One of the foremost economic issues facing the United States, as well as other countries, is whether the current outsized level of inflation will subside. In other words, is the current high level of inflation transitory?

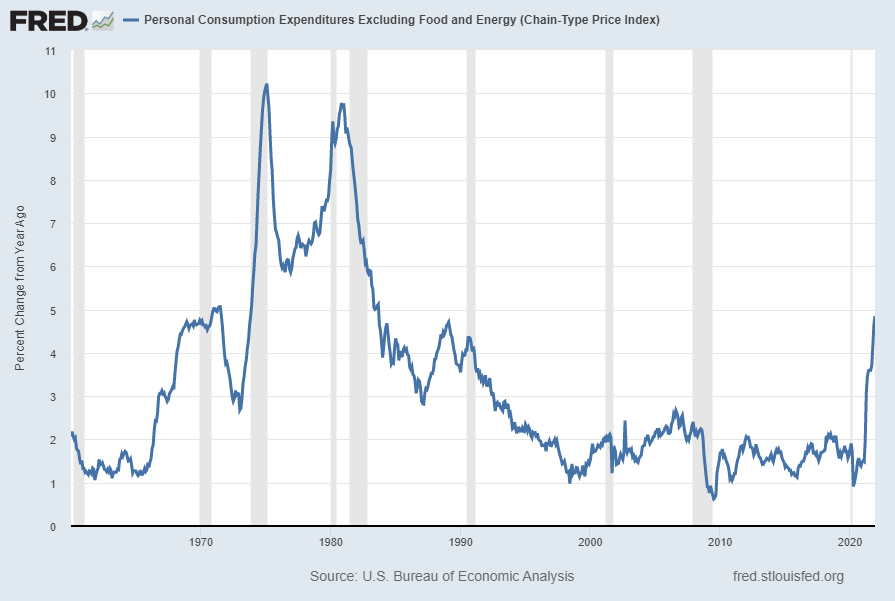

For reference, here is a long-term chart of the Core Personal Consumption Expenditures Index, which is often said to be the Federal Reserve’s “preferred” inflation measure. The current reading, as of the January 28, 2022 update, is 4.9%:

source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) [PCEPILFE], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 7, 2022: https://fred.stlouisfed.org/series/PCEPILFE

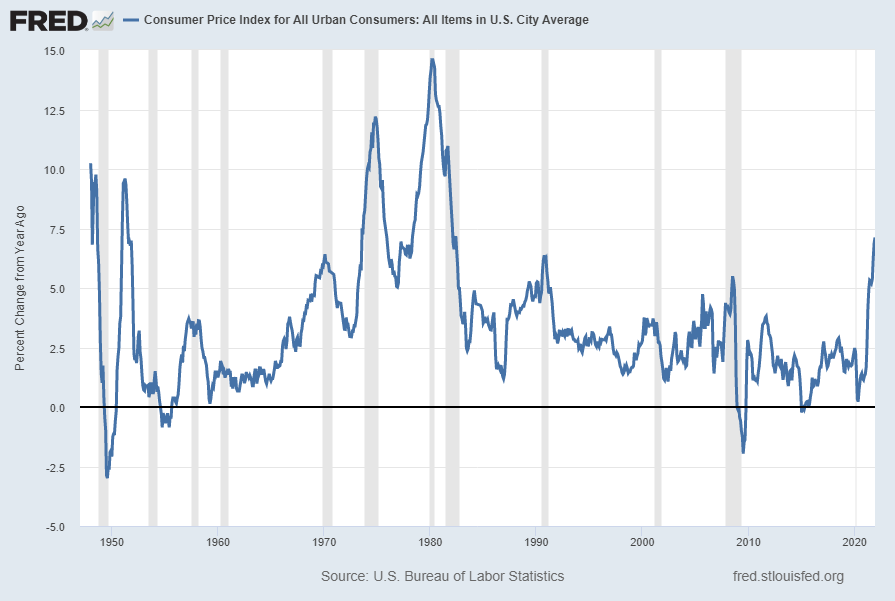

Below is a chart of CPI inflation. The reading for the December 2021 report, released January 12, 2022, is 7.1%:

source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 7, 2022: https://fred.stlouisfed.org/series/CPIAUCSL

Of course, price stability (i.e. lack of significant inflation) is one of two main stated goals of the Federal Reserve, as seen in the Federal Reserve’s Dual Mandate.

Below are various reasons that have been cited in support of the belief that the current high level of inflation will be transitory, i.e. it will subside over the next few months at which point it will stabilize. Please note that the commentary below is purely for reference…i.e. I do not necessarily share in the belief that inflation will be transitory, nor do I necessarily believe any of the reasons offered below.

Overall, the most-commonly stated reason for the current upswing in inflation stems from the belief that due to COVID-19, production has been constrained, and other supply chain issues have also arisen, such as delivery bottlenecks. As stated by Federal Reserve Chair Jerome Powell, during the January 26, 2022 FOMC Press Conference:

Inflation remains well above our longer-run goal of 2 percent. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. In particular, bottlenecks and supply constraints are limiting how quickly production can respond to higher demand in the near term. These problems have been larger and longer lasting than anticipated, exacerbated by waves of the virus.

While the drivers of higher inflation have been predominantly connected to the dislocations caused by the pandemic, price increases have now spread to a broader range of goods and services. Wages have also risen briskly, and we are attentive to the risks that persistent real wage growth in excess of productivity could put upward pressure on inflation. Like most forecasters, we continue to expect inflation to decline over the course of the year.

