On December 21, 2022 The CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

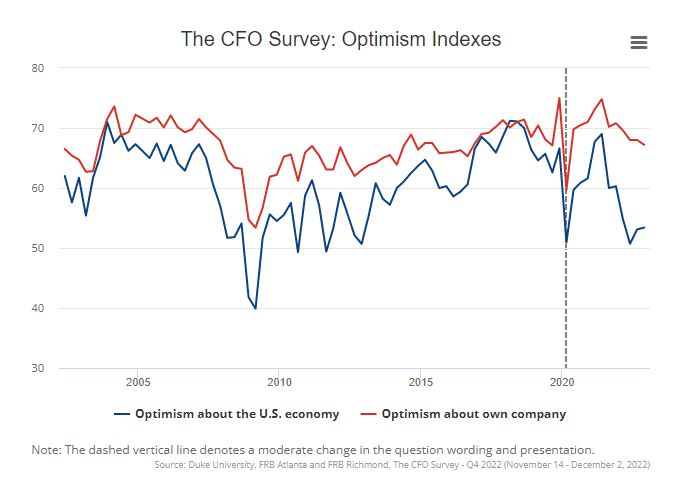

CFO optimism about the U.S. economy remains at 53 on a scale of 0 to 100, the same as last quarter but well below the historic average of about 60. And CFOs expect real GDP to grow by only 0.7 percent in 2023, with 31 percent of CFOs expecting negative real growth. Also, CFOs anticipate their companies’ revenues to grow by only 5 percent in 2023, which is down from last quarter’s 2023 forecast and also less than anticipated 2022 revenue growth.

About two-thirds of CFOs report that current interest rates have not affected their capital expenditures or non-capital spending plans, while about 30 percent say that rates have already dampened spending plans. Nearly 40 percent say they either have already curtailed spending plans or would curtail spending should interest rates increase by another two percentage points.

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 53.4, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3886.93 as this post is written

No comments:

Post a Comment