On June 5, 2015 the June Duke/CFO Magazine Global Business Outlook Survey (pdf) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey, I found the following to be the most notable excerpts:

U.S. companies expect wage hikes of more than 3 percent over the next year, with hiring increasing by more than 2 percent. Wage and employment growth is predicted to be strongest in tech, services and consulting, health care and construction.“Wage growth expectations the past few quarters have been the highest in the survey since 2007,” said John Graham, a finance professor at Duke’s Fuqua School of Business and director of the survey. “In fact, CFOs indicate that difficulty in hiring and retaining qualified employees is a top three concern, especially in industries like tech and health care.”

also:

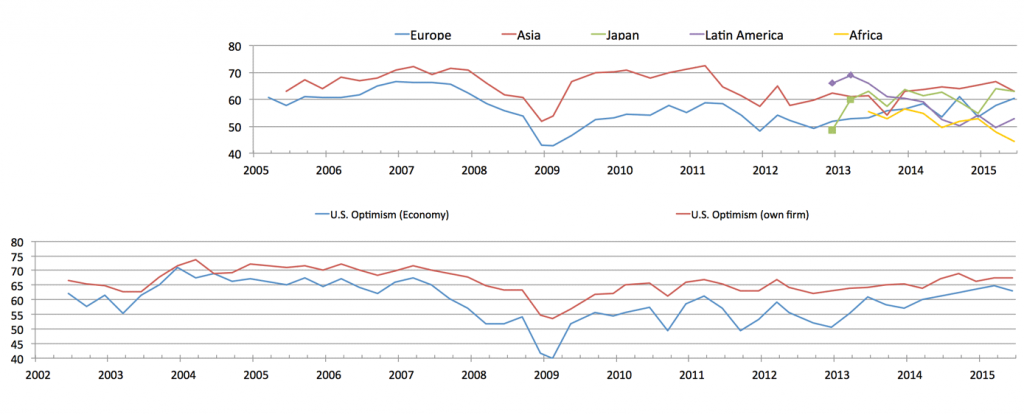

U.S. CFOs remain optimistic about the U.S. economy’s outlook. On a scale from zero to 100, they rate the outlook at 63, down from 65 last quarter but still the third highest since 2007. U.S. companies plan to increase capital spending six percent over the next year.

The CFO survey contains two Optimism Index chart, with the bottom chart showing U.S. Optimism (with regard to the economy) at 63, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO Surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2095.25 as this post is written

No comments:

Post a Comment