A few days ago (February 8, 2022) I wrote a post titled “The Belief That Current Inflation Levels Will Subside.” That post discussed various reasons that support the belief that the current high level of inflation will be transitory, i.e. inflation will subside over the next few months at which point it will then stabilize. This belief is the consensus among economists and other professional forecasters, and is seen in forecasts from the Federal Reserve.

However, there are many reasons to believe that inflation will increase from these levels, perhaps substantially. Of course, should this increase occur, it would create an array of problems. Due to the perniciousness of inflation – especially high levels of inflation – “price stability” has been one of two long-stated main goals of the Federal Reserve as seen in the Federal Reserve’s “Dual Mandate.”

Perhaps the main reason to believe that inflation will increase from these levels is that increases so far have been largely unforeseen, and that such increases have been of an outsized magnitude. As well, as further discussed below, there are many highly notable aspects of the current U.S. economic and financial situation which can (substantially) worsen inflation.

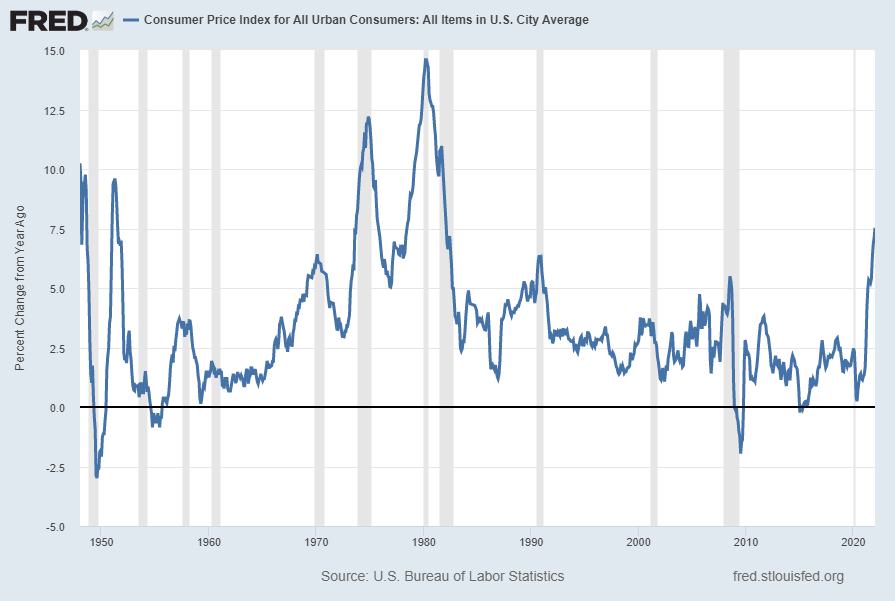

For reference, here are some charts of the most commonly cited U.S. inflation measure, headline CPI, at 7.5% as of the latest update of February 10, 2022 (from the January 2022 CPI report):

source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 7, 2022: https://fred.stlouisfed.org/series/CPIAUCSL

As seen in the chart above, the level of CPI is at decade-high levels. The last time such a level was seen was in the early-80’s, which (of course) was considered a highly inflationary era. Of note, not only is inflation currently at a historically high level, but the inflation is very broad-based.

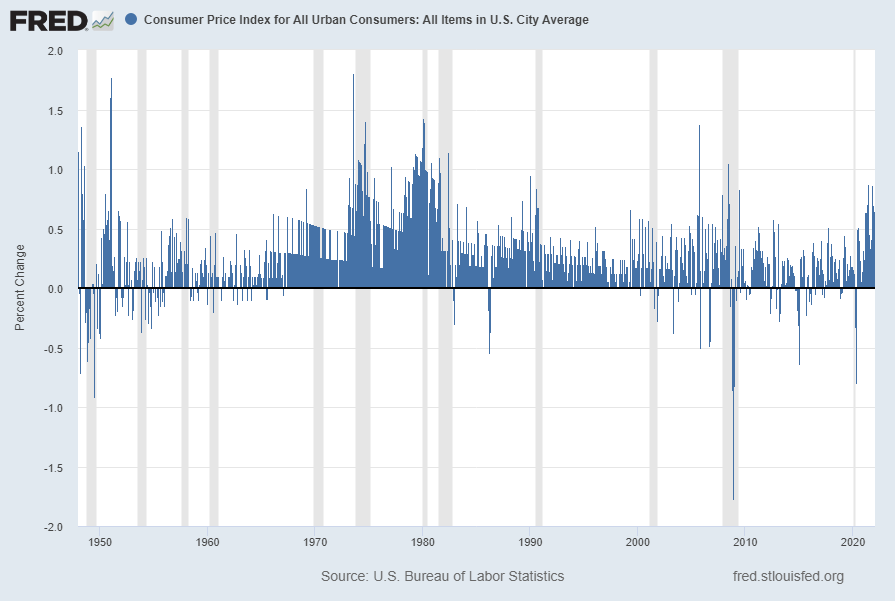

Here is this same CPI measure on a “Percent Change” (from prior month) basis, showing a January 2022 value of .6 Percent:

