On June 8, 2016 the June Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey, I found the following to be the most notable excerpts - although I don’t necessarily agree with them:

Forty-seven percent of U.S. companies say they will pull back on spending or hiring due to concern about the political situation. Nearly 40 percent of U.S. CFOs indicate that they believe that foreign businesses are less willing to do business with the U.S. due to political uncertainty.

also:

“While the recent disappointing headline non-farm payrolls grabbed a lot of attention, our survey shows the aggregate numbers miss a crucial point. U.S. companies rate difficulty hiring and retaining skilled employees as their second biggest concern – while last year it ranked fifth,” said Fuqua professor Campbell R. Harvey, a founding director of the survey. “Business leaders plan to increase their workforce by 2 percent over the next year, which would reduce the unemployment rate to levels not seen since the late 1960s. CFOs are telling us that expected wage increases (3.3 percent) greatly outpace expected increases in product prices (1.5 percent).“The tight labor market, combined with a skills mismatch between what companies want and what they can get, makes wage inflation inevitable,” Harvey said. “This is exactly the type of data that will energize the Fed to be more aggressive in hiking interest rates – despite the recent setback in non-farm payrolls.”

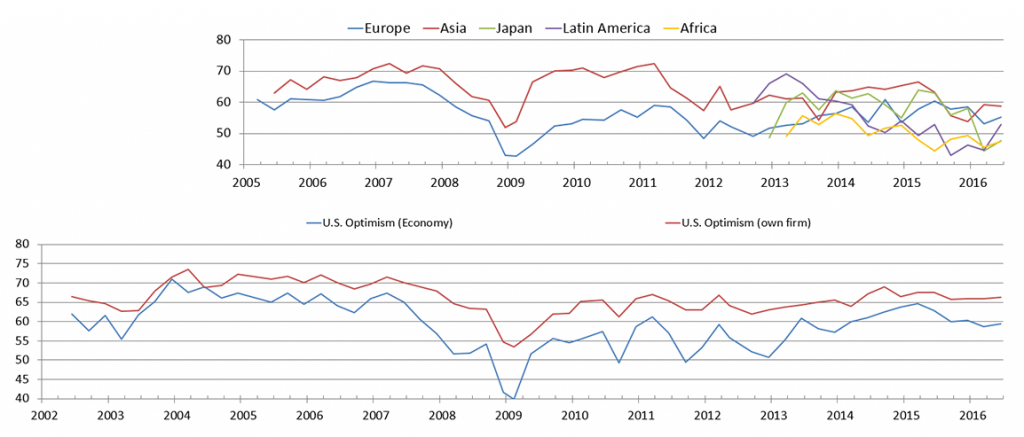

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 59.4, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2071.22 as this post is written

No comments:

Post a Comment