The following is the latest update of 10 charts that depict various aspects of the U.S. economic and financial situation.

I find these charts portray disturbing long-term trends. These trends have been in effect for years.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts are from the Federal Reserve, and represent the most recently updated data.

(click on charts to enlarge images)

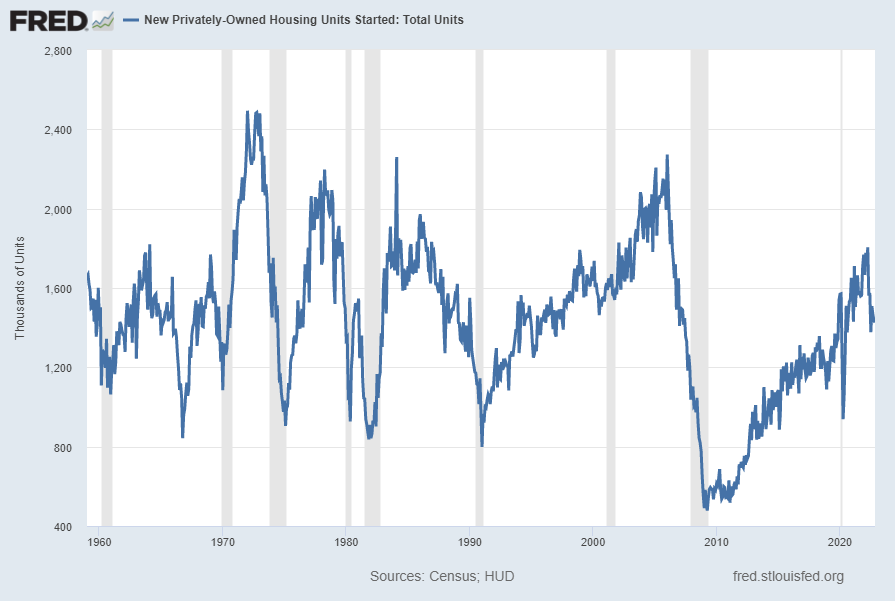

Housing starts (last update December 20, 2022):

U.S. Bureau of the Census, Housing Starts: Total: New Privately Owned Housing Units Started [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/HOUST/, January 13, 2023.

–

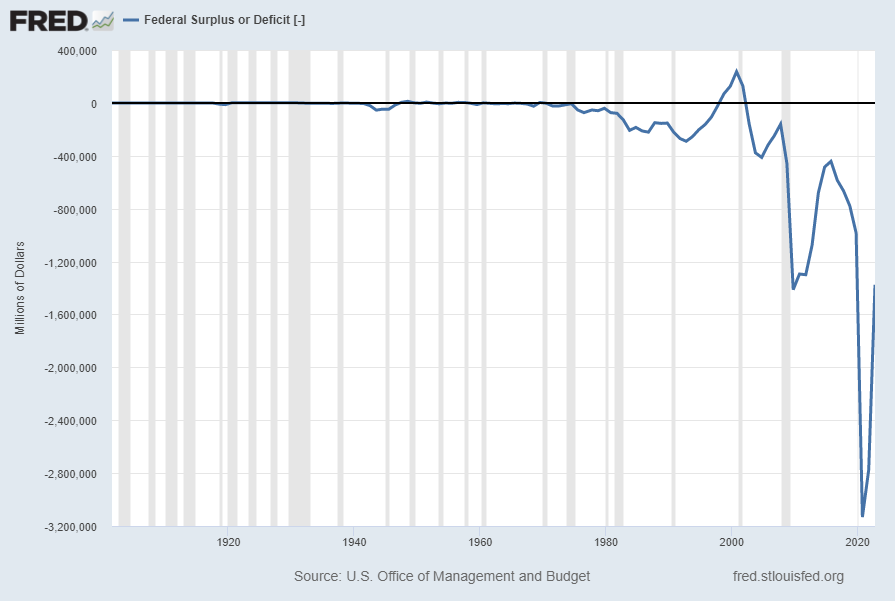

The Federal Deficit (last updated October 21, 2022):

U.S. Office of Management and Budget, Federal Surplus or Deficit [-] [FYFSD], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYFSD/, January 13, 2023.

