Throughout this site there are many discussions of economic indicators. This post is the latest in a series of posts indicating facets of U.S. economic weakness or a notably low growth rate.

The level and trend of economic growth is especially notable at this time. As seen in various sources, recession estimates have been at high levels.

As seen in the October 2023 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 2.18% GDP in 2023, .98% GDP in 2024, 2.12% GDP in 2025, and 1.99% in 2025.

Charts Indicating U.S. Economic Weakness

Below is a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

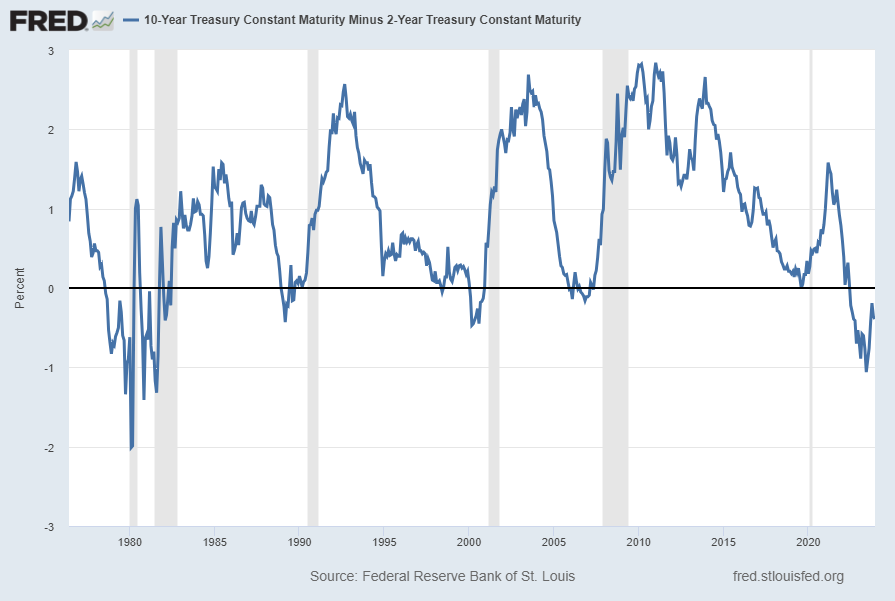

The Yield Curve (T10Y2Y)

Many people believe that the Yield Curve is a leading economic indicator for the United States economy.

On March 1, 2010, I wrote a post on the issue, titled “The Yield Curve As A Leading Economic Indicator.”

While I continue to have the stated reservations regarding the “Yield Curve” as an indicator, I do believe that it should be monitored.

The U.S. Yield Curve (one proxy seen below) is (all things considered) notably inverted when viewed from a long-term perspective. Below is the spread between the 10-Year Treasury Constant Maturity and the 2-Year Treasury Constant Maturity from June 1976 through the December 5, 2023 update, showing a value of -.39% [10-Year Treasury Yield (FRED DGS10) of 4.28% as of the December 5 update, 2-Year Treasury Yield (FRED DGS2) of 4.64% as of the December 5 update]:

source: Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 6, 2023: https://fred.stlouisfed.org/series/T10Y2Y

__

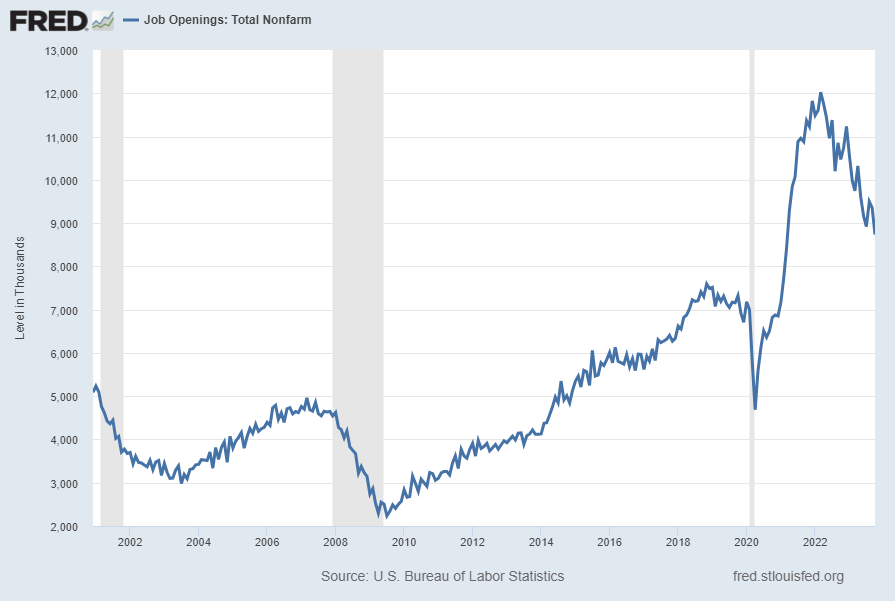

Job Openings (JTSJOL)

