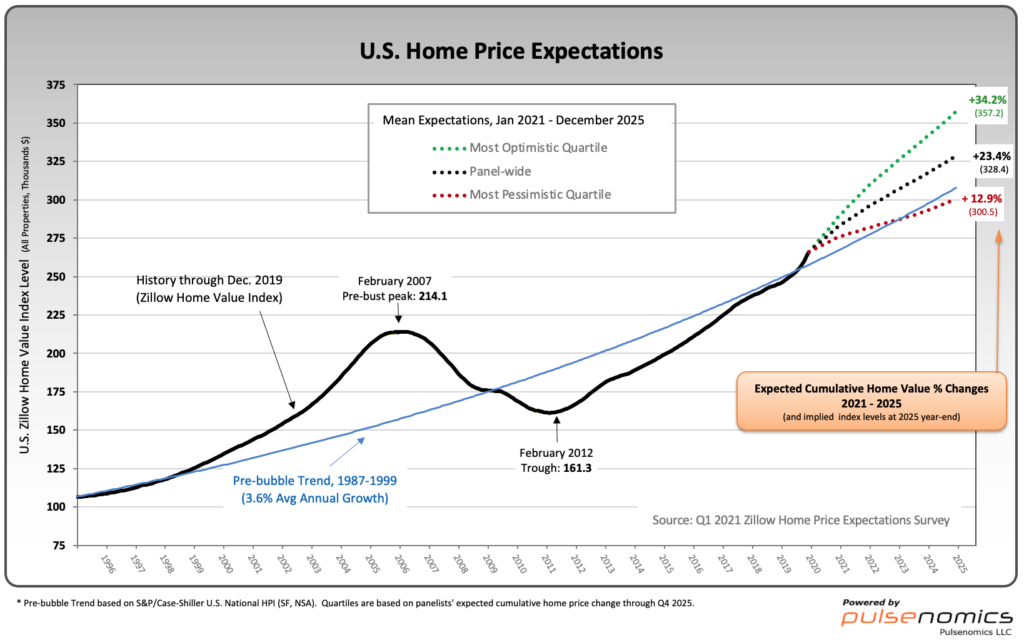

Various Q1 2021 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q1 2021 Home Price Expectations Survey is interesting. Of the 100+ survey respondents, none (of the displayed responses) forecasts a cumulative price decrease through 2025.

The Median Cumulative Home Price Appreciation for years 2021-2025 is seen as 6.0%, 10.93%, 15.23%, 19.13%, and 23.59%, respectively.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic in hindsight.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4124.66 as this post is written

No comments:

Post a Comment