–

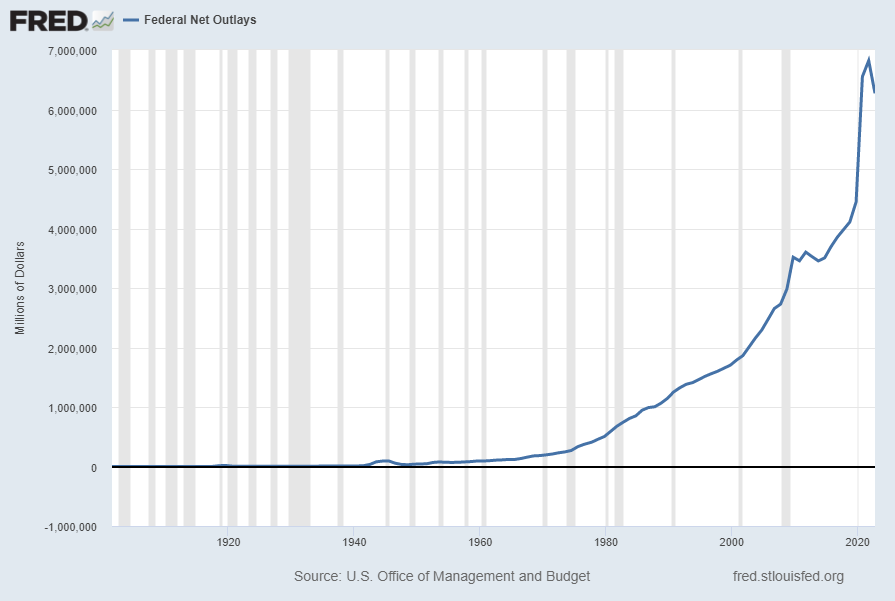

Federal Net Outlays (last updated October 21, 2022):

U.S. Office of Management and Budget, Federal Net Outlays [FYONET], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYONET/, January 13, 2023.

–

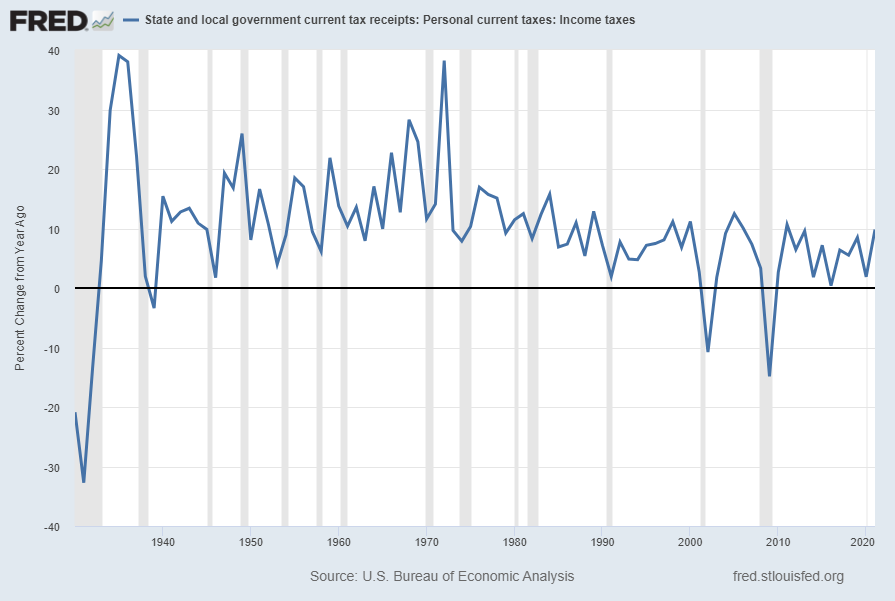

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated September 29, 2022):

U.S. Bureau of Economic Analysis, State and local government current tax receipts: Personal current taxes: Income taxes [ASLPITAX], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/ASLPITAX/, January 13, 2023.