Job openings (Job Openings: Total Nonfarm [JTSJOL]), although still at a (very) high level, have recently declined significantly. This “Job Openings” measure had a value of 8,733 (Thousands) through October 2023 as of the December 5, 2023 update, as shown below:

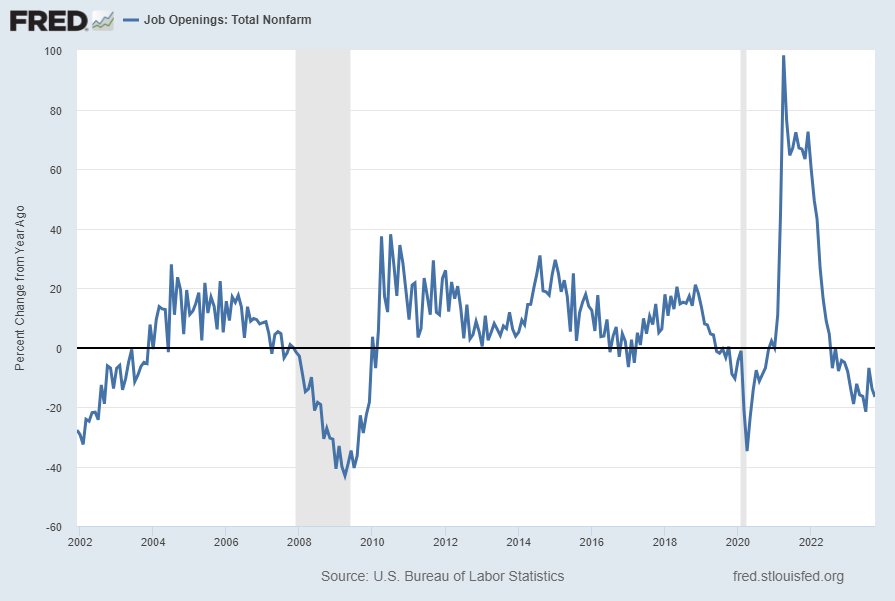

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -16.6%:

source: U.S. Bureau of Labor Statistics, Job Openings: Total Nonfarm [JTSJOL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 6, 2023: https://fred.stlouisfed.org/series/JTSJOL

