On March 24, 2022, the Zillow Q1 2022 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

Pulsenomics founder Terry Loebs said the panel’s average projections for home price growth in 2022 have been revised upward, from 6.6% three months ago to 9% in this survey.

“Against the backdrop of tightening Fed policy and increasing mortgage rates, this more bullish outlook for home values suggests that home inventory shortages will remain the dominant price driver this year,” Loebs said. “If price increases this year for homes, rents, energy, and food each exceed wage growth – as the panel expects – home affordability challenges will intensify further, especially for low- and moderate-income renters.”

Zillow economists forecast a 16.3% rise in typical home values from February through December.

–

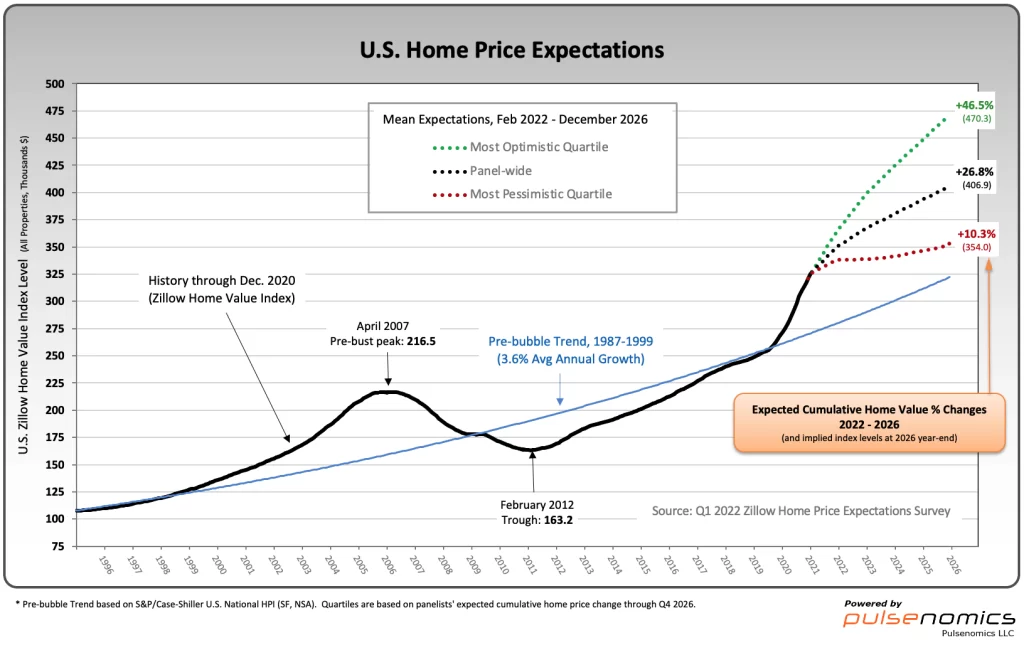

Various Q1 2022 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q1 2022 Home Price Expectations Survey is interesting. Of the 109 survey respondents, only four (of the displayed responses) forecasts a cumulative price decrease through 2026.

The Median Cumulative Home Price Appreciation for years 2022-2026 is seen as 8.50%, 13.60%, 17.81%, 21.08%, and 25.43%, respectively.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic in hindsight.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic in hindsight.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Residential real estate is an exceedingly large asset bubble. As such, from these price levels there exists potential for a price decline of outsized magnitude.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4496.68 as this post is written

No comments:

Post a Comment