–

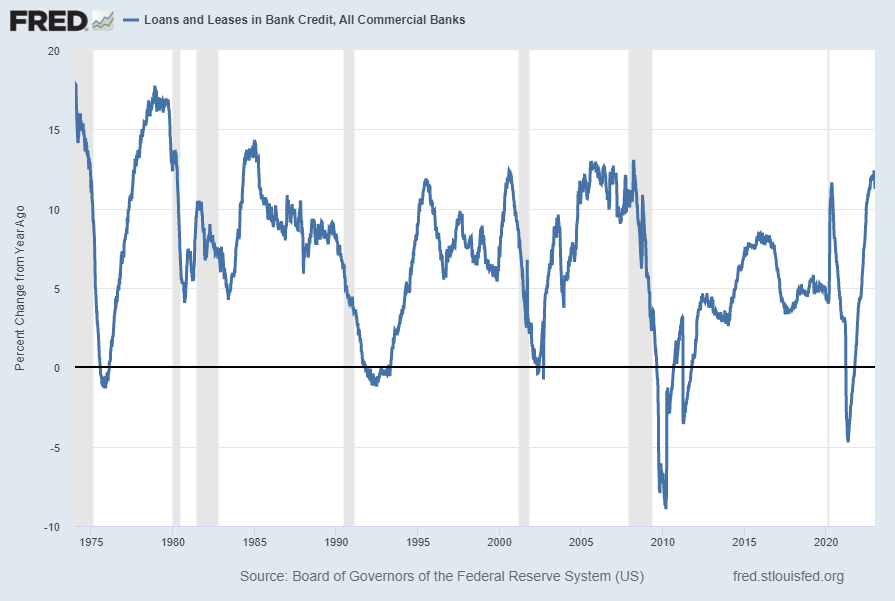

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated January 6, 2023):

Board of Governors of the Federal Reserve System (US), Loans and Leases in Bank Credit, All Commercial Banks [TOTLL], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTLL/, January 13, 2023.

–

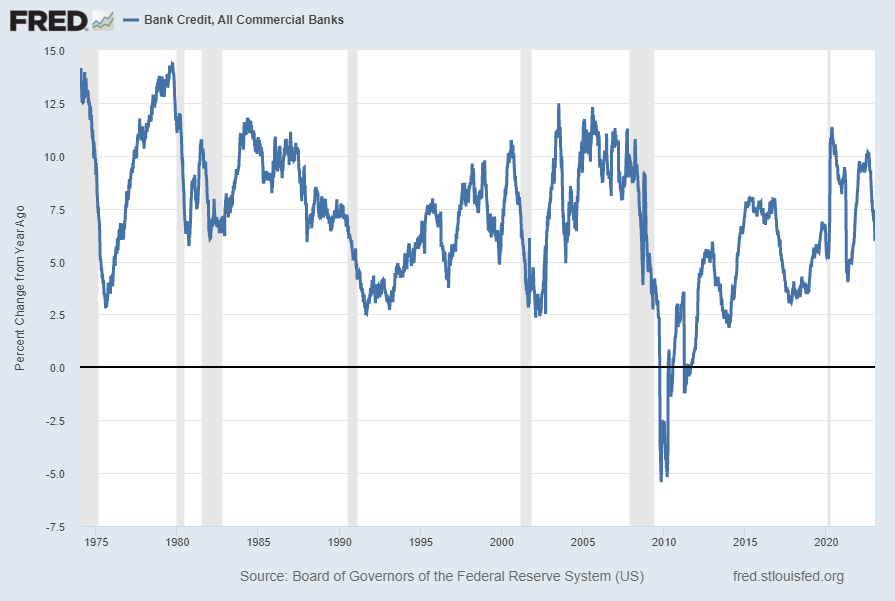

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated January 6, 2023):

Board of Governors of the Federal Reserve System (US), Bank Credit of All Commercial Banks [TOTBKCR], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTBKCR/, January 13, 2023.

–

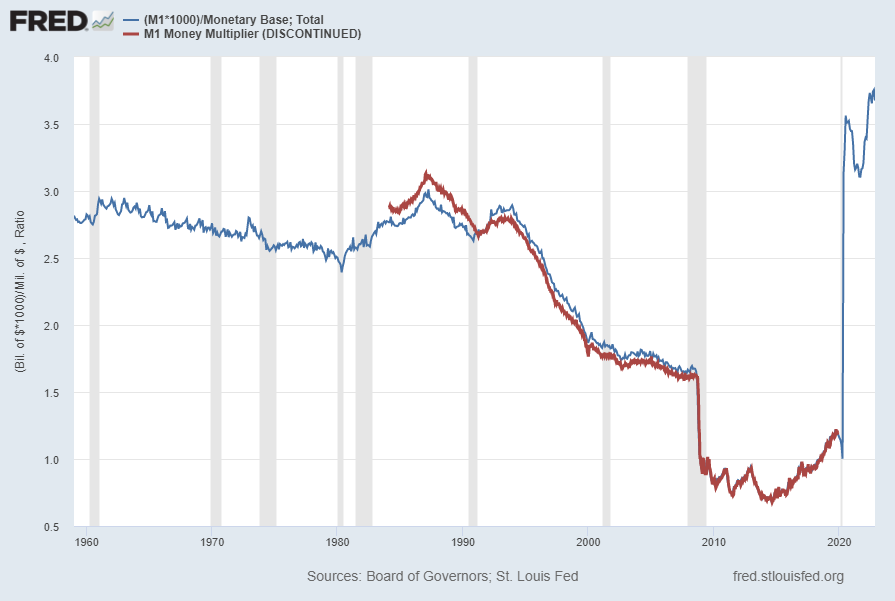

M1 Money Multiplier Proxy:

Federal Reserve Bank of St. Louis, M1 Money Multiplier [MULT], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/MULT/, January 13, 2023.

