I found various notable items in

Walmart’s Q4 2013 earnings call transcript (pdf) dated January 21, 2013. I view Walmart’s results and comments as particularly noteworthy given their retail prominence and focus on low prices. I have previously commented on their quarterly conference call comments; these previous posts are found under the “

paycheck to paycheck” label.

Here are various excerpts that I find most notable:

comments from Mike Duke, president and CEO of Wal-Mart Stores, Inc, page 8:

Walmart leveraged operating expenses again this year. That’s three consecutive years now that we reduced operating expenses as a percentage of sales.

comments from Mike Duke, page 9:

The focus of Bill and his team on cost containment has never been stronger, as Walmart U.S. leveraged operating expenses by 27 basis points this year. We pass the majority of these cost savings to customers every day. Our EDLP promise – along with the broad assortment – is the key to driving sales. Strong merchandising, efficient operations and thoughtful use of capital will keep Walmart U.S. strong into the future.

comments from Mike Duke, page 10:

Fifth, e-commerce. I’m excited about our investments in e-commerce to help us grow with our customers and expand the Walmart shopping experience.

comments from Bill Simon, president and CEO of Walmart U.S., page 16:

Our customers continue to rely on us to deliver Every Day Low Prices. This is evident by our consistent gains in market share across the majority of the businesses.

comments from Bill Simon, page 17:

You heard us talk about the early response to layaway during the third quarter, and I’m pleased to say the momentum continued, with net layaway sales up almost 10 percent for the season versus last year.

comments from Bill Simon, page 21:

You’ve heard us say, supercenters remain our primary growth vehicle, and we will continue to expand this format to drive share.

also:

We also accelerated the small format rollout. In fiscal 2013, we opened 76 small formats, including Neighborhood Markets and Express stores, allowing us to serve even more customers across the country. In fiscal 2014, we plan to add approximately 100 small stores.

comments from Bill Simon, page 22:

However, February sales started slower than planned due in large part, to the delay in income tax refunds. We began seeing increased tax refund check activity late last week in our stores. This resulted in a more normalized sales pattern for this time of the year.

also:

Due to the slower sales rate in the first few weeks of this year’s first quarter, we’re forecasting comp sales for the 13-week period from January 26 to April 26, 2013 to be around flat.

_____

The Special Note summarizes my overall thoughts about our economic situation

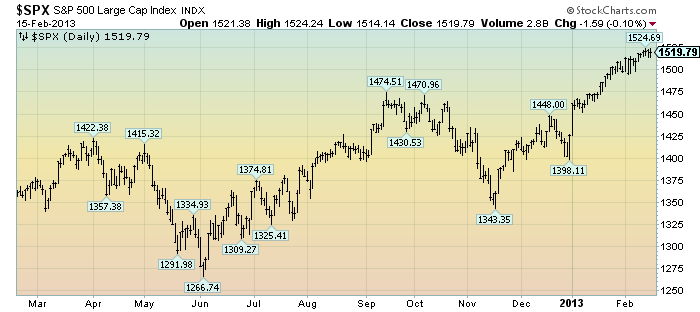

SPX at 1505.31 as this post is written