On July 25, 2019, the Zillow Q2 2019 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

Home value appreciation has slowed over the past several months, from 8.1% annual growth in December 2018 to 5.2% in June 2019 – the slowest annual pace since 2015. The expected decline in demand in 2020 is likely to extend the housing slowdown going forward.Home prices are predicted to rise 4.1% in 2019, but experts have lowered their forecasts for home price appreciation for the next couple years. They predict home prices will rise 2.8% in 2020, down from their Q2 2018 prediction of 2.9% growth. Similarly, their 2021 forecasts have slid from 2.6% growth to 2.5% appreciation.

–

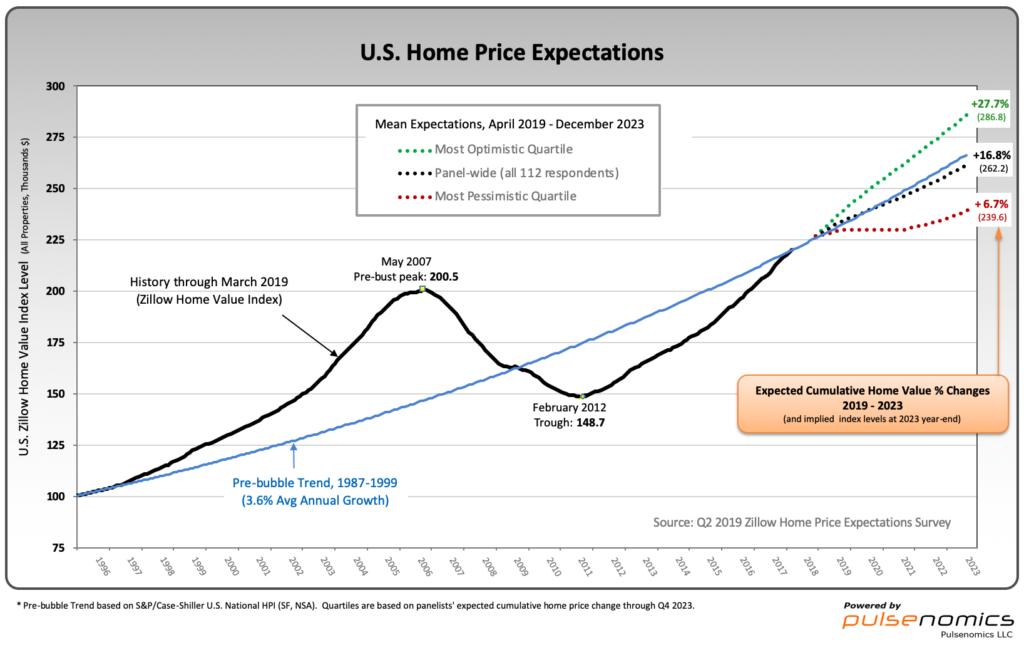

Various Q2 2019 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q2 2019 Home Price Expectations Survey is interesting. Of the 100+ survey respondents, only six (of the displayed responses) forecasts a cumulative price decrease through 2023, and none of those forecasts is for a double-digit percentage decline. The largest decline is seen as a 3.58% cumulative price decrease through 2023.

The Median Cumulative Home Price Appreciation for years 2019-2023 is seen as 4.00%, 7.02%, 9.64%, 12.55%, and 15.92%, respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in the above-referenced forecast) will prove far too optimistic in hindsight. From a longer-term historical perspective, such a decline is very mild in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3003.67 as this post is written

No comments:

Post a Comment