–

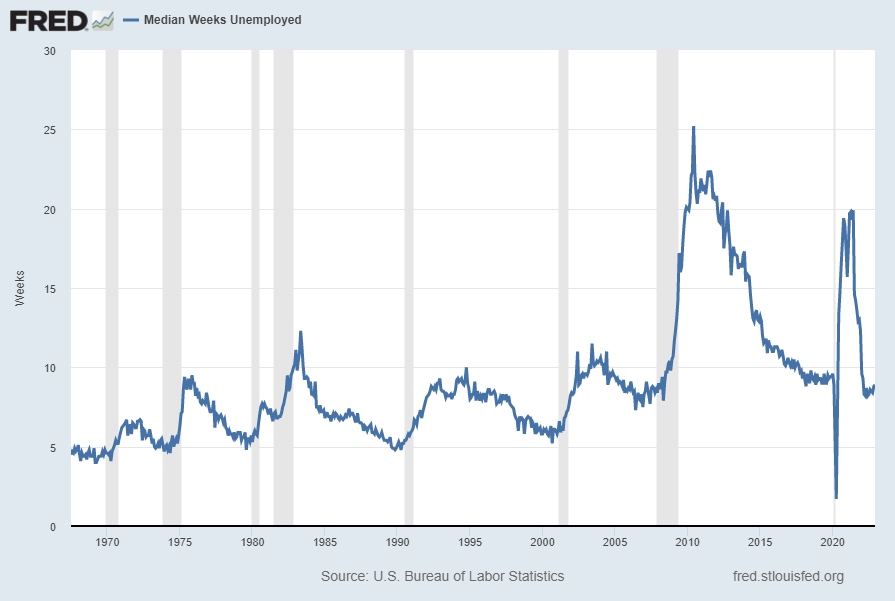

Median Duration of Unemployment (last updated January 6, 2023):

U.S. Bureau of Labor Statistics, Median Duration of Unemployment [UEMPMED], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/UEMPMED/, January 13, 2023.

–

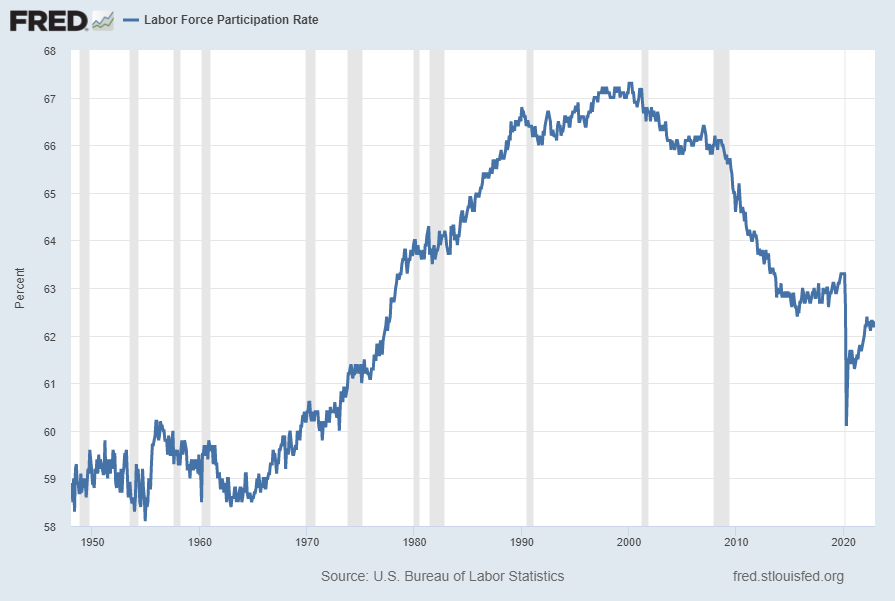

Labor Force Participation Rate (last updated January 6, 2023):

U.S. Bureau of Labor Statistics, Civilian Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/CIVPART/, January 13, 2023.

–

The Chicago Fed National Activity Index (CFNAI) Three Month Moving Average (CFNAI-MA3)(last updated September 26, 2022):

not available

–

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3999.49 as this post is written

No comments:

Post a Comment