I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they (on average) depict such a tenuous situation now – 76 months after the official (as per the September 20, 2010 NBER BCDC announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts are from the Federal Reserve, and represent the most recently updated data.

(click on charts to enlarge images)

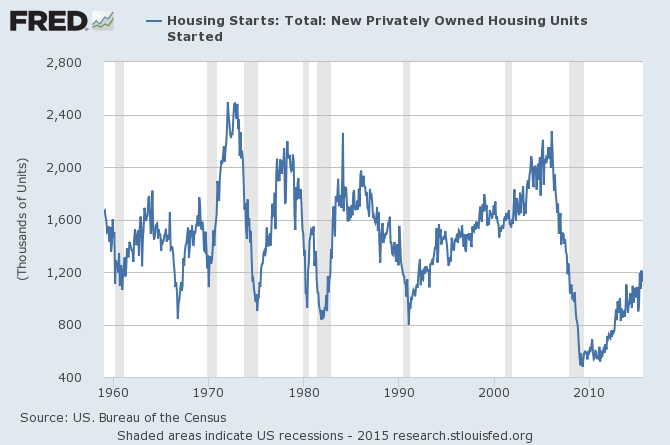

Housing starts (last updated 9-17-15):

US. Bureau of the Census, Housing Starts: Total: New Privately Owned Housing Units Started[HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/HOUST/, October 13, 2015.

–

The Federal Deficit (last updated 2-20-15):

US. Office of Management and Budget, Federal Surplus or Deficit [-] [FYFSD], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYFSD/, October 13, 2015.

–

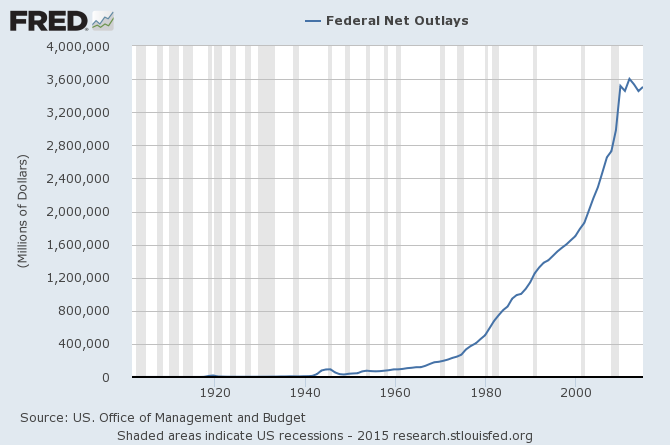

Federal Net Outlays (last updated 2-20-15):

US. Office of Management and Budget, Federal Net Outlays [FYONET], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/FYONET/, October 13, 2015.

–

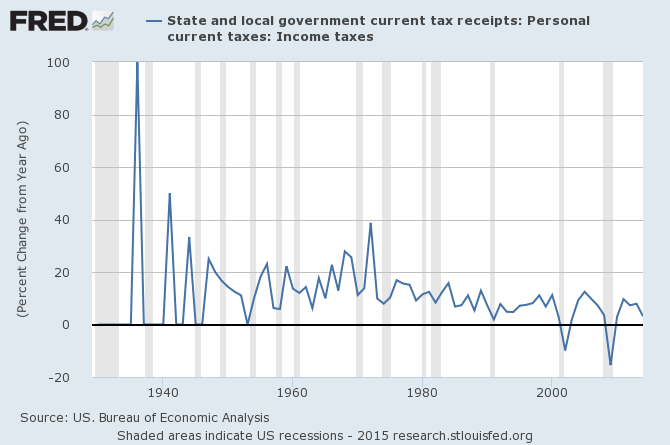

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated 7-30-15):

US. Bureau of Economic Analysis, State and local government current tax receipts: Personal current taxes: Income taxes [ASLPITAX], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/ASLPITAX/, October 13, 2015.

–

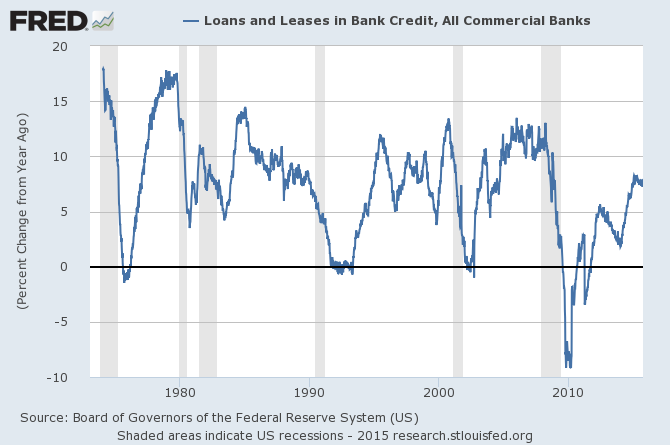

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated 10-9-15):

Board of Governors of the Federal Reserve System (US), Loans and Leases in Bank Credit, All Commercial Banks [TOTLL], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTLL/, October 13, 2015.