__

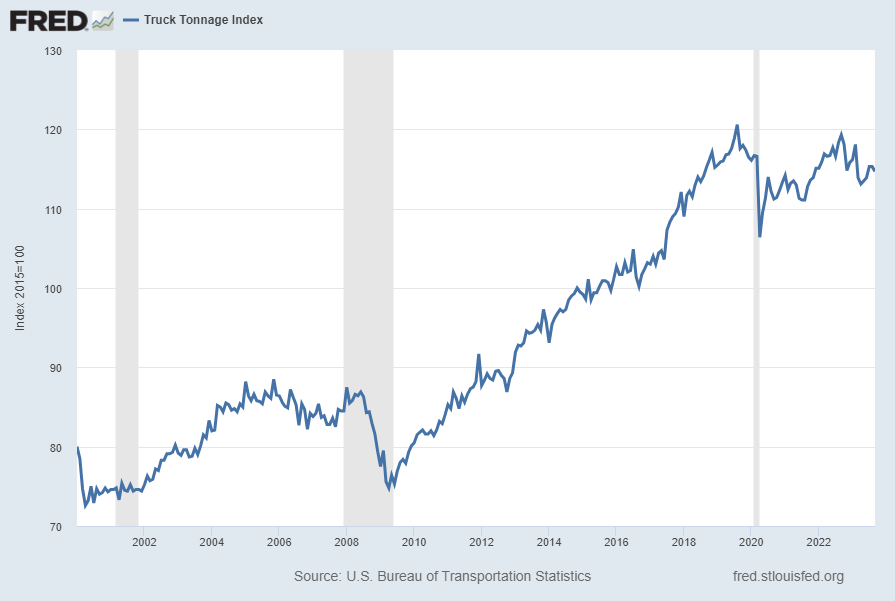

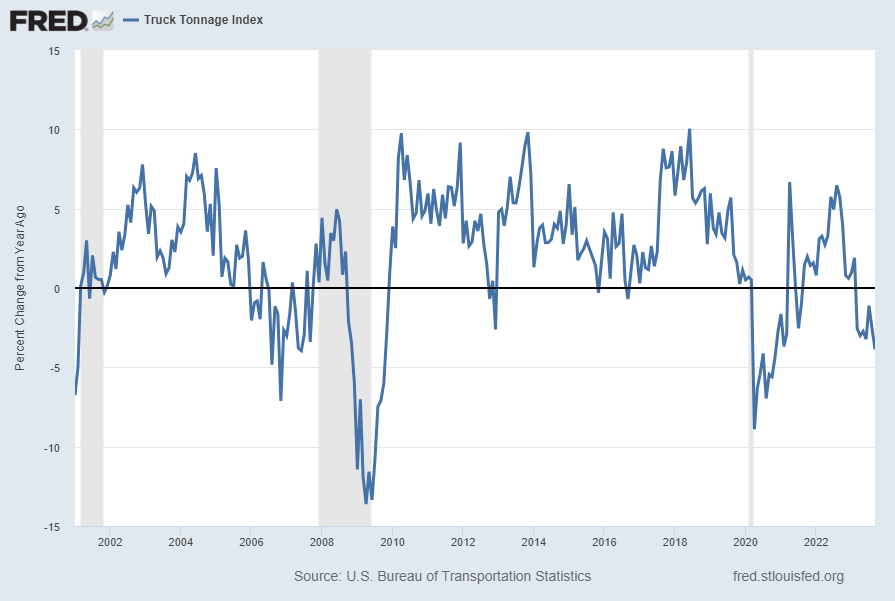

Truck Tonnage (TRUCKD11)

“Truck Tonnage” (TRUCKD11) has yet to reach its pre-pandemic peak, and has recently been faltering. Shown below is this measure with last value of 114.7 through September, last updated December 6, 2023:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -3.9%:

source: U.S. Bureau of Transportation Statistics, Truck Tonnage Index [TRUCKD11], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 6, 2023: https://fred.stlouisfed.org/series/TRUCKD11

__

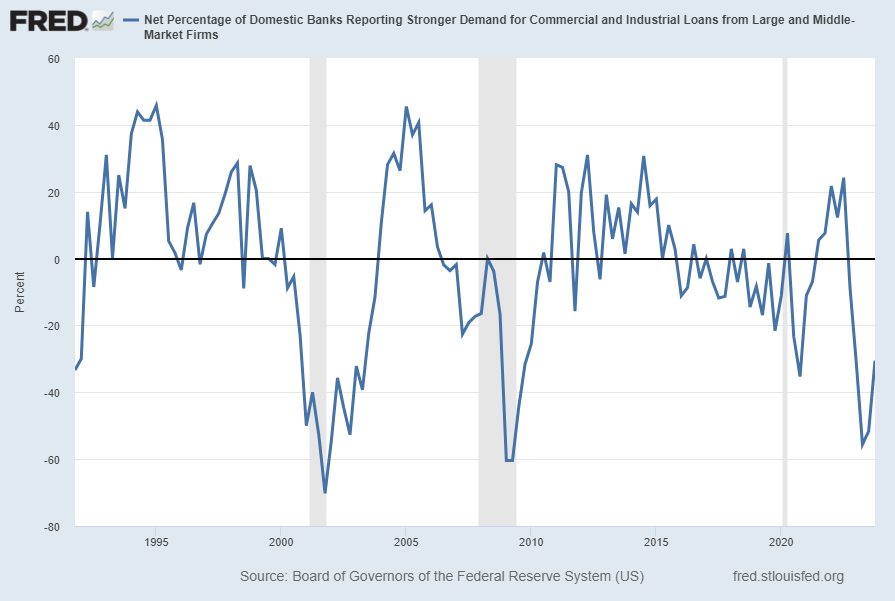

Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans from Large and Middle-Market Firms (DRSDCILM)

