On January 9, 2017 I wrote a post titled “Low Interest Rates And The Formation Of Asset Bubbles.“ As discussed in that post – and for other reasons – the level of the Fed Funds rate – and whether its level is appropriate – has vast importance and far-reaching consequences with regard to many aspects of the economy and financial system.

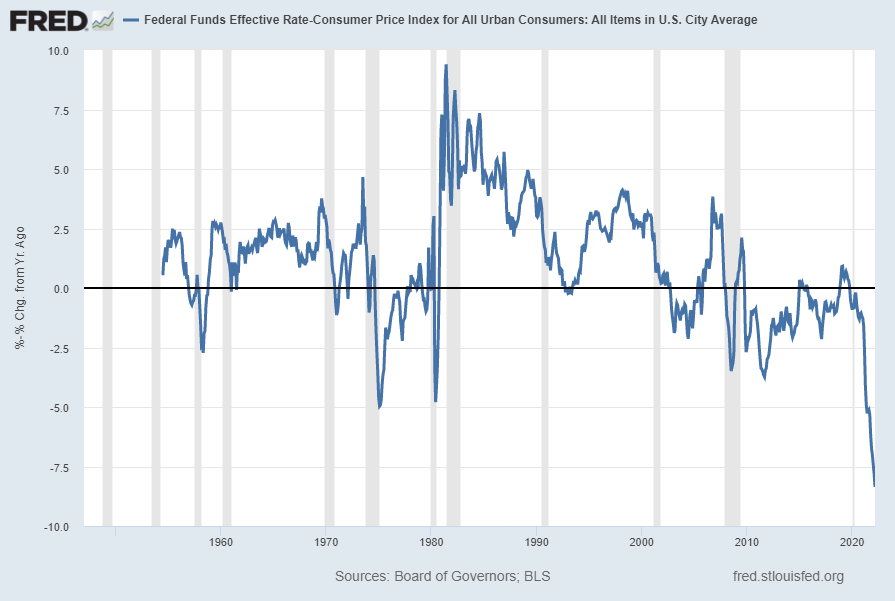

Along these lines, below is an updated long-term chart indicating the Real Fed Funds Rate [FRED FEDFUNDS – CPIAUCSL] , with a last value of -8.35759% through March 2022. [FEDFUNDS = .20% as of the April 1, 2022 update; CPIAUCSL = 8.55759% as of the April 12, 2022 update]

Of particular note is the post-2000 persistently negative Real Fed Funds rate:

source: Board of Governors of the Federal Reserve System (US), Effective Federal Funds Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 13, 2022: https://fred.stlouisfed.org/series/FEDFUNDS

source: U.S. Bureau of Labor Statistics, Consumer Price Index: All Items in U.S. City Average, All Urban Consumers [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 13, 2022: https://fred.stlouisfed.org/series/CPIAUCSL

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4419.17 as this post is written

No comments:

Post a Comment