In this CFO survey, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Uncertainty about regulatory policy and health care costs is causing chief financial officers in the United States to hold back investment plans, a new survey finds.also:

The survey has been conducted for 85 consecutive quarters and spans the globe, making it the world's longest-running and most comprehensive research on senior finance executives. This quarter, nearly 750 CFOs responded to the survey, which ended June 9. Results are for the U.S. unless stated otherwise.also:

Almost 40 percent of CFOs indicated uncertainty is currently higher than normal. Among those companies, about 60 percent said that uncertainty has caused them to delay new projects and investments.

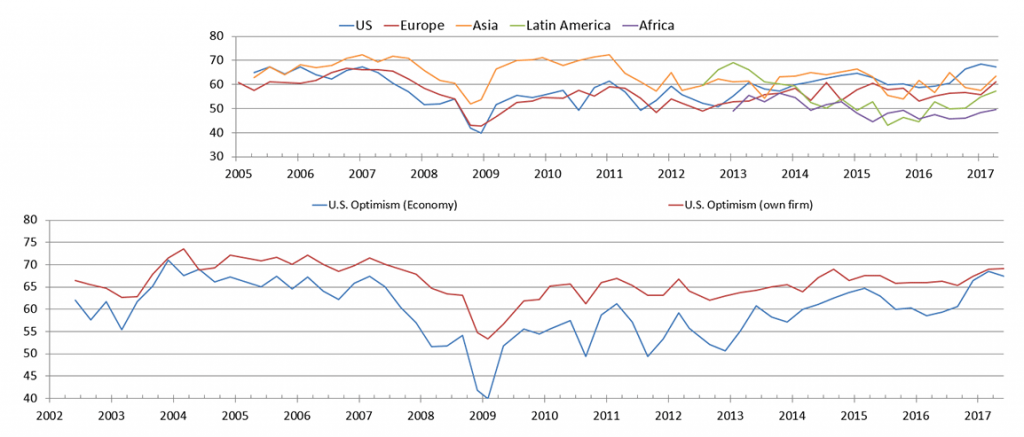

The Optimism Index fell slightly this quarter to 67 on a 100-point scale. That's two points lower than last quarter but still far above the long-run average of 60.The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 67, as seen below:

"CFOs remain optimistic not only about the overall economy but about their own firms too," Graham said. "Our analysis of past results shows the CFO Optimism Index is an excellent predictor of the future, especially hiring plans and overall GDP growth."

Hiring plans are stronger than one year ago and U.S. companies expect to pay higher wages, with median wage growth of about 3 percent over the next 12 months, even greater in the construction and tech industries.

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2428.11 as this post is written

No comments:

Post a Comment