On September 29, 2022, the Zillow Q3 2022 Home Price Expectations Survey results were released. This survey is done on a quarterly basis.

An excerpt from the press release:

Although the panel-wide 2022 expected home price appreciation rate ticked up to 9.8% from 9.3% in this most recent survey, all 107 survey respondents project home price deceleration in 2023. The share of panelists who believe their long-term outlook might be too optimistic jumped up to 67% from 56% last quarter.

“U.S. home price appreciation is clearly easing up in response to the historic surge in mortgage rates,” said Terry Loebs, founder of Pulsenomics. “Our expert panel’s mean projections indicate that residential rent price growth is expected to outpace headline CPI inflation over the coming three years and exceed home price growth through at least 2025. Despite softening house prices, this implies that affordability hurdles for prospective first-time homeowners will remain high and persist for years to come.”

–

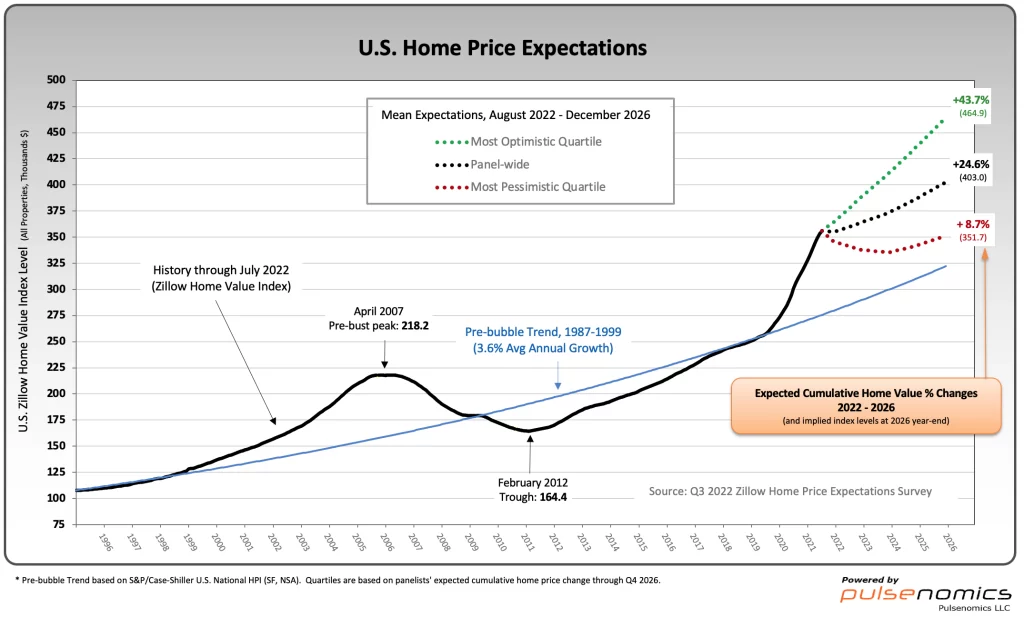

Various Q3 2022 Zillow Home Price Expectations Survey charts are available, including that seen below:

As one can see from the above chart, the average expectation is that the residential real estate market, as depicted by the U.S. Zillow Home Value Index, will continually climb.

The detail of the Q3 2022 Home Price Expectations Survey is interesting. Of the 107 survey respondents, only five (of the displayed responses) forecasts a cumulative price decrease through 2026.

The Median Cumulative Home Price Appreciation for years 2022-2026 is seen as 9.50%, 13.30%, 16.50%, 19.02%, and 23.37%, respectively.

For a variety of reasons, I continue to believe that these forecasts will prove far too optimistic in hindsight.

I have written extensively about the residential real estate situation. For a variety of reasons, it is exceedingly complex. While many people continue to have an optimistic view regarding future residential real estate prices, in my opinion such a view is unsupported on an “all things considered” basis. Residential real estate is an exceedingly large asset bubble. As such, from these price levels there exists potential for a price decline of outsized magnitude.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3640.47 as this post is written

No comments:

Post a Comment