“The Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans from Large and Middle-Market Firms” measure has been notably weak. The current value is -30.5% as of the November 6, 2023 quarterly update:

source: Board of Governors of the Federal Reserve System (US), Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans from Large and Middle-Market Firms [DRSDCILM] , retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 6, 2023:

https://fred.stlouisfed.org/series/DRSDCILM

__

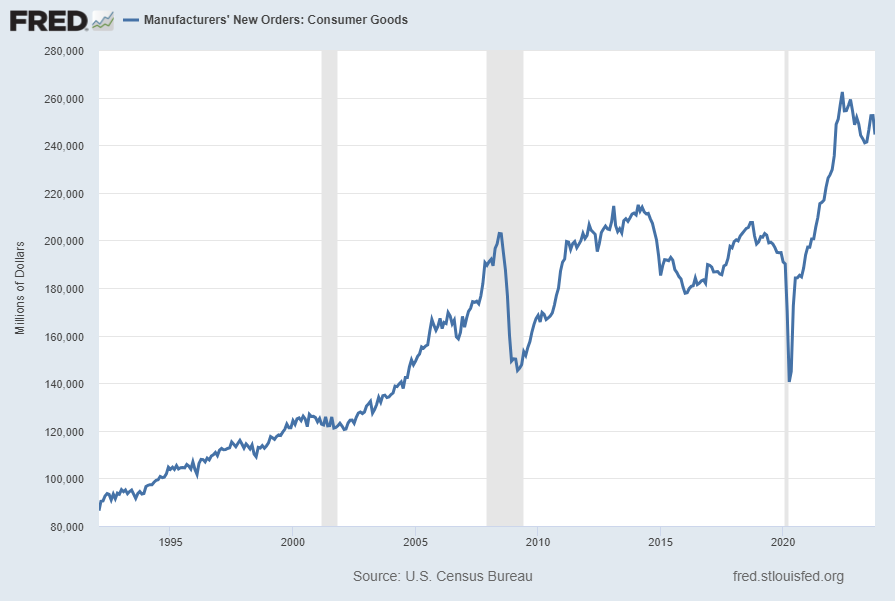

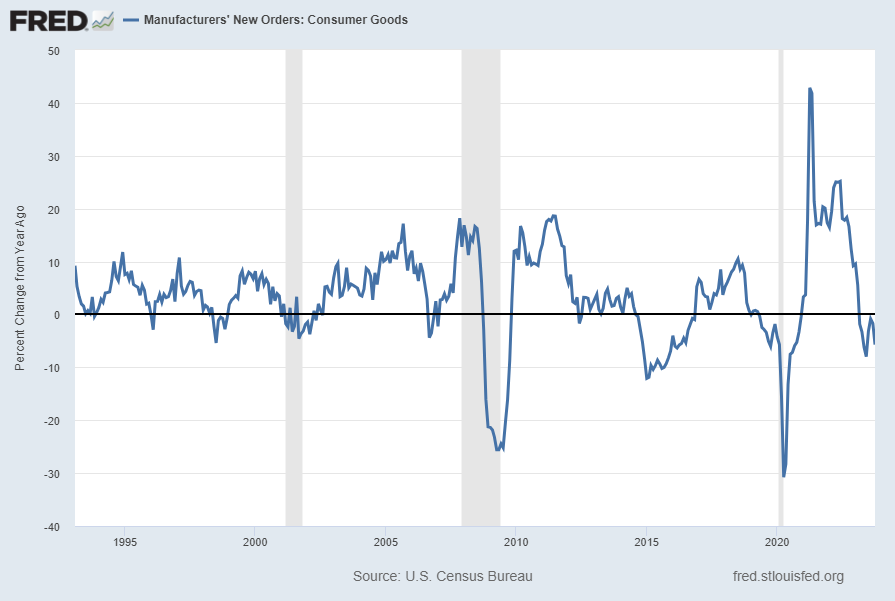

Value of Manufacturers’ New Orders for Consumer Goods Industries (ACOGNO)

A measure for consumer goods exhibiting a recent peak is the “Value of Manufacturers’ New Orders for Consumer Goods Industries” (ACOGNO). Shown below is this measure with last value of 244,490 ($ Millions) through October 2023 (last updated December 4, 2023):

Displayed below is this same ACOGNO measure on a “Percent Change From Year Ago” basis with value -5.7%:

source: U.S. Census Bureau, Value of Manufacturers’ New Orders for Consumer Goods Industries [ACOGNO], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed December 6, 2023: https://fred.stlouisfed.org/series/ACOGNO

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate weak economic growth or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4563.22 as this post is written

No comments:

Post a Comment