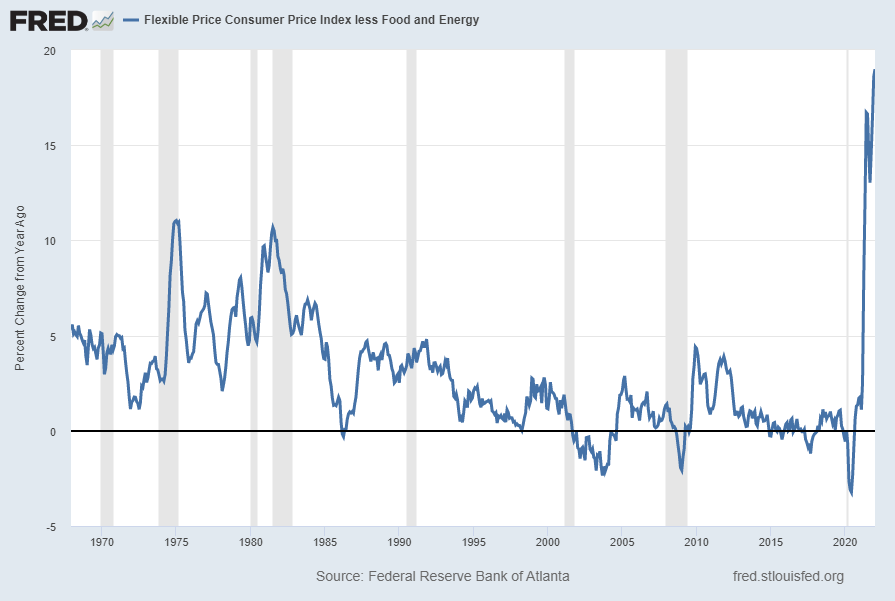

Another measure that depicts an outsized level of inflation is the Federal Reserve Bank of Atlanta’s Core Flexible Price Consumer Price Index. As of the February 10, 2022 update the reading is at 18.99% as seen in the chart below:

source: Federal Reserve Bank of Atlanta, Flexible Price Consumer Price Index less Food and Energy [COREFLEXCPIM159SFRBATL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 14, 2022: https://fred.stlouisfed.org/series/COREFLEXCPIM159SFRBATL

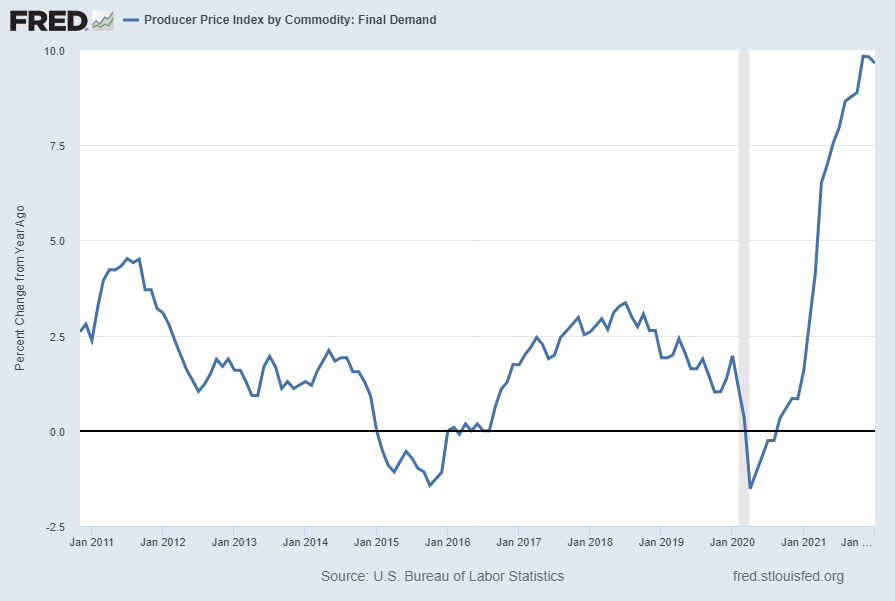

From the Producer Price Index report of January 2022, released February 15, 2022, here is the Producer Price Index by Commodity: Final Demand [PPIFID] currently showing a 9.7% Change From Year Ago:

source: U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Final Demand [PPIFID], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 15, 2022: https://fred.stlouisfed.org/series/PPIFID

Of note, various early-stage input prices, including many commodity prices, continue to sharply increase.

Another issue is whether various supply-chain issues are ameliorating with time. While various indexes and metrics have recently been introduced to measure supply-chain disruptions, from an all-things-considered basis it does not (yet) appear as if such issues are substantially diminishing.

