Recently Deloitte released their “CFO Signals” report for 1st Quarter 2012.

As seen in page 2 of the full (pdf) report, “Ninety-four CFOs responded during the two weeks ended February 24. Over 71% are from public companies, and over 77% are from companies with more than $1B in annual revenue."

Here are some excerpts that I found notable:

from page 4:

Rising optimism is clearly reflected in CFOs’ earnings growth expectations. After bottoming out at 9.3%* in the third quarter of last year, expected growth rose to 10.1%* last quarter and to 12.8%* this quarter. Rising variability of projections, however, indicates substantial difference of opinion.

But sales growth projections continued their downward trend. CFOs’ expected 5.9%* gains are a new low for this survey, and the U.S. expectation is just 5.2%*. This begs the question, “How long can companies expect earnings to outpace sales?” Eight consecutive quarters of this dynamic appear to suggest companies believe their cost-containment strategies can make up for slowing sales growth – perhaps through some combination of focusing on higher-margin businesses, exiting businesses outside core competencies, reaping benefits of efficiency improvement efforts, offshoring of resources, and expectations of declining input costs.

from page 4:

In contrast to the last two quarters, companies’ growth plans appear to be spurring hiring at home. CFOs’ expected domestic hiring gains of 2.1%* are more than double last quarter’s survey-low 1.0%*, and just over half of CFOs project gains. U.S. CFOs’ projections rose from 1.4%* last quarter to 1.8%* this quarter...

from page 4:

Similar to rising earnings projections, growing investment and hiring expectations raise questions about reasons for confidence as revenue appears to be leveling off. Perhaps companies are focused on anticipated growth that is more than a year away, or perhaps they are simply more optimistic than they should be.

from page 11, regarding "Top Industry Challenges" :

Pricing trends are again a top concern but declined from 52% last quarter to 37% this quarter. They are the top concern within Retail/Wholesale and Services and a top-two concern in Financial Services.

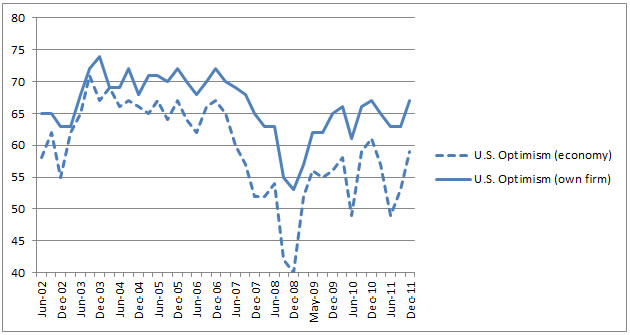

from page 15, regarding "Own-company optimism" :

Major (positive) reversal in optimism: After two quarters in negative territory, net optimism rebounded sharply to +48 percentage points this quarter. Nearly two thirds of CFO say they are more optimistic this quarter than they were last quarter, with just 15% more pessimistic (22% report no change)._____

I post various business and economic surveys because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

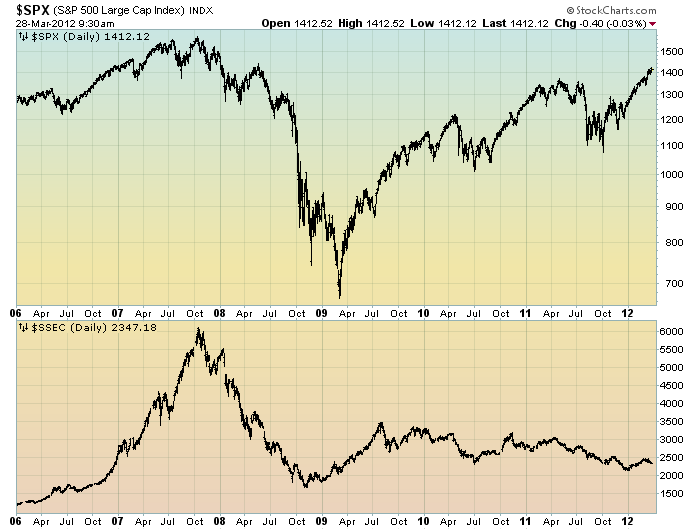

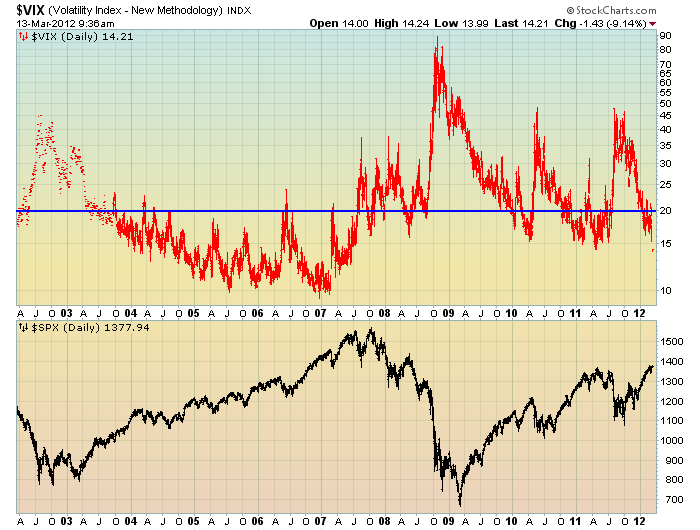

SPX at 1403.28 as this post is written