As mentioned above, the consensus among professional forecasters is that by the end of 2022 inflation will have significantly subsided. For example, as seen in the January 2022 Wall Street Journal Economic Forecast Survey, the average survey response for December 2022 is that CPI will be 3.11% and the Core PCE will be 3.0%. Year-end 2023 forecasts shows further diminishment.

Various surveys of both consumers and businesses indicate inflation expectations. For instance, the Federal Reserve Bank of Atlanta publishes a “Business Inflation Expectations” (BIE) survey. Its latest reading, as of the January 12, 2022 report, shows year-ahead inflation expectations among businesses surveyed to average 3.4%.

As for consumer expectations, the Federal Reserve Bank of New York published the December 2021 Survey of Consumer Expectations on January 10, 2022. In seen in this survey “Median one-year and three-year-ahead inflation expectations both remained unchanged in December at 6.0% and 4.0%, respectively.”

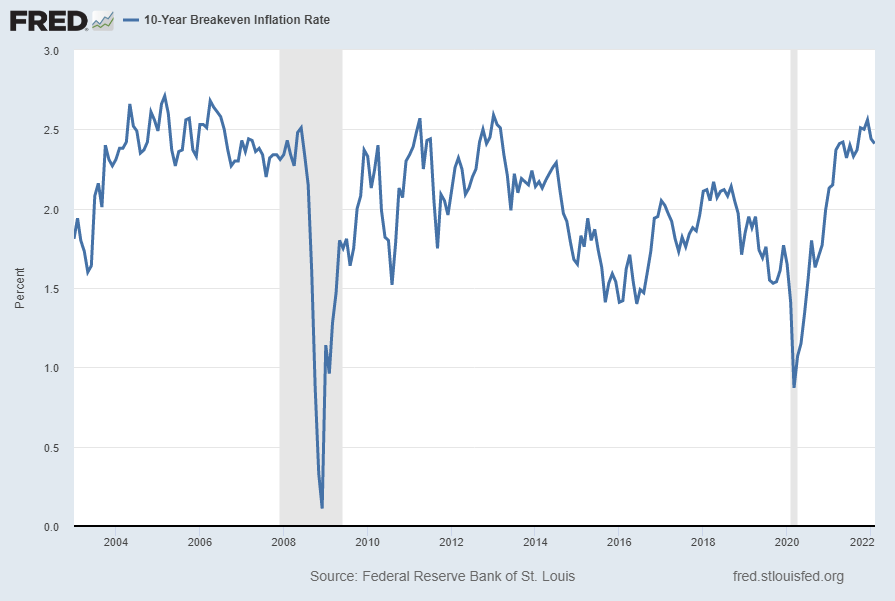

Various market-based measures indicate future inflation below 3 percent. Below is a chart of the 10-Year Breakeven Inflation Rate, at 2.41% as of February 4, 2022. This rate is defined in FRED as: “The latest value implies what market participants expect inflation to be in the next 10 years, on average.”

source: Federal Reserve Bank of St. Louis, 10-Year Breakeven Inflation Rate [T10YIE], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 6, 2022: https://fred.stlouisfed.org/series/T10YIE

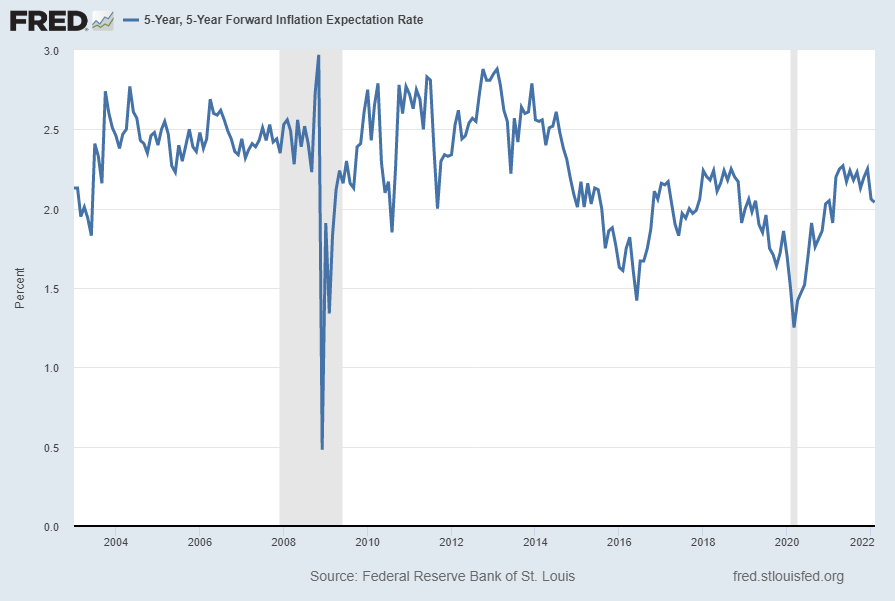

Another market-based inflation indicator is the 5-Year, 5-Year Forward Inflation Expectation Rate, at 2.04% as of February 4, 2022. This rate is defined in FRED as: “This series is a measure of expected inflation (on average) over the five-year period that begins five years from today.” A long-term chart is seen below:

source: Federal Reserve Bank of St. Louis, 5-Year, 5-Year Forward Inflation Expectation Rate [T5YIFR], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 6, 2022: https://fred.stlouisfed.org/series/T5YIFR

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4483.87 as this post is written

No comments:

Post a Comment