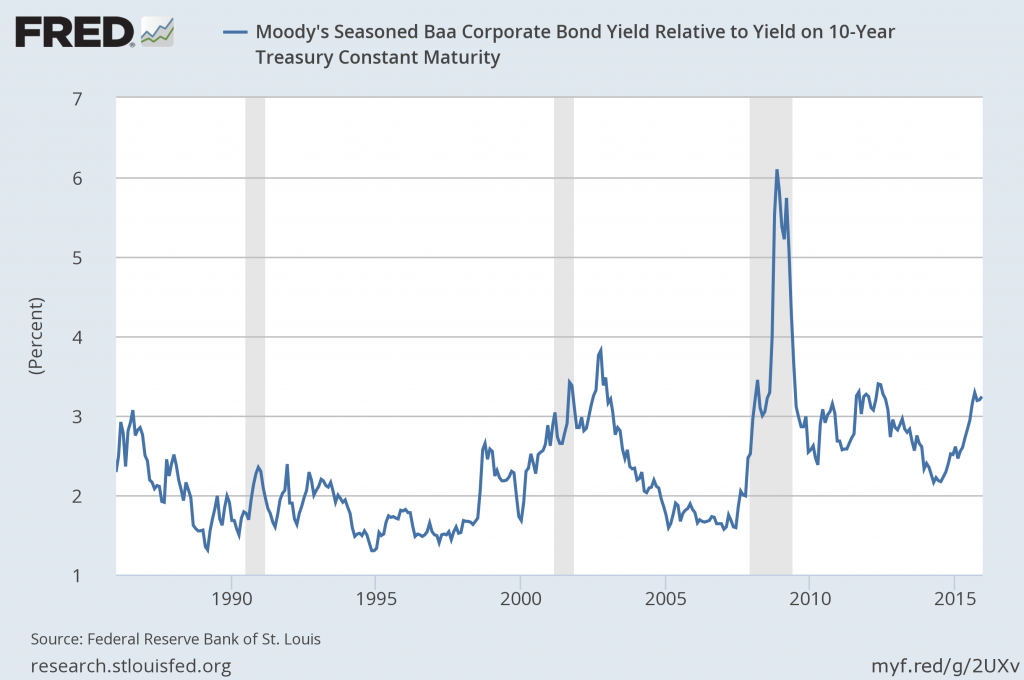

In the October 6, 2015 post ("Comparisons Of Economic And Financial Aspects - 2008 And 2015") I discussed credit spreads and featured a chart of the spread between Moody’s Seasoned Baa Corporate Bond and the 10-Year Treasury Constant Maturity.

For reference, here is an updated long-term chart of the measure, with a current reading (updated as of December 14, with a value from December 11, 2015) of 3.24 percent:

Federal Reserve Bank of St. Louis, Moody’s Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity [BAA10Y], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/BAA10Y/, December 15, 2015.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2050.72 as this post is written

No comments:

Post a Comment