On March 15, 2017 the March Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

Results also show that CFOs are feeling the most confident about economic growth than they've been in more than a dozen years, and they strongly support several of the president's initiatives.These findings and detailed analysis of tax and economic reforms are from the Duke University/CFO Global Business Outlook. The survey has been conducted for 84 consecutive quarters and spans the globe, making it the world's longest-running and most comprehensive research on senior finance executives. This quarter, nearly 900 CFOs responded to the survey, which ended March 10. Results are for the U.S. unless stated otherwise.

also:

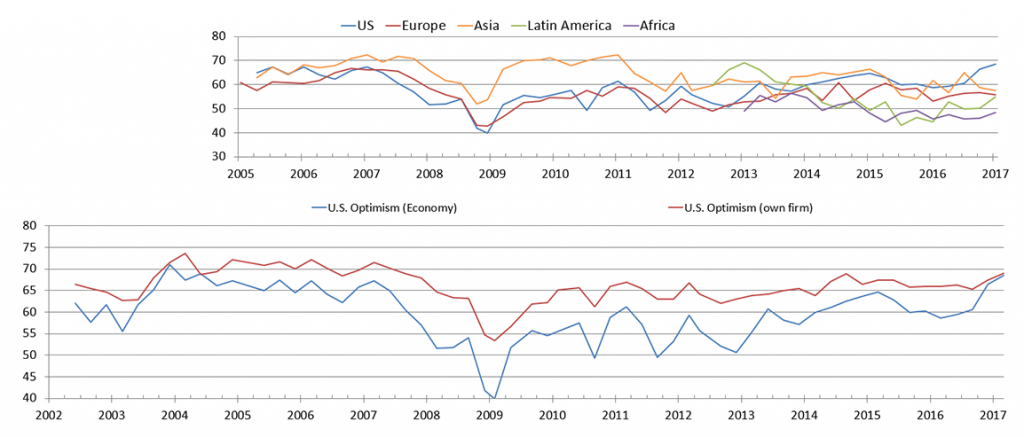

The Optimism Index jumped this quarter to 69 (on a 100-point scale), the highest level in 14 years and much higher than the long-run average of 60."The jump in business optimism is leading to strong hiring and spending plans for 2017," Graham said. "Our analysis of past forecasts shows that the Optimism Index is an accurate predictor of GDP growth and employment over the next year."Sixty-one percent of U.S. firms plan to increase their payrolls in 2017, with an average increase of about 3 percent (median 1 percent). Wage hikes are expected to average nearly 4 percent. Capital spending is expected to increase 6 percent on average (median 3 percent), a notable improvement from flat or negative spending plans for most of 2016."There's a disconnect here," said Duke finance professor Campbell R. Harvey, founding director of the CFO Survey. "Despite the optimism, the high rate of employment growth and wages, and the substantial possibility of both corporate and individual tax cuts, CFOs have very pessimistic growth forecasts, where only 16.8 percent believe we can hit 3 percent growth in 2017. That is surprising."

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 69, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2381.38 as this post is written

No comments:

Post a Comment