On February 29, 2024, the Fannie Mae Q1 2024 Home Price Expectations Survey (HPES) results were released. This survey is done on a quarterly basis.

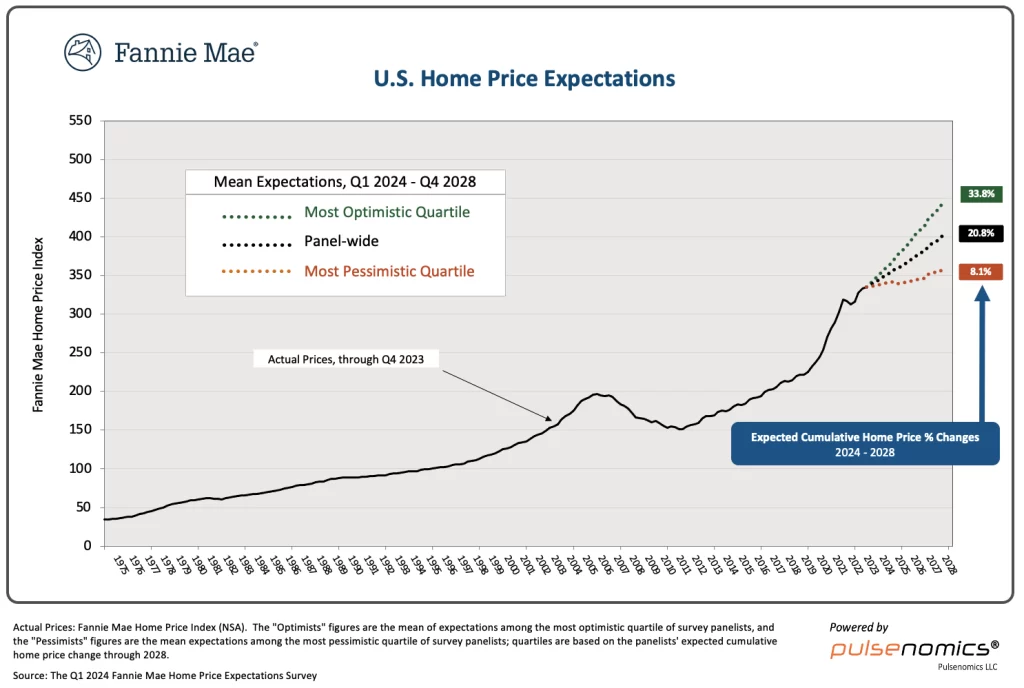

Various Q1 2024 Fannie Mae Home Price Expectations Survey information is available, including the chart seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the Fannie Mae Home Price Index, will continually climb.

The detail of the survey is interesting. Of the survey respondents, only four (of the displayed responses) forecasts a cumulative price decrease through 2028.

The Median Cumulative Home Price Appreciation for years 2024-2028 is seen as 4.0%, 7.74%, 12.16%, 16.08%, and 20.84%, respectively.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Residential real estate is an exceedingly large asset bubble. As such, from these price levels there exists potential for a price decline of outsized magnitude.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 5081.24 as this post is written

No comments:

Post a Comment