There are a variety of economic models that are supposed to predict the probabilities of recession.

While I don’t agree with the methodologies employed or probabilities of impending economic weakness as depicted by the following two models, I think the results of these models should be monitored.

Please note that each of these models is updated regularly, and the results of these – as well as other recession models – can fluctuate significantly.

Currently (last updated January 15, using data through December) this “Yield Curve” model shows a 5.74% probability of a recession in the United States twelve months ahead. It showed a 6.42% probability through November.

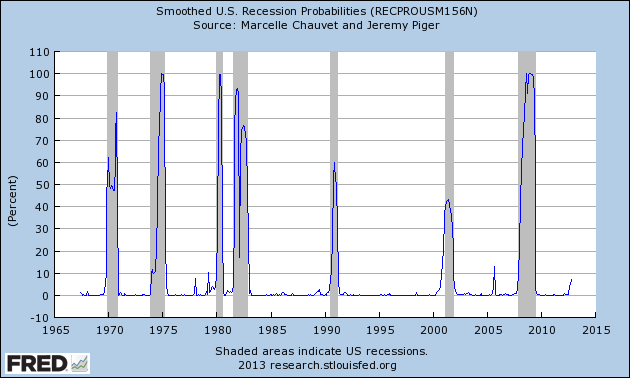

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

This model, last updated on January 2, 2013, currently shows a 7.34% probability using data through October.

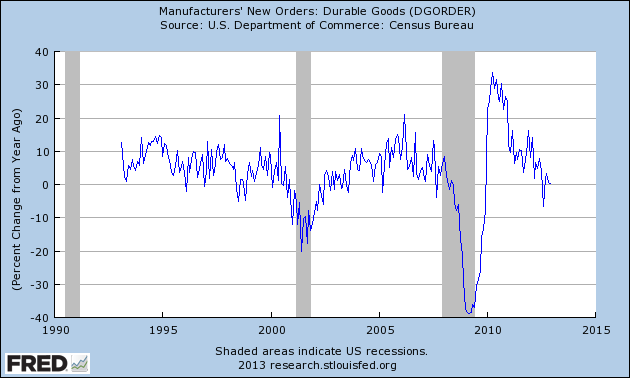

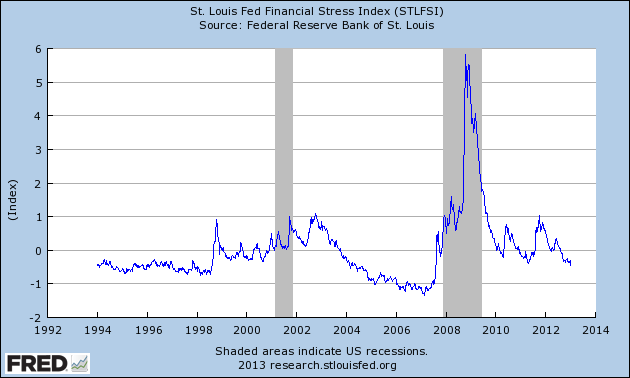

Here is the FRED chart (last updated January 2) :

(click on chart to enlarge image)

-

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1485.98 as this post is written