On June 13, 2018 the June 2018 Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

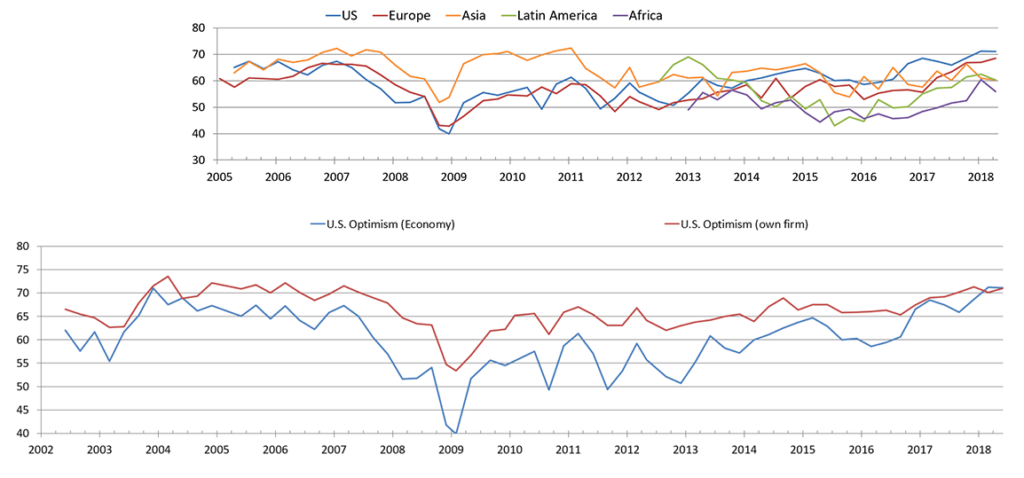

The Optimism Index in the U.S. remained at an all-time high of 71 on a 100-point scale this quarter. Optimism fell in Africa, Asia, Europe, and Latin America. The survey’s CFO Optimism Index is an accurate predictor of future hiring and overall GDP growth.“This increased U.S. optimism appears to have increased expectations for M&A activity,” Graham said. “More than 70 percent of CFOs expect more mergers and acquisitions to occur over the next year.”

also:

The proportion of firms indicating they are having difficulty hiring and retaining qualified employees remains near a two-decade high, with 41 percent of CFOs calling it a top concern. The typical U.S. firm says it plans to increase employment by a median 3 percent in 2018 and expects wages to increase 4 percent on average.“The tight labor market continues to put upward pressure on wages,” said Chris Schmidt, senior editor at CFO Research. “Wage inflation is now a top five concern of U.S. CFOs.”Wage growth should be strongest in the tech, transportation, and service/consulting industries. U.S. companies expect the prices of their products to increase by more than 3 percent over the next year.

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 71, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2775.63 as this post is written

No comments:

Post a Comment