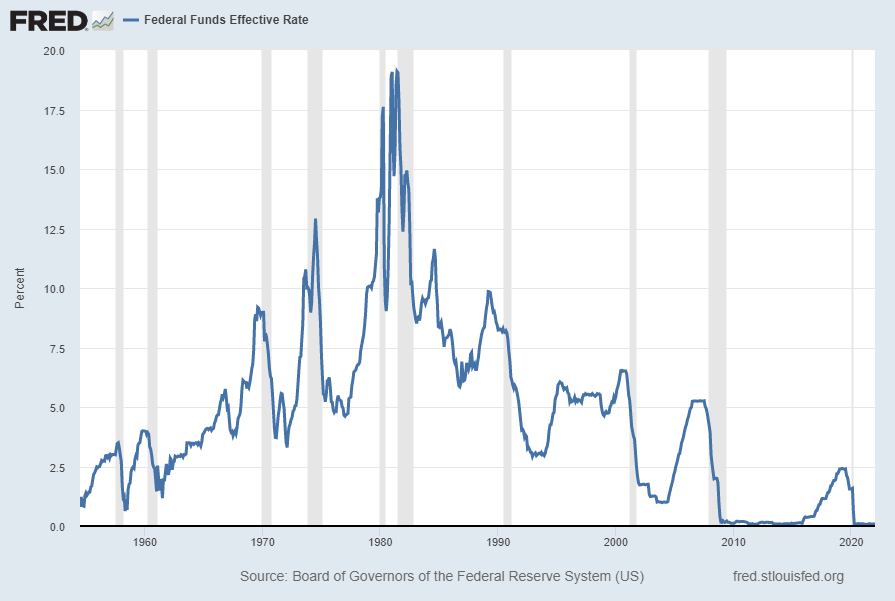

A paramount concern with regard to inflation is whether the Federal Reserve is adequately addressing it. In the past, most notably in the (late) 70’s – early 80’s era, the Federal Reserve raised rates sharply in an effort to diminish inflation.

In this current situation, the foremost question is whether the Fed is “behind the curve” with regard to the purported primary inflation remedy, that of raising interest rates. The Fed Funds Effective Rate as seen in the chart below remains at a negligible level (.08% as of the February 1, 2022 update):

source: Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 14, 2022: https://fred.stlouisfed.org/series/FEDFUNDS

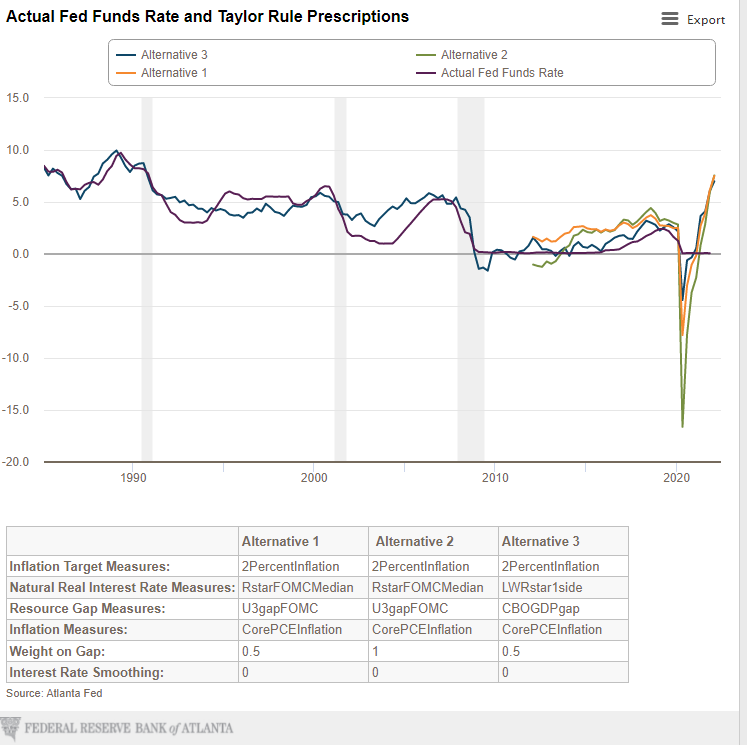

There are various indicators that can be used to gauge whether the current level of the Fed Funds Rate is appropriate. One such prominent measure is the Taylor Rule and the resulting Taylor Rule Prescription. Of note, the Taylor Rule Prescription can vary substantially depending upon which parameters are specified.

As seen on the Federal Reserve Bank of Atlanta’s site, the Taylor Rule prescription given the assigned factors is seen in the following chart, updated February 10, 2022:

As seen in the above chart, the Taylor Rule Prescription for the three alternatives shown range from 6.98% to 7.55% compared to the actual Fed Funds Rate of .09%.

Other indicators also imply that the Fed Funds Rate should be substantially higher than current levels.

As noted previously, there are many aspects of the current economic and financial situation which may serve to further extend the level and duration of inflation. A proper discussion of these factors and how they could substantially extend inflation would be both lengthy and complex.

One of these aspects is the possibility of a “wage-price spiral” occurring. Given various conditions, including widespread labor shortages in various sectors as well as wage growth that has been increasing, there is reason to believe that a “wage-price spiral” dynamic could occur. Such a dynamic would be (highly) problematical.

Lastly, if high levels of inflation persist – and further increase – there is a possibility of a hyperinflationary environment occurring. A hyperinflation would be exceedingly problematical.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4443.32 as this post is written

No comments:

Post a Comment