On August 13, 2015, the Zillow Q3 2015 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the Press Release:

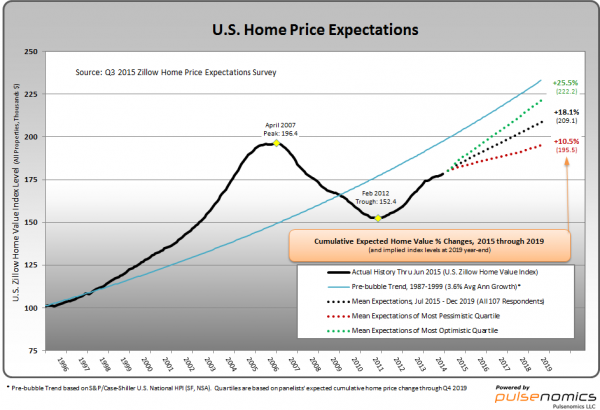

Panelists predicted home values to end 2015 up 4.1 percent year-over-year, on average, down from the 4.3 percent year-end prediction made by the same panel last quarter. Home value appreciation is expected to slowly level off beginning next year (3.4 percent average annual expected appreciation) and through 2019 (3.1 percent average annual expected appreciation).This trajectory would see the median U.S. home value rise above the April 2007, bubble-era peak of $196,400, on average, by December 2017. The most optimistic panelists predicted home values would surpass bubble-era peaks as soon as February 2017, while the most pessimistic said pre-bubble peaks would not be met or exceeded before the end of the decade (figure 1).“The panel’s expectation for U.S. home values fell to a 3.4 percent average annual rate for the five-year forecast horizon. This is the first time in 18 months that this proxy for experts’ housing market sentiment has weakened, and it’s the lowest rate recorded in three years,” said Pulsenomics Founder Terry Loebs. “With slow wage growth persisting and monetary policy liftoff looming, home price expectations may continue to drift lower for some time.”

–

Various Q3 2015 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q3 2015 Home Price Expectations Survey (pdf) is interesting. Of the 100+ survey respondents, only two (of the displayed responses) forecasts a cumulative price decrease through 2019; and only one forecasts a double-digit percentage cumulative price drop. That forecast is from Mark Hanson, which foresees a 11.91% cumulative price decrease through 2019.

The Median Cumulative Home Price Appreciation for years 2015-2019 is seen as 4.00%, 7.74%, 11.39%, 14.75%, 17.90%, respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in Mark Hanson’s above-referenced forecast) will prove too optimistic in hindsight. From a longer-term historical perspective, such a decline is very mild in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2086.36 as this post is written

No comments:

Post a Comment