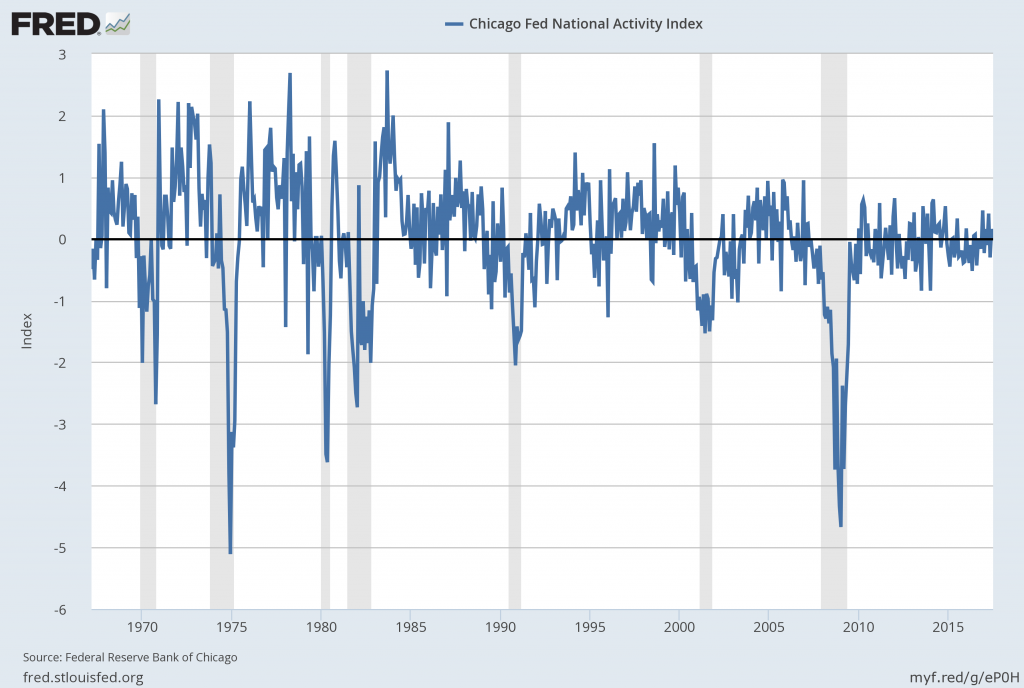

The August 2017 Chicago Fed National Activity Index (CFNAI) updated as of August 21, 2017:

The CFNAI, with current reading of -.01:

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis, August 21, 2017;

https://fred.stlouisfed.org/series/CFNAI

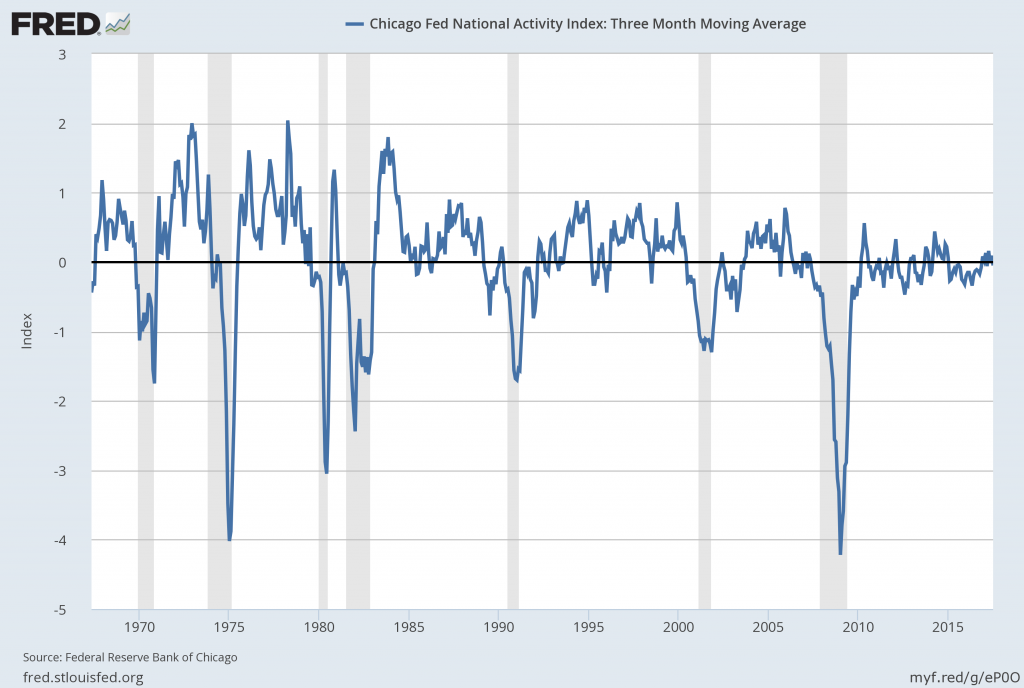

The CFNAI-MA3, with current reading of -.05:

Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis, August 21, 2017;

https://fred.stlouisfed.org/series/CFNAIMA3

–

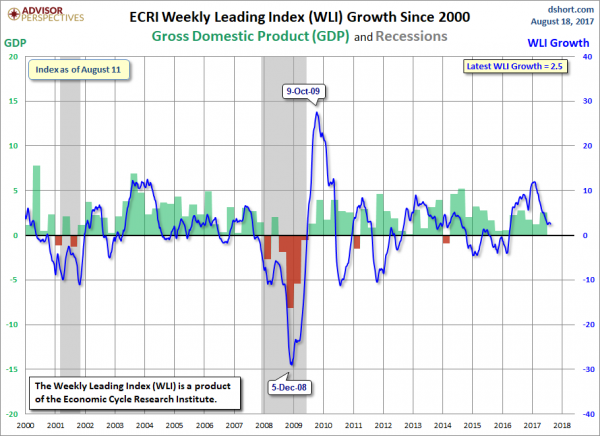

The ECRI WLI (Weekly Leading Index):

As of August 18, 2017 (incorporating data through August 11, 2017) the WLI was at 144.5 and the WLI, Gr. was at 2.5%.

A chart of the WLI,Gr., from Doug Short’s ECRI update post of August 18, 2017:

–

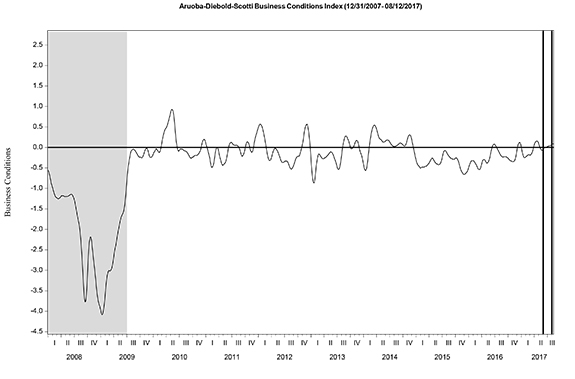

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting the ADS Index from December 31, 2007 through August 12, 2017:

–

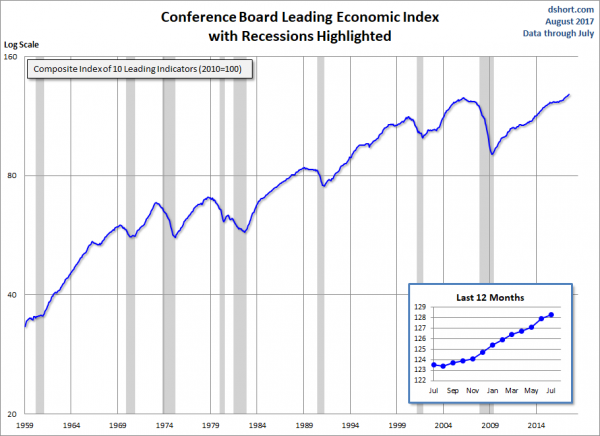

The Conference Board Leading (LEI), Coincident (CEI) Economic Indexes, and Lagging Economic Indicator (LAG):

As per the August 17, 2017 press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Increased in July” (pdf) the LEI was at 128.3, the CEI was at 115.7, and the LAG was 124.8 in July.

An excerpt from the release:

“The U.S. LEI improved in July, suggesting the U.S. economy may experience further improvements in economic activity in the second half of the year,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “The large negative contribution from housing permits, a reversal from June, was more than offset by gains in the financial indicators, new orders and sentiment.”Here is a chart of the LEI from Doug Short’s Conference Board Leading Economic Index update of August 17, 2017:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2426.01 as this post is written

No comments:

Post a Comment