–

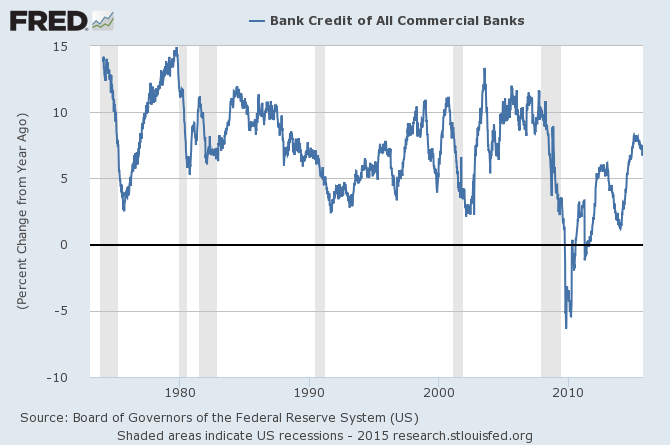

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated 10-9-15):

Board of Governors of the Federal Reserve System (US), Bank Credit of All Commercial Banks[TOTBKCR], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/TOTBKCR/, October 13, 2015.

–

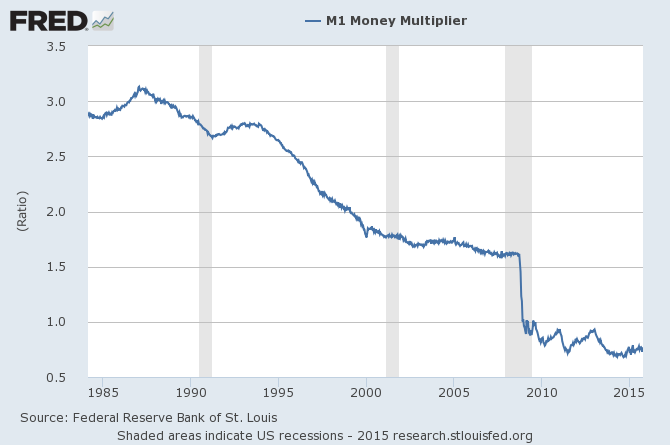

M1 Money Multiplier (last updated 10-8-15):

Federal Reserve Bank of St. Louis, M1 Money Multiplier [MULT], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/MULT/, October 13, 2015.

–

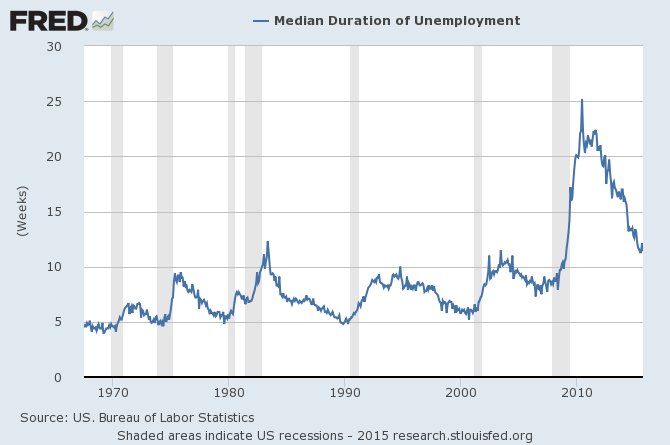

Median Duration of Unemployment (last updated 10-2-15):

US. Bureau of Labor Statistics, Median Duration of Unemployment [UEMPMED], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/UEMPMED/, October 13, 2015.

–

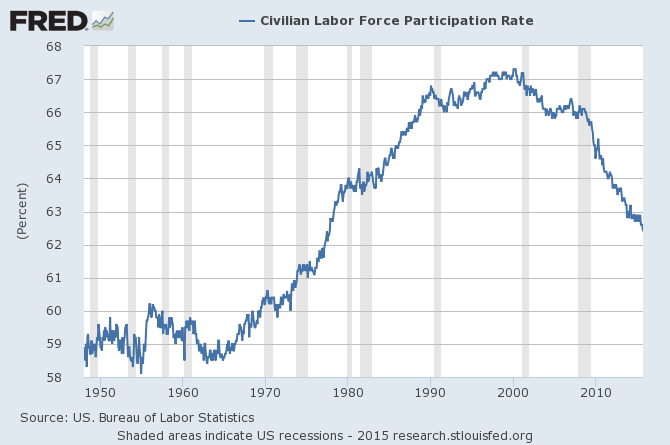

Labor Force Participation Rate (last updated 10-2-15):

US. Bureau of Labor Statistics, Civilian Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/CIVPART/, October 13, 2015.

–

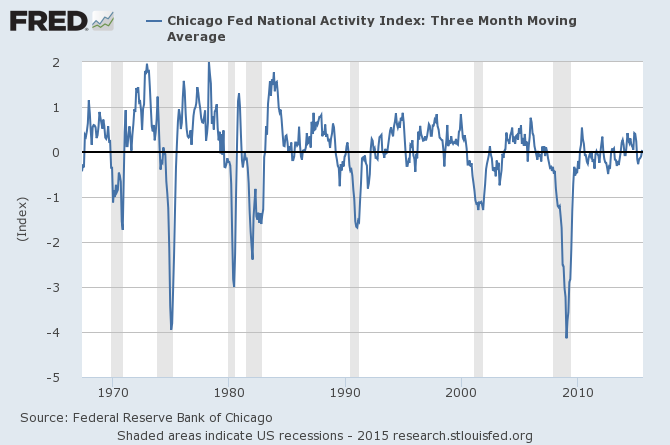

The Chicago Fed National Activity Index (CFNAI) 3-month moving average (CFNAI-MA3)(last updated 9-24-15):

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average[CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/CFNAIMA3/, October 13, 2015.

–

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2003.69 as this post is written

No comments:

Post a Comment