On September 24, 2020, the Zillow Q3 2020 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

“In many ways, the pandemic has helped supercharge a pre-existing housing supply shortage that has struggled to keep up with strong demand,” said Zillow economist Treh Manhertz. “Many of those fortunate enough to have kept their jobs are looking to take advantage of low mortgage rates by jumping into the market, and they’re finding competition to be fierce with inventory as limited as ever. The longer-term path for prices will depend largely on the course of inventory, including whether homeowner finances are stable enough to avoid a wave of distressed sales when forbearance terms expire and at what level builders, who are reporting sky-high confidence, can bring homes to market.”

The panel is now nearly unanimous in their view that home prices will rise this calendar year, with only two of 104 respondents indicating expectations for a nationwide price fall. In the previous (Q2 2020) survey, 48 of 106 respondents expected a decline.

“In contrast to the debate concerning the contours and sustainability of the U.S economic recovery, these survey data reveal a definitive and remarkably sharp V-shape in U.S. home price expectations,” said Terry Loebs, founder of Pulsenomics. “In a matter of a few months, the pandemic has turbo-charged what had been relatively limited acceptance of remote work, amplified the value of larger living spaces, and ushered in a new era of monetary accommodation by The Fed. With these fundamental forces stoking demand for homeownership amidst stubborn supply constraints, it’s hard to imagine home price expectations returning to the lows of last quarter any time soon.”

–

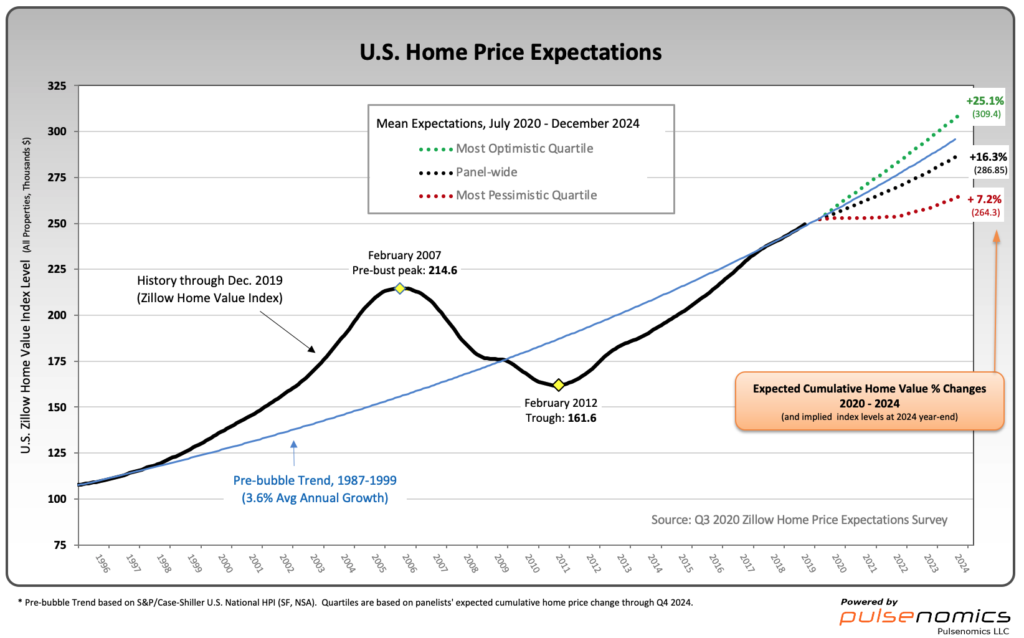

Various Q3 2020 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q3 2020 Home Price Expectations Survey is interesting. Of the 104 survey respondents, only one (of the displayed responses) forecasts a cumulative price decrease through 2024, and that forecast is seen as a 18.80% cumulative price decrease through 2024.

The Median Cumulative Home Price Appreciation for years 2020-2024 is seen as 3.5%, 6.60%, 9.51%, 12.79%, and 16.90% respectively.

For a variety of reasons, I continue to believe that even the most “bearish” of these forecasts (as seen in the above-referenced forecast) will prove far too optimistic in hindsight. From a longer-term historical perspective, such a decline is very mild in light of the wild excesses that occurred over the “bubble” years.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Furthermore, from these price levels there exists outsized potential for a price decline of severe magnitude, unfortunately. I discussed this downside, based upon historical price activity, in the October 24, 2010 post titled “What’s Ahead For The Housing Market – A Look At The Charts.”

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3246.59 as this post is written

No comments:

Post a Comment