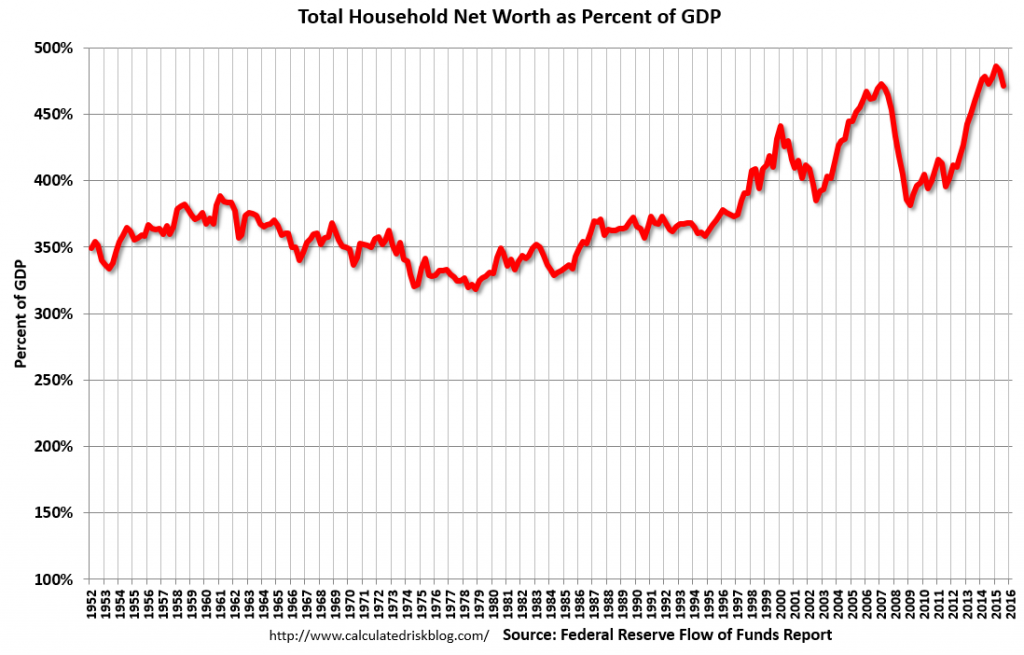

The following chart is from the CalculatedRisk blog post of December 10, 2015 titled “Fed’s Flow of Funds: Household Net Worth Declined in Q3.” It depicts Total Household Net Worth as a Percent of GDP. The underlying data is from the Federal Reserve’s Z.1 report, “Financial Accounts of the United States“:

(click on chart to enlarge image)

As seen in the above-referenced CalculatedRisk blog post:

Household net worth was at $85.2 trillion in Q3 2015, down from $86.4 trillion in Q2. The decline was due to the decline in the stock market in Q3.The Fed estimated that the value of household real estate increased to $21.8 trillion in Q3 2015. The value of household real estate is still $0.7 trillion below the peak in early 2006 (not adjusted for inflation).

I have written in previous posts on this Household Net Worth (as a percent of GDP) topic:

As one can see, the first outsized peak was in 2000, and attained after the stock market bull market / stock market bubbles and economic strength. The second outsized peak was in 2007, right near the peak of the housing bubble as well as near the stock market peak.

also:

I could extensively write about various interpretations that can be made from this chart. One way this chart can be interpreted is a gauge of “what’s in it for me?” as far as the aggregated wealth citizens are gleaning from economic activity, as measured compared to GDP.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2052.23 as this post is written

No comments:

Post a Comment