While the concept of Americans' incomes can be defined in a number of ways, many prominent measures continue to show disconcerting trends.

One prominent measure is the Employment Cost Index (ECI).

Here is a description from the BLS document titled "The Employment Cost Index: what is it?":

The Employment Cost Index (ECI) is a quarterly measure of the change in the price of labor, defined as compensation per employee hour worked. Closely watched by many economists, the ECI is an indicator of cost pressures within companies that could lead to price inflation for finished goods and services. The index measures changes in the cost of compensation not only for wages and salaries, but also for an extensive list of benefits. As a fixed-weight, or Laspeyres, index, the ECI controls for changes occurring over time in the industrial-occupational composition of employment.

On July 31, 2015, the ECI for the second quarter was released. Here is an excerpt from the July 31, 2015 Wall Street Journal article titled "U.S. Labor Costs Rise at Slowest Pace in Three Decades":

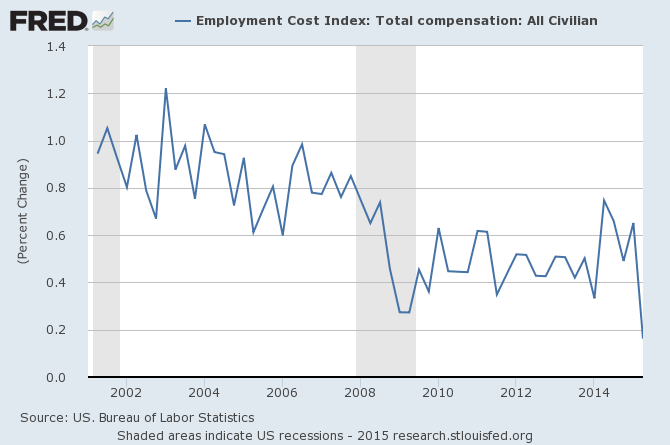

The employment-cost index, a broad measure of workers’ wages and benefits, climbed a seasonally adjusted 0.2% in the second quarter from the first quarter, the Labor Department said Friday. That marked the smallest quarterly gain since record keeping began in 1982. Economists surveyed by The Wall Street Journal expected a 0.6% increase.

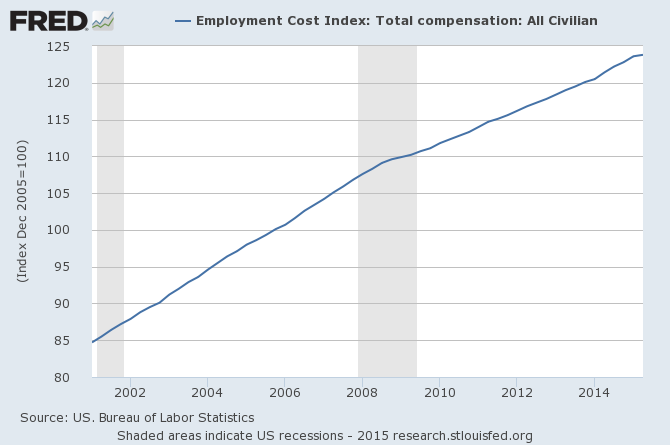

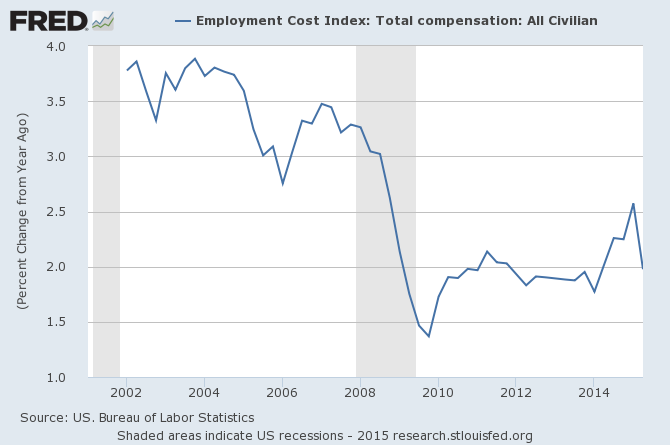

Below are three charts, updated on July 31, 2015 that depict various aspects of the ECI.

The first depicts the ECI, with a value of 123.8:

US. Bureau of Labor Statistics, Employment Cost Index: Total compensation: All Civilian[ECIALLCIV], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/ECIALLCIV/, August 2, 2015.

The second chart depicts the ECI on a "Percent Change from Year Ago" basis, showing a 1.98% increase Year-over-Year (YoY):

The third chart depicts the ECI on a "Percent Change" (from last quarter) basis, showing a .16% increase from the first quarter:

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2103.84 as this post is written

No comments:

Post a Comment