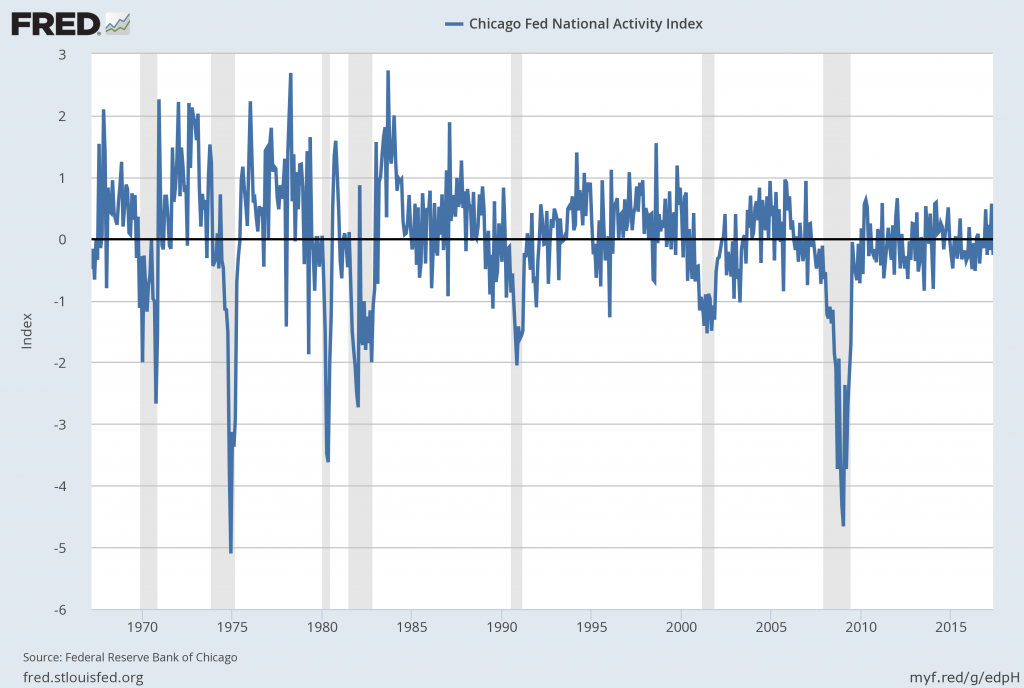

The June 2017 Chicago Fed National Activity Index (CFNAI) updated as of June 26, 2017:

The CFNAI, with current reading of -.26:

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis, June 26, 2017;

https://fred.stlouisfed.org/series/CFNAI

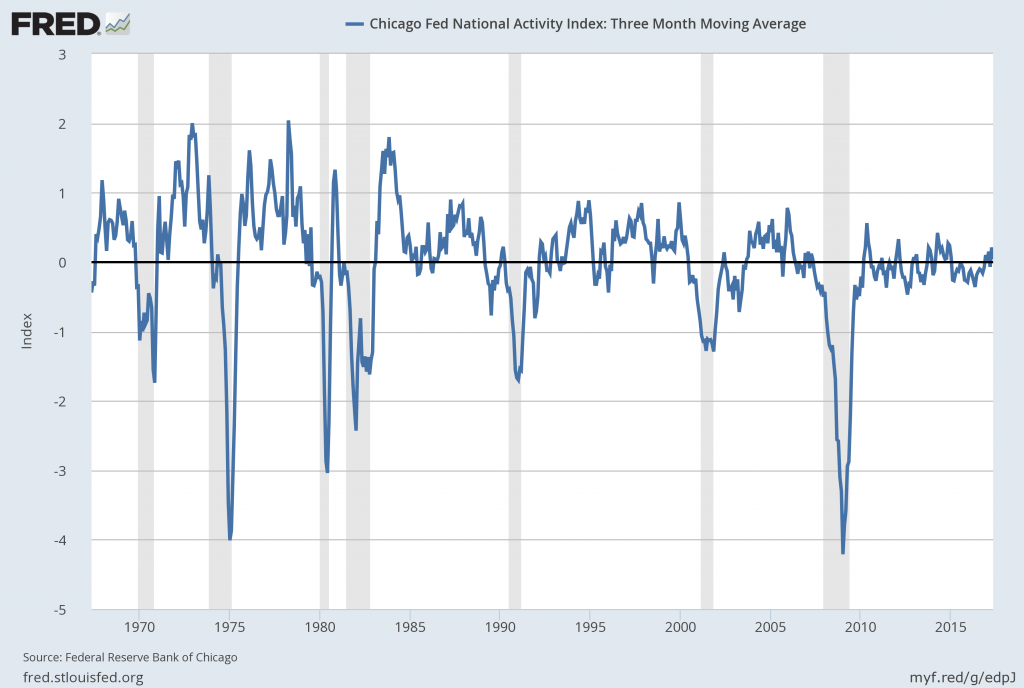

The CFNAI-MA3, with current reading of .04:

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis, June 26, 2017;

https://fred.stlouisfed.org/series/CFNAIMA3

–

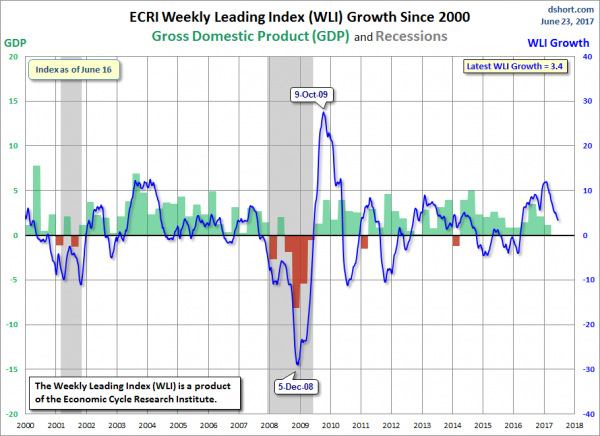

The ECRI WLI (Weekly Leading Index):

As of June 23, 2017 (incorporating data through June 16, 2017) the WLI was at 143.7 and the WLI, Gr. was at 3.4%.

A chart of the WLI,Gr., from Doug Short’s ECRI update post of June 23, 2017:

–

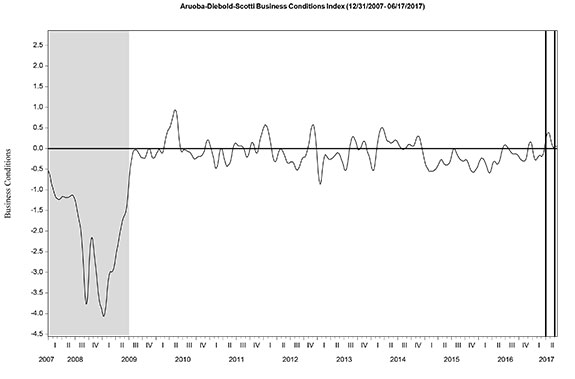

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting the ADS Index from December 31, 2007 through June 17, 2017:

–

The Conference Board Leading (LEI), Coincident (CEI) Economic Indexes, and Lagging Economic Indicator (LAG):

As per the June 22, 2017 press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Increased in May” (pdf) the LEI was at 127.0, the CEI was at 115.3, and the LAG was 124.2 in May.

An excerpt from the release:

“The U.S. LEI continued on its upward trend in May, suggesting the economy is likely to remain on, or perhaps even moderately above, its long-term trend of about 2 percent growth for the remainder of the year,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “The improvement was widespread among the majority of the leading indicators except for housing permits, which declined again. And, the average workweek in manufacturing has recently shown no sign of improvement.”Here is a chart of the LEI from Doug Short’s Conference Board Leading Economic Index update of June 22, 2017:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2439.97 as this post is written

No comments